Solana-based meme coin cats in a dog’s world (MEW) surged to an all-time high of $0.011 on October 25. However, a wave of profit-taking has since triggered a price drop, with MEW now trading at $0.0096 — a 14% decline from its peak.

BeInCrypto’s assessment of MEW’s technical and on-chain setup shows an outflow of liquidity as traders exit to secure gains, heightening the risk of further price declines for the meme coin.

cats in a dogs world Loses Bullish Support

MEW’s moving average convergence/divergence (MACD), which measures an asset’s price trends and momentum and identifies its potential buy or sell signals, confirms this bearish outlook.

An analysis of the MEW/USD one-day chart reveals that the MACD line (blue) recently crossed below the signal line (orange). This crossover suggests growing selling pressure, which could drive the price lower as traders start exiting positions or taking profits.

Read more: Top 9 Safest Crypto Exchanges in 2024

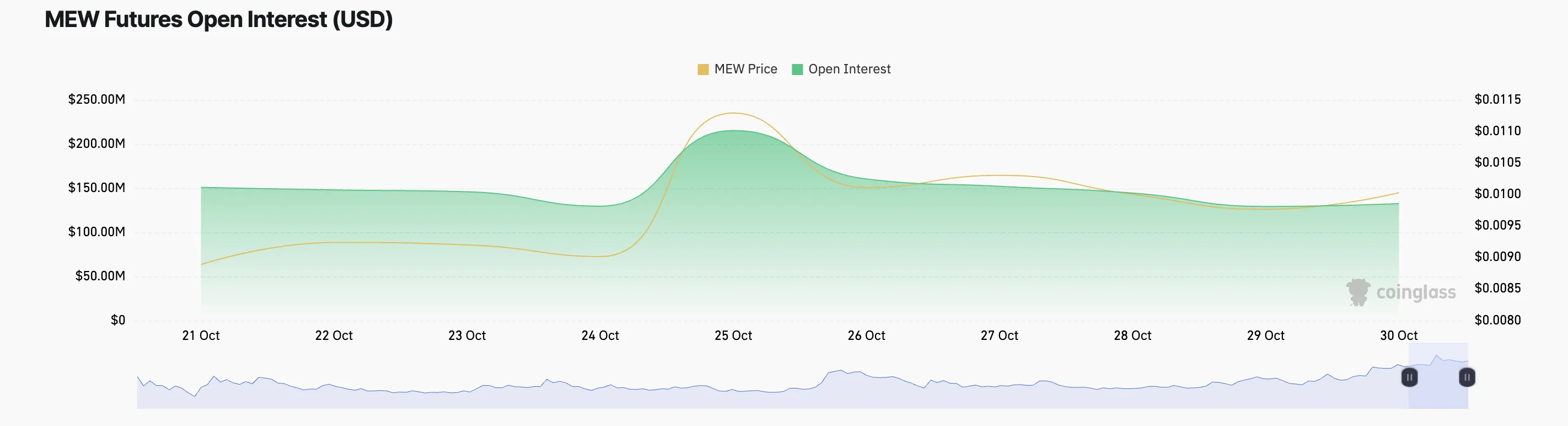

Moreover, MEW’s declining open interest confirms traders’ exit from the meme coin’s market. As of this writing, this stands at $134 million, having dropped by 39% since MEW’s price began to fall from its all-time high.

Open interest — