Fantom (FTM) has shown significant recovery after a recent drawdown that caused substantial losses for holders. Many investors chose to secure their holdings, contributing to the downturn.

However, this period of losses may soon come to an end as Fantom regains momentum, bringing optimism back to the market.

Fantom Investors Are Skeptical

This week, the supply of FTM on exchanges rose sharply, with 37 million tokens transferred within 48 hours. Investors sold their holdings to secure $31 million worth of profits, reflecting concerns over the altcoin’s stalled uptrend. Such moves typically indicate waning confidence in a cryptocurrency’s short-term prospects.

The lack of sustained upward momentum has left many investors worried about further losses. Fear of vanishing profits has pushed holders to dump their tokens, amplifying selling pressure. However, the recent price surge could help mitigate these concerns, potentially stabilizing market sentiment for FTM.

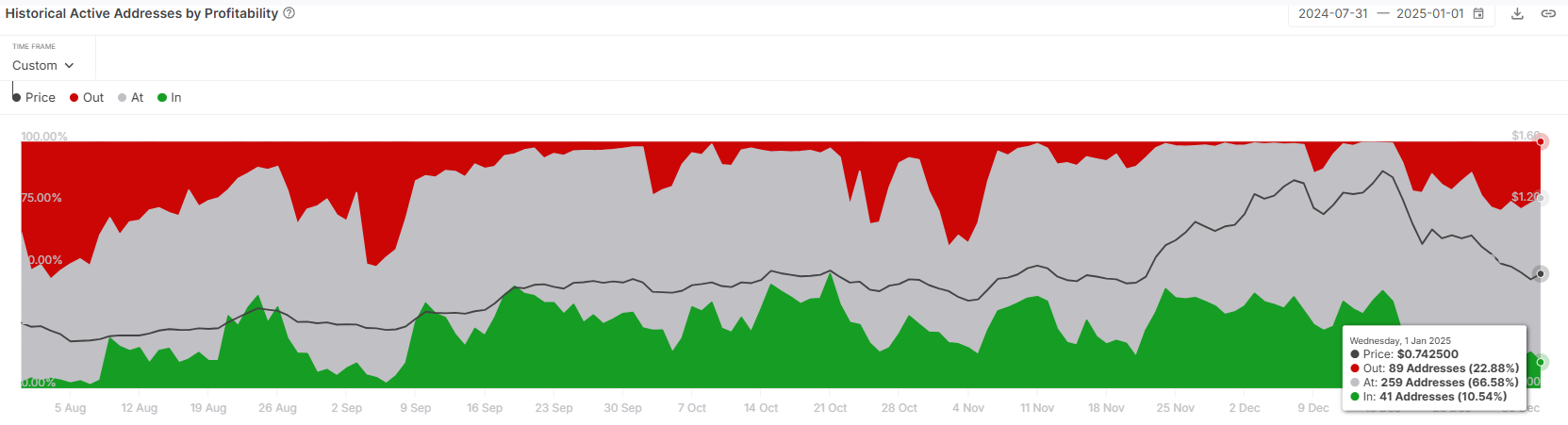

Active address profitability data reveals that only 10% of participating FTM investors are currently in profit. This is the lowest level for this group, suggesting a slowdown in selling activity. Historically, when profitability is this low, fewer investors are inclined to sell, reducing downward pressure on the price.

The slowdown in selling could support Fantom’s recovery. As fewer holders liquidate their positions, the altcoin has a better chance of maintaining its recent gains and building on its upward trajectory. This dynamic may help FTM regain crucial price levels in the coming weeks.

