Dogecoin has struggled to recover from its recent losses, with demand noticeably declining over the past few days. As the year draws to a close, many investors are choosing to sit out the volatility associated with this transitional period.

This could leave DOGE vulnerable to further price declines unless significant market activity resumes.

Dogecoin Whales Are The Hope

Dogecoin whales play a critical role in preventing the altcoin from further decline. Transactions exceeding $100,000 have surged, reaching 9,410—the highest level since November 2021. This resurgence in high-value transactions indicates strong whale activity, which has historically been pivotal in stabilizing Dogecoin during volatile periods.

If whales maintain their current activity levels, they could provide the liquidity and market support necessary to shield DOGE from further dips. However, this support must be sustained as broader investor participation remains subdued. For Dogecoin to regain its footing, a consistent influx of high-value transactions is essential.

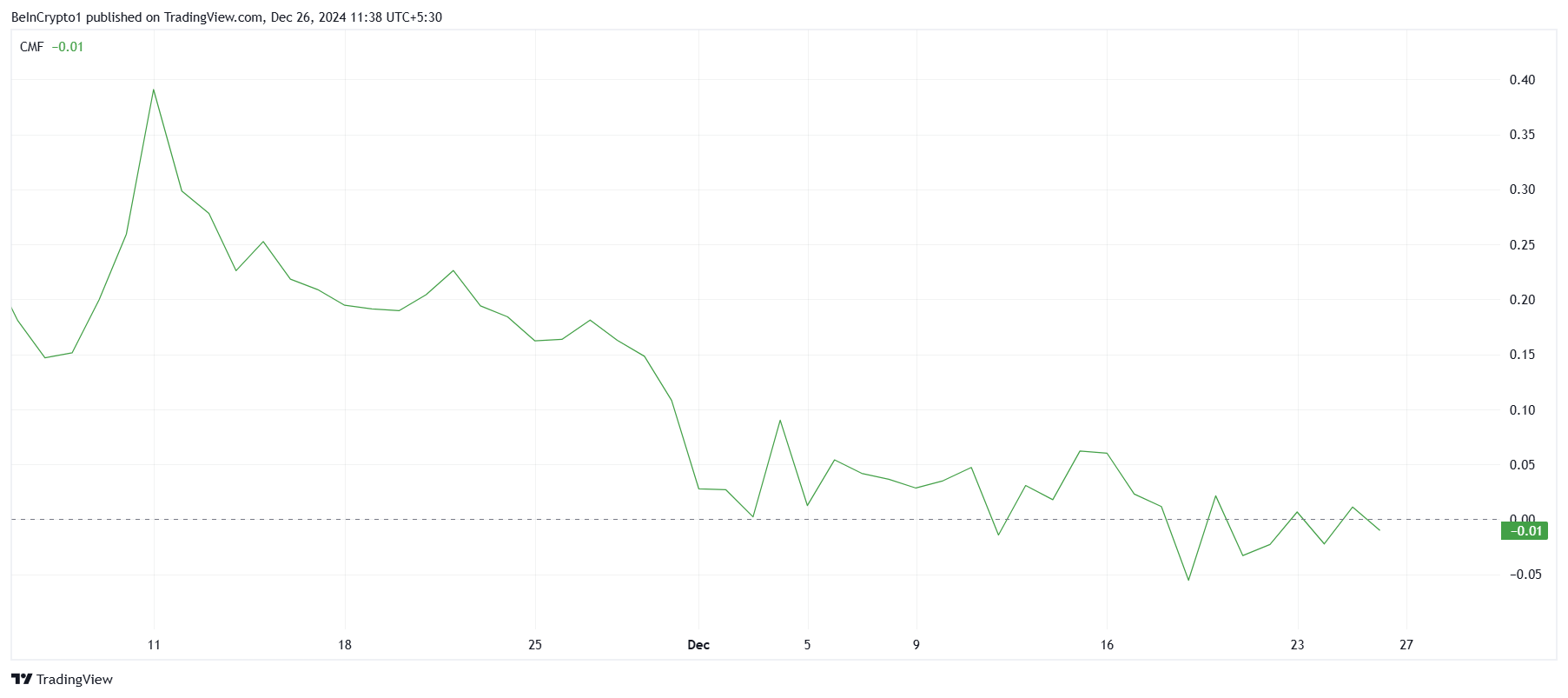

Dogecoin’s Chaikin Money Flow (CMF) indicator is hovering around the neutral line, signaling minimal inflows into the market. This suggests that investors remain cautious, potentially due to uncertainty in broader market conditions or waning interest in DOGE.

