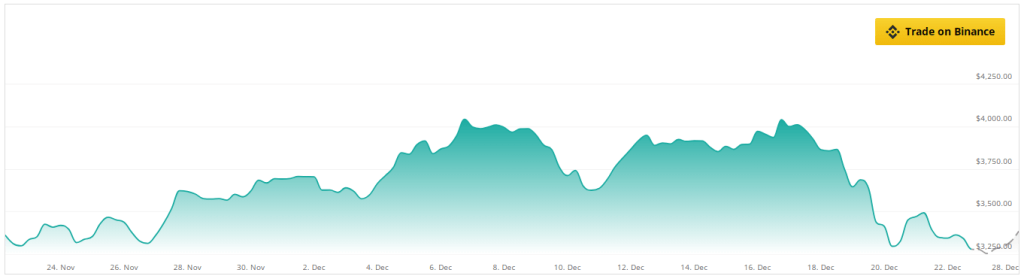

As 2024 nears its conclusion, Ethereum price fluctuations are being closely monitored. The trajectory of the cryptocurrency is critically influenced by key resistance and support levels, as indicated by recent analysis from crypto experts, which suggests a cautiously optimistic outlook.

Related Reading

Important Price Levels To Monitor

Analyzing cryptocurrencies, Justin Bennett emphasized the importance of Ethereum recovering the $3,540 level over the weekly period on December 22. This pricing range is regarded as necessary to show a potential change in the market toward optimism.

Should Ethereum be unable to clear this barrier, it runs the danger of sliding below the significant support zone of $3,000, leading to a drop toward $2,600. For investors as well as speculators, a drop of this degree would be costly.

As bullish as I’m turning with the overall setup going into 2025, buyers still have work to do.

For example, $ETH needs to recover $3,540 on the weekly time frame to look bullish next week.

Buyers have 33 hours to get it done.#Ethereum pic.twitter.com/cAChCbJxjd

— Justin Bennett (@JustinBennettFX) December 21, 2024

Market Sentiment And Analyst Predictions

The analysis by Titan of Crypto who utilized the Ichimoku cloud approach to predict probable recovery further strengthens the optimism surrounding Ethereum.

The analyst noted that Ethereum has retested some critical levels, which gives the impression that the present correction cycle is about nearing its end. The strength of Kumo Cloud’s support line indicates that Ethereum may well form a base for higher moves if it can manage to hold on to the existing levels.

Whales Ramp Up Accumulation

Meanwhile, Ethereum whales have increased their holdings and amassed about 340,000 ETH, which is worth more than $1 billion, in just a few days. This rise in accumulation shows that big investors are becoming more confident of the prospects of the altcoin.

Ethereum Whales Bought $1 Billion ETH In The Past 96 Hours – Details https://t.co/fZe8jWmQ3S

— Jose JM (@CryptoJoseJM) December 22, 2024

In addition, spot Ethereum ETFs have garnered inflows of over $2 billion since their introduction in the US market, which is indicative of the growing interest in these instruments. If regulatory authorities permit staking yields within these funds, analysts anticipate that this trend could surpass Bitcoin ETFs by 2025.

Ethereum Price Forecast

At the time of writing, Ether was trading at $3,330, down 0.7% and 15.7% in the daily and weekly timeframes, data from Coingecko shows.

Based on how the Ethereum market is doing right now, there will likely be a positive upward trend within the next week, despite Ether’s numbers flashing red in the charts.

Analysts are hopeful about its chances of recovering, even though it is selling at a 21% discount to what they think it will be worth in a month.

Source: CoinCheckup

A potential breakout that could test critical resistance levels is being indicated by technical indicators such as the Relative Strength Index (RSI) and Moving Averages.

Ethereum is anticipated to experience a robust development trajectory in the medium to long term, with a 35% price increase within the next three months and a remarkable 100% growth within a year, according to projections.

Featured image from DALL-E, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/can-ethereum-break-3500-before-end-of-2024-analyst-weighs-in/

2024-12-23 11:00:25