In the last seven days, Cardano’s (ADA) price has increased by nearly 80%, making it the second-best-performing asset among the top 10 cryptocurrencies. This bull run has sparked speculation that the altcoin could return to its 2021 peak levels.

But after hitting $0.62 yesterday, November 11, ADA’s price retraced to $0.60. For some, this pullback could mark the end of this incredible run. However, this on-chain analysis begs to differ.

Cardano Catches the Attention of All and Sundry

The Cardano bull run began around November 6, shortly after all indications pointed to a Donald Trump win in the US election. Before that, ADA’s price was about $0.33, but seven days after, the token rallied to $0.62 before this drop to $0.60.

Using data from IntoTheBlock, the Average Transaction Size, which offers insight into whales’ and retail users’ activity on the blockchain, reveals that the retracement might not last long. When the metric rises, it means that institutional players are engaging in a lot of speculative activity.

Conversely, a decline in the metric indicates that retail investors are making most of the transactions. As of this writing, the Average Transaction Size has increased to $171,588 over the last seven days, indicating that large investors are playing a crucial role in ADA’s recent ascent.

Historically, when this happens, Cardano’s price continues its rally even though it might face brief pullbacks. For instance, in March, when the metric jumped like this, ADA climbed as high as $0.74. Therefore, if this remains the same, ADA might retest $0.62 and possibly go higher.

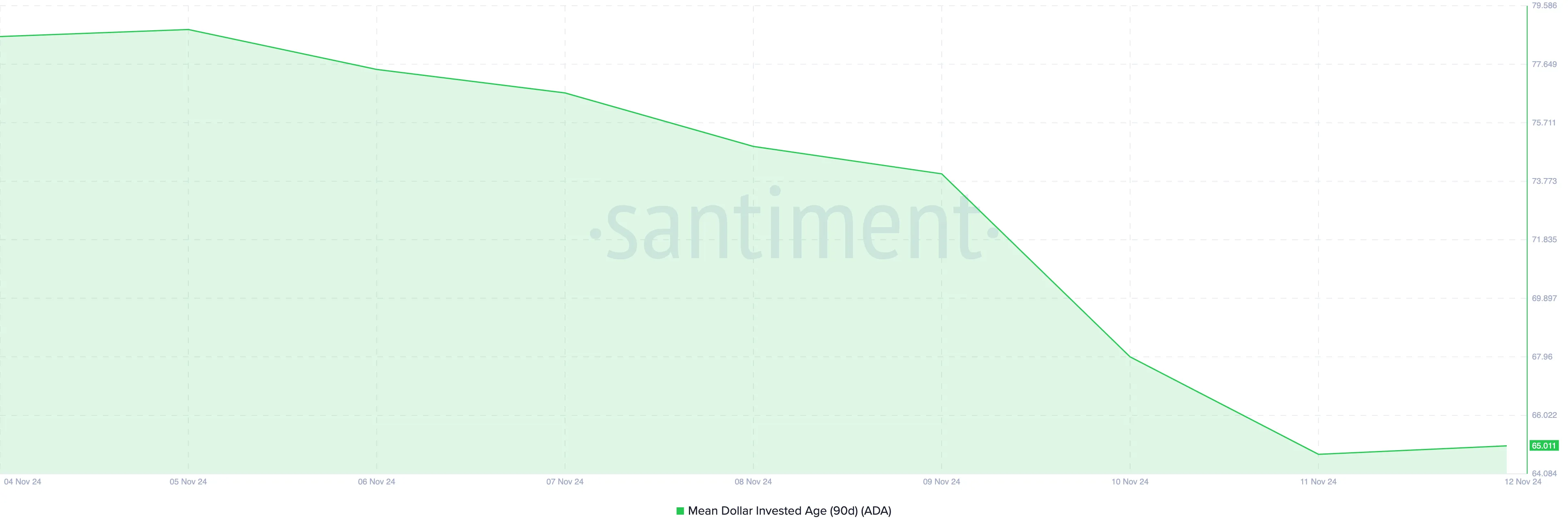

Another metric suggesting that Cardano’s bull run is not over is the Mean Dollar Invested Age (MDIA). The MDIA is the average age of every dollar invested in a cryptocurrency.