The lack of significant inflows reflects the hesitancy among market participants. Without a noticeable uptick in buying pressure, Dogecoin’s macro momentum could weaken further, leaving it reliant on whale activity and external catalysts to sustain its price levels.

DOGE Price Prediction: Securing Support

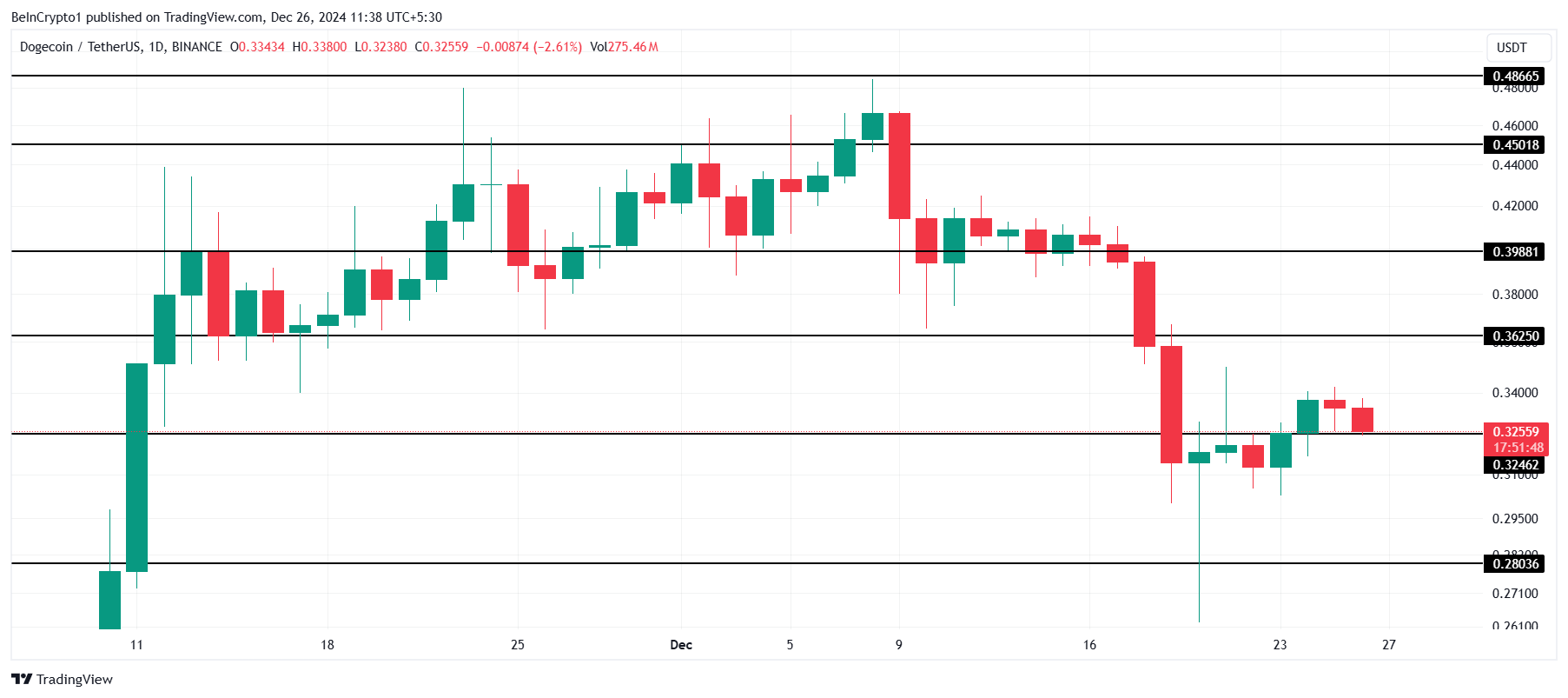

Dogecoin is currently priced at $0.32, a level it is attempting to establish as a support floor. Securing this level is crucial for the meme coin to recover from its recent 32% crash from $0.46. Holding this support could signal a potential turnaround in investor sentiment.

The next target for DOGE is to flip $0.36 into support and continue its uptrend toward $0.40. Achieving this milestone would restore confidence in the cryptocurrency, paving the way for sustained growth and increased market activity.

However, failing to secure $0.32 as a support level could lead to a drop toward $0.28. Such a decline would invalidate the bullish outlook, leaving Dogecoin vulnerable to further losses. Monitoring these key levels will be critical for traders and investors in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/dogecoins-32-crash-can-only-be-recovered-by-whales/

2024-12-26 08:00:00