FTM Price Prediction: Aiming at $1

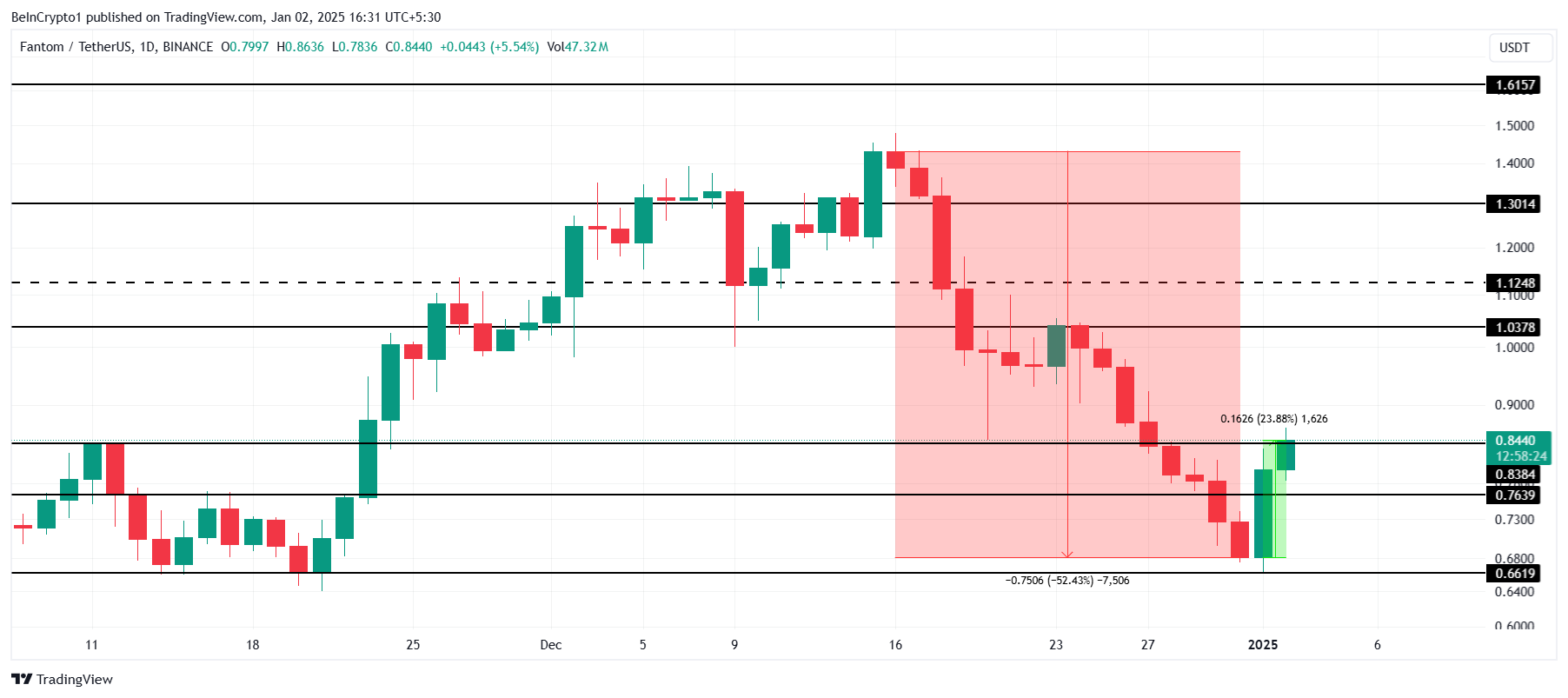

Fantom’s price rose by 23.88% in the past 24 hours, pushing the altcoin above the $0.83 resistance level. Trading at $0.84, FTM is now focused on securing this rise and sustaining its bullish momentum. Holding above this level is crucial for maintaining market optimism.

If FTM successfully bounces off the $0.83 support level, it could continue its uptrend. This would allow the altcoin to recover the 52% losses incurred during December’s second half. Reclaiming $1.03 as support would mark a significant milestone, restoring investor confidence and signaling further growth potential.

However, failing to hold above $0.83 could result in a retracement to $0.76, invalidating the bullish outlook. This scenario would erase part of the recent gains, leaving Fantom vulnerable to a deeper decline toward $0.66. Sustained momentum is critical to avoiding further setbacks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/fantom-price-jumps-after-selling-halts/

2025-01-02 17:00:00