Chainlink’s (LINK) price could be looking at a drawdown as the veil of optimism is being lifted from the investors.

The emerging bearishness could result in a drawdown, as the network’s activity has been minimal compared to its valuation.

Concerns for Chainlink

Chainlink’s price struggling to breach and close above a key resistance level has a lot to do with the investors. Since the end of July, LINK holders have shown intense bullishness despite the crash. This kept the altcoin from losing significantly and also drove the altcoin’s price upwards in mid-August. However, this strong optimism is now beginning to wane.

Despite the recent increase in price, the weighted sentiment for LINK is consistently sliding. It remains above the zero line at present, indicating that there is still some positive sentiment among holders. However, this optimism is gradually fading.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

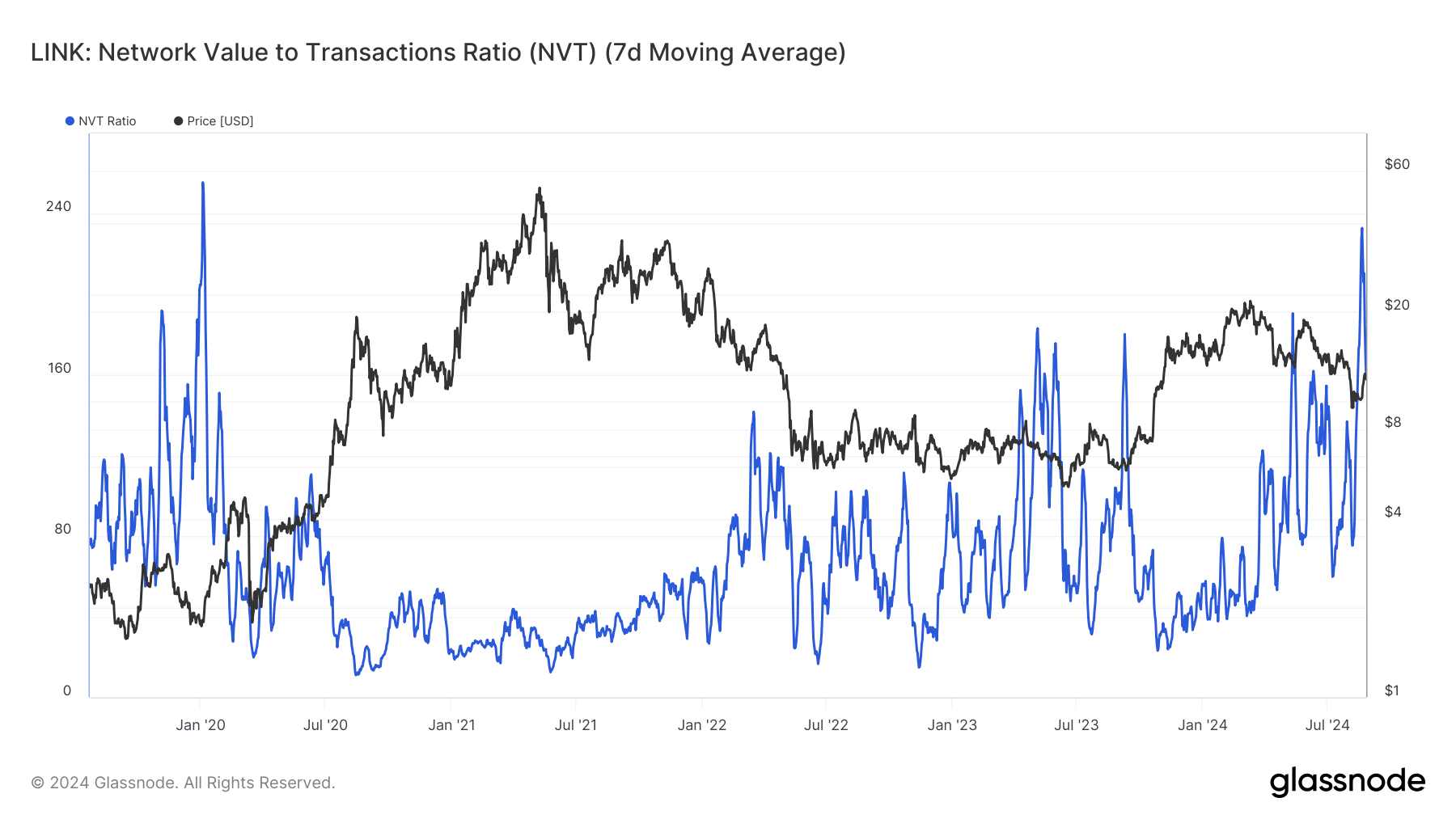

One key indicator of this shift in sentiment is the NVT (Network Value to Transactions) ratio. This ratio is currently at a four-year and eight-month high, last seen at these levels in January 2020. The NVT ratio is a metric used to assess the valuation of an asset relative to its transaction activity.

The elevated NVT ratio suggests that LINK is highly overvalued compared to its actual network activity. This could indicate that the price has run too far ahead of the underlying fundamentals.

As the bullish sentiment fades and the NVT ratio remains high, LINK investors may need to brace for potential price corrections.

LINK Price Prediction: Key Barrier Ahead

Chainlink’s price at $12.00 is looking to flip the resistance of $12.35 into a support level. This level has been tested multiple times as a bounce-back point, making recovery above it crucial for LINK.

However, the mixed signals coming from the network and LINK holders suggest a different path. Chainlink’s price could be noting a drawdown to $10.79, the local support floor. While a decline below this level is unlikely, unfortunate conditions could send the altcoin to $10.00. This would wipe away the 22% recovery noted in mid-August.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if the altcoin manages to keep its rise intact and bounce off the support at $10.79, it could breach $12.35. This would lead to a rise beyond $13.00 for Chainlink’s price, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/chainlink-link-price-eyes-recovery/

2024-08-27 08:00:00