Cardano Network is poised to tap into $1.3 trillion in Bitcoin liquidity for its decentralized finance (DeFi) ecosystem through a new integration with BitcoinOS (BOS), a Bitcoin smart contract platform. As a result, the Cardano Bitcoin price may begin to move in the same direction.

This integration comes at a time when ADA and BTC prices show little to no correlation. The question remains: will this development alter the current state of affairs?

Cardano Taps into Bitcoin Liquidity

On October 24, BitcoinOS, a Bitcoin roll-up protocol, disclosed that its Grail bridge will go live on Cardano’s network.

“Cardano, the 11th largest blockchain by market cap, is integrating the BitcoinOS Grail Bridge to unleash decentralized programmability and scalability on Bitcoin!” BitcoinOS wrote on X.

This development means the Cardano ecosystem can now access Bitcoin’s liquidity, which is worth about $1.33 trillion. It also enables ADA users to access Bitcoin securely and without intermediaries, further enhancing the decentralized nature of both networks.

In light of this development, market observers may wonder whether it will strengthen the ties around the Cardano Bitcoin price. Since July, Cardano’s price has declined by 32% against Bitcoin, highlighting that the leading cryptocurrency has been outperforming the token.

Read more: How to Mine Cardano and Earn More Coins

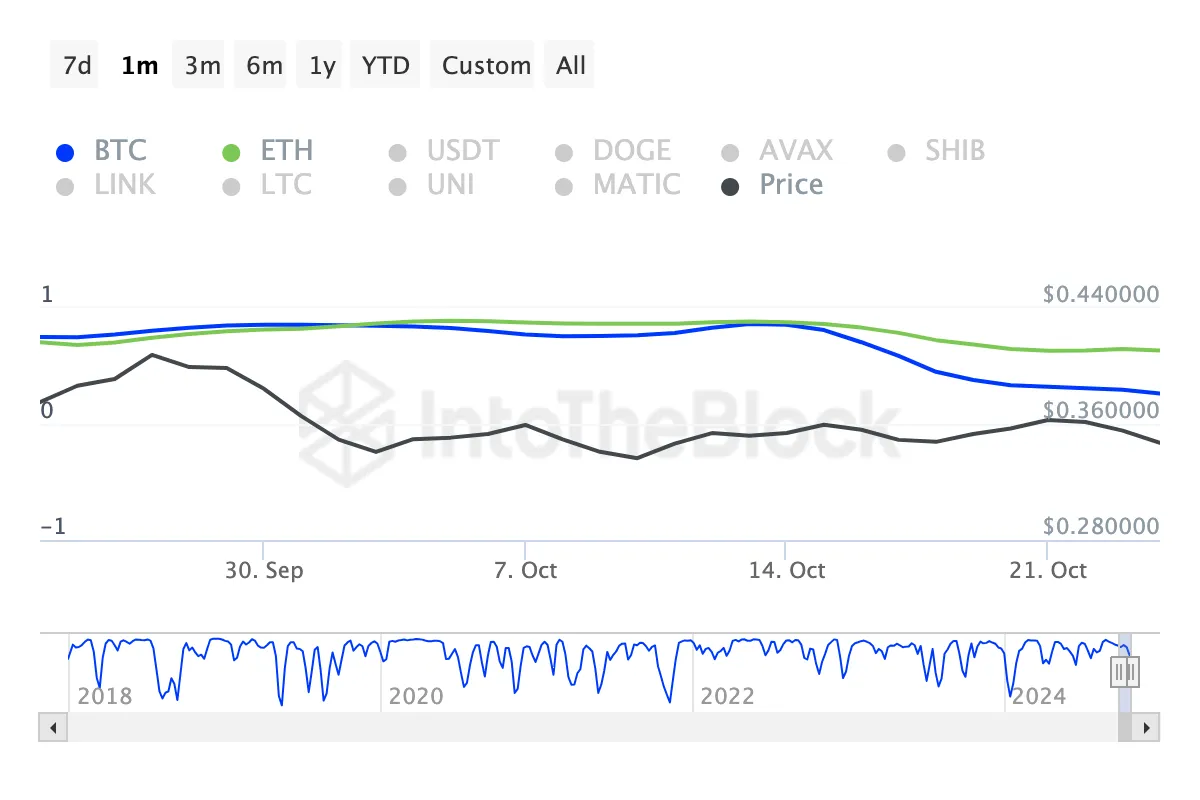

This is further supported by the 30-day correlation matrix from IntoTheBlock. The correlation matrix, or coefficient of correlation, ranges from -1 to +1, where values closer to -1 suggest that the prices of two cryptocurrencies rarely move together.

Conversely, a coefficient near +1 indicates that prices typically move in the same direction. In the case of ADA and BTC, the correlation coefficient stands at 0.26, demonstrating that the two cryptocurrencies rarely trend together.

However, this recent development suggests that a shift could be on the horizon. Earlier today, Cardano’s founder, Charles Hoskinson, who has previously criticized Bitcoin, shared his thoughts on the matter.

According to Hoskinson, the BitcoinOS bridge would enable the Cardano network to assist Bitcoin in leveraging various aspects of DeFi.

ADA Price Prediction: Indicators Project Decline

Currently, Cardano’s price is $0.34, representing a 10% decline in the last 30 days. Bitcoin’s price, on the other hand, is up 7% within the same timeframe.

On the daily chart, the Chaikin Money Flow (CMF) has fallen into negative territory. The CMF is a technical oscillator that gauges the level of accumulation or distribution within the market.

A rising CMF indicates strong accumulation, while a low reading suggests increased distribution. Given ADA’s current condition, the price could potentially drop to $0.31 in the short term.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

In a highly bearish scenario, it might even fall to $0.28. However, if Bitcoin’s price rises to $70,000, this could trigger a recovery for ADA, possibly allowing it to climb to $0.41.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-bitcoin-price-amid-integration/

2024-10-25 16:30:00