Cardano (ADA) holders have reason to be cautiously optimistic as the altcoin’s price has increased by 3% over the past week, reaching $0.34. However, the overall sentiment surrounding the coin remains largely bearish.

On-chain data and price charts suggest that ADA could potentially rally to $0.47 if the current upward momentum continues. The key question is whether there is enough demand to support this move.

Cardano’s Price Rally Lacks Needed Support

While Cardano has experienced a price rally in the past week, the increase appears unsustainable. This is evident from its negative price Daily Active Address (DAA) divergence, a metric that tracks an asset’s price movement alongside changes in its daily active addresses. Since September 3, this metric has consistently returned negative values, indicating weak support for the recent price gains.

When an asset’s price rises despite negative price DAA divergence, it indicates that the price rally lacks strong support from increased user activity, signaling weakness and unsustainability.

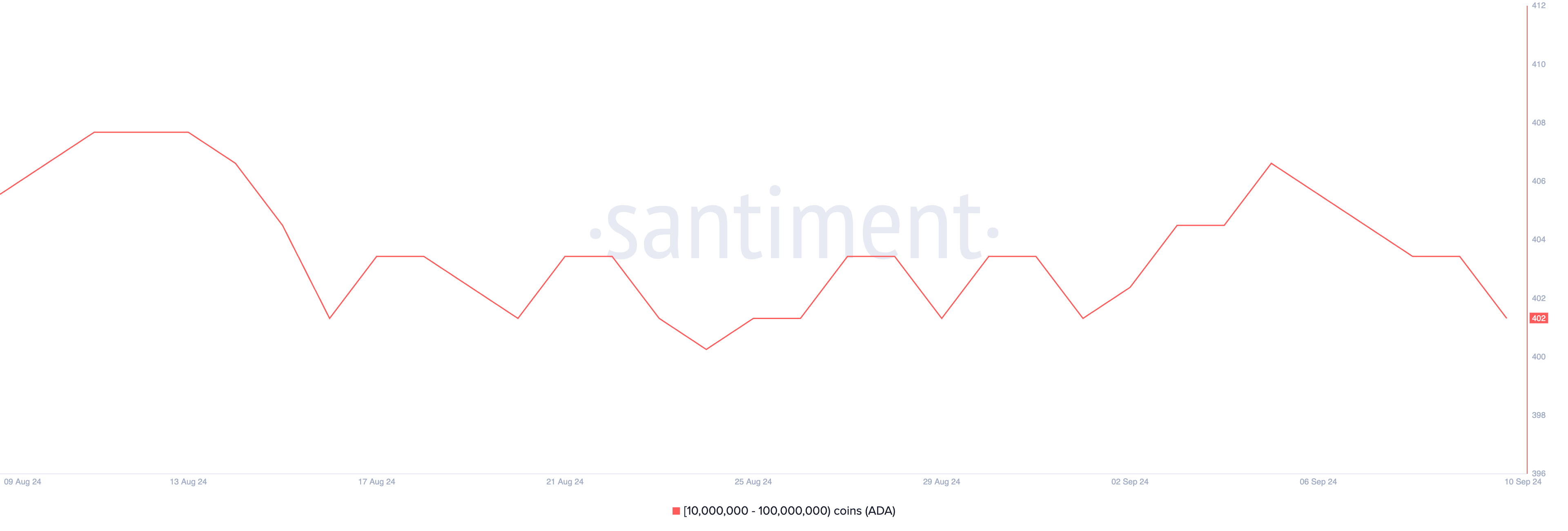

Cardano’s declining whale activity further reinforces this outlook. Data on supply distribution shows that large investors holding between 10,000,000 and 100,000,000 ADA have gradually reduced their holdings since September 5.

A decline in whale holdings is typically a bearish signal, which may prompt retail traders to sell and secure profits. If this trend continues, Cardano risks losing its recent gains as selling pressure mounts.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

ADA Price Prediction: Brace For a Decline To $0.27

Cardano’s one-day chart reveals that the altcoin has been moving below a descending trend line since July. This bearish trend line forms when an asset faces significant selling pressure, creating strong resistance as it struggles to break above certain price levels.

Although the recent rally has pushed ADA closer to this resistance line, the current buying pressure appears insufficient to break through. This is evident from the declining Chaikin Money Flow (CMF), which measures liquidity flow in the market. Cardano’s CMF is currently negative at -0.01, indicating a capital exit from the market.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in September 2024

The combination of a rising price and a falling CMF forms a bearish divergence, indicating that the price rally lacks strong buying support and may soon face a correction.

The Fibonacci retracement indicator suggests that ADA’s price could fall back to the August 5 low of $0.27 if buying pressure continues to weaken. However, if market sentiment shifts to a more bullish outlook, ADA’s price could climb toward $0.47.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-gains-come-slowly/

2024-09-10 19:33:55