The altcoin market showcases a dynamic interplay between community-driven tokens and institutionally backed projects, each with distinct characteristics and trajectories.

Understanding their distinct dynamics is crucial for stakeholders to tackle the crypto market.

Community-driven tokens epitomize decentralization, emerging from grassroots initiatives instead of corporate boardrooms. Dogecoin is a perfect example of this ideal.

Launched in 2013 as a satirical take on cryptocurrencies, Dogecoin has evolved into a significant digital asset. At the time of writing, DOGE’s market capitalization stands at approximately $67 billion, reflecting its widespread adoption and strong community support.

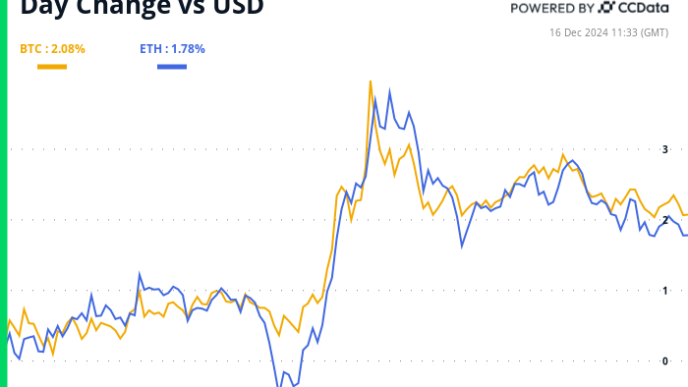

In 2024, Dogecoin’s price substantially increased, surging by 376% and reaching a peak of approximately $0.43. This growth is symbolic of the influence of community engagement and high-profile endorsements on its valuation. Despite lacking significant technological breakthroughs, Dogecoin has repeatedly attracted a global audience through its simplicity and shared identity.

With that said, community-driven tokens face noteworthy challenges. Juan Pellicer, Senior Research Analyst at IntoTheBlock, highlights their vulnerabilities during bear markets.

“Community-driven tokens often rely on volunteer efforts, which can wane as market enthusiasm diminishes,” he said in an interview with BeInCrypto.

Without structured funding or dedicated development teams, many projects may struggle to sustain operations during hard times. Yet their decentralized nature can reduce risks. Equitable token distribution often mitigates market volatility caused by large-scale sell-offs, unlike some institutional tokens that liquidate reserves to survive.

Scalability is another concern for community-driven tokens. Grassroots momentum can drive prominence, but sustained growth often requires professionalization, which risks alienating decentralization advocates.

Institutionally backed tokens like ZKsync, meanwhile, have the advantage of resources and partnerships, providing greater operational resilience. As a Layer-2 scaling solution for Ethereum, it aims to enhance blockchain scalability and performance. Structured funding and stability enable these projects to keep going and navigate compliance with more ease.

“Institutionally backed tokens are generally better prepared to meet regulatory demands and maintain operations through economic turbulence,” Peciller added.

As of December 2024, ZKsync’s native token has a market capitalization of approximately $817 million and a trading price near $0.22.

Despite their advantages, institutional tokens face criticism for centralization by association. Many crypto enthusiasts view centralized control as contradicting decentralization principles. Critics argue that consolidating power within a few entities undermines trust and autonomy, which are fundamental to blockchain ideals.

Institutional tokens, on the bright side, offer valuable lessons for community-driven projects. Their focus on sustainable funding models can act as a blueprint for grassroots initiatives to secure long-term operational viability. Community-driven tokens could adopt their mechanisms for revenue generation.

Resilience and Regulation in a Maturing Market

Community-driven tokens like Dogecoin often experience price volatility influenced by social media trends and public sentiment.

For instance, Dogecoin’s value surged nearly 20% following Elon Musk’s announcement on November 13 of the “Department of Government Efficiency.” Conversely, ZKsync’s collaborations with major platforms have bolstered its credibility and adoption within the decentralized finance (DeFi) sector.

The resilience of altcoins in bear markets often depends on their operational structures.

“Institutional-backed tokens generally perform better in bear markets. They benefit from stronger liquidity, solid financial backing, and clearer regulatory compliance, which help them weather downturns more effectively. Community-driven tokens, on the other hand, tend to be more volatile and are often more vulnerable when market sentiment shifts,” Christoph Tunkl, CEO of Welf, told BeInCrypto in an interview.

In a 2022 blog post, crypto influencer Joe Roberts argued that there are a few key indicators to consider when confirming a token’s strong community presence. These include growth speed, the longevity of community sentiment, and analysis of social media metrics.

“Regarding cryptocurrencies, community strength is a crucial factor in determining the likelihood of a project’s success. This statement is exemplified by Dogecoin and Shiba INU, where the community supporting those coins is way more relevant than what their team is accomplishing and the project itself,” Roberts wrote.

Regulation is another factor that may heavily influence altcoins’ trajectories. Institutional tokens align more closely with regulatory frameworks, likely giving them an edge in an era of tightening oversight.

Community-driven tokens often lack formal structures, making compliance somewhat of a challenge, but they find more popularity with users. Without adaptation, many decentralized projects may meet existential risks under stricter regulatory conditions.

Industry advocates anticipate a nuanced future. Early crypto projects thrived on community-driven initiatives but struggled with sustainability. Exceptions like Dogecoin and Shiba Inu remain relevant due to strong communities.

Is a Hybrid Path The Future of Altcoins?

The divide between grassroots and institutional models need not remain absolute. A hybrid approach could redefine the altcoin space, harmonizing the strengths of both. Community-driven tokens might incorporate sustainable funding mechanisms while preserving decentralization. Similarly, institutional projects could adopt community engagement strategies to enhance loyalty and adoption.

“The market will likely become more regulated, and institutional players will have a bigger role. But community-driven projects will still be important for innovation and experimentation. It’s not necessarily a competition, but more of a complementary evolution,” Tunki added.

This interplay reflects broader trends in the crypto ecosystem. As blockchain integrates into mainstream finance, balancing decentralization with scalability and compliance will shape the next wave of altcoins.

As the crypto market grows, this balance will determine which altcoins thrive and which fade away. Whether through collaboration or competition, the interplay between grassroots momentum and institutional power will shape cryptocurrency’s future, creating an ecosystem as complex as the technology itself.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Farah Ibrahim

https://beincrypto.com/community-altcoins-coexist-institutional-giants/

2024-12-16 11:00:00