A rising Mean Dollar Invested Age metric indicates that investments are becoming more stagnant, with older coins staying in the same wallets. Conversely, a decreasing Mean Dollar Invested Age suggests that investments are returning to active circulation, pointing to increased network activity.

From a historical perspective, the flow of ADA tokens back into circulation is a bullish sign. Therefore, if the MDIA continues to fall, then the altcoin has a good chance of climbing than its current value.

ADA Price Prediction: $0.70 First, Above $1 Later?

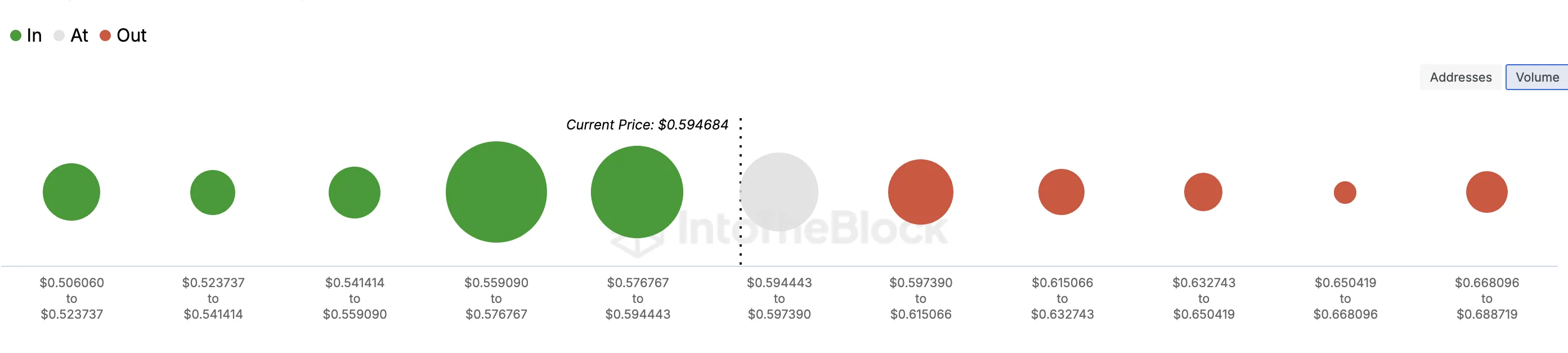

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) shows that ADA is trading at a point where thousands of addresses have accumulated $1.24 billion tokens. The IOMAP classifies addresses based on the purchase price and shows whether addresses have unrealized profits or losses.

Also, the metric is crucial to spotting support and resistance. Typically, the higher the volume or cluster, the stronger the support or resistance. As seen below, the altcoin seems to have strong support at $0.59, where 87,950 addresses purchased about 1.79 billion ADA.

This figure is higher than the volume bought between $0.61 and $0.69. Therefore, according to the laws stated above, ADA could breach these levels and rise to $0.70 in the short term.

In addition, the technical point of view also seems to support this move. But this time, BeInCrypto analyzes the weekly chart to assess the long-term potential.

On the weekly ADA/USD chart, the altcoin has broken out of a descending triangle. A descending triangle is a bearish pattern characterized by a downward-sloping upper trendline and a flatter, horizontal lower trendline.

When the price breaks down below the lower trendline, further correction might happen. But in ADA’s case, the price has risen above the sloping upper trendline, suggesting that the altcoin’s value could go higher.

If that is the case, then Cardano’s bull run could extend into next year, with the price possibly climbing by nearly 127% to $1.34. On the other hand, if selling pressure intensifies before then, this AD A price prediction might not come to pass. Instead, the crypto’s value might sink much lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-bull-run-temporary-setback/

2024-11-12 07:53:40