Ethereum (ETH) price faced a notably challenging August following a 30% decline in late July. The introduction of spot Ethereum exchange-traded funds (ETFs) was initially anticipated to spark renewed interest and drive positive price action.

However, institutional investors’ lukewarm reception of ETH ETFs played a significant role in the ongoing slump.

Ethereum Did Not See Much Bullishness

Institutional investors have shown a clear lack of enthusiasm towards Ethereum since the launch of spot ETH ETFs. In their first month, these ETFs recorded outflows of approximately $476 million. The outflows were significantly influenced by the Grayscale Ethereum Trust (ETHE) unlock, which caused a bearish ripple effect across the market.

In stark contrast, spot Bitcoin ETFs garnered inflows exceeding $3.7 billion during the same period. The disparity in investor sentiment between Bitcoin and Ethereum is significant and suggests that Ethereum’s current market perception is overwhelmingly negative. This sluggish performance of spot ETH ETFs could further depress Ethereum’s price.

Read more: How to Invest in Ethereum ETFs?

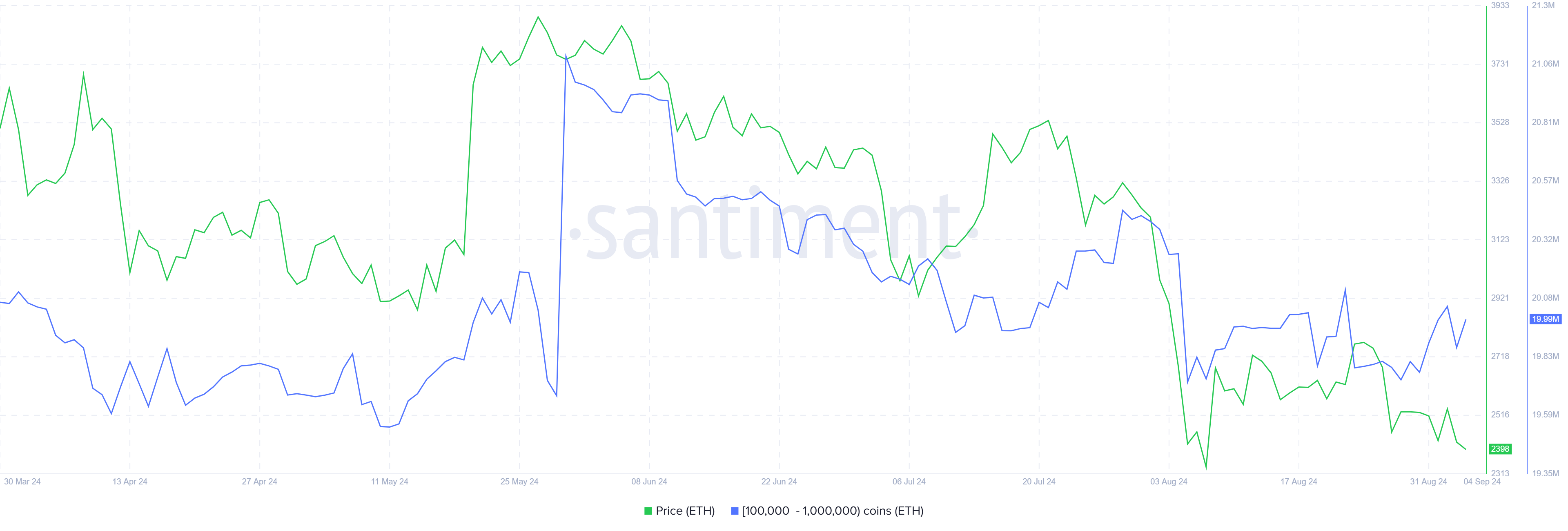

Furthermore, the investors’ sentiment towards Ethereum appears bearish, particularly when considering the actions of large-scale holders, often referred to as crypto whales. Addresses holding between 100,000 to 1 million ETH offloaded around 410,000 ETH in the last week, equating to a little under $1 billion at $981 million in value.

This massive sell-off reflects a broader pessimistic sentiment within the market, further pressuring ETH’s price downward. These whale activities are a strong indicator of the market’s current mood. When such large holders begin to liquidate their positions, it often signals a lack of confidence in near-term recovery.

ETH Price Prediction: Wait Before Recovery

Ethereum’s price has remained below the critical $2,811 resistance level since the 30% drop in late July, with recent consolidation occurring under $2,546. This consolidation suggests that ETH is struggling to gain upward momentum, which is crucial for any potential recovery.

Given the factors discussed, Ethereum may continue to consolidate under $2,546, with the potential to test the $2,344 support level in the coming days. The lack of institutional support and the broader market’s bearish sentiment could result in further downside pressure.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if institutions and crypto whales start to exhibit renewed interest and inflows into ETH ETFs improve, the outlook could shift. In such a scenario, ETH could breach the $2,546 level and move towards $2,681. Successfully flipping this resistance into support would invalidate the short-term bearish outlook, potentially setting the stage for a more sustained recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/can-ethereum-price-recover-negative-month-eth-etfs/

2024-09-04 12:30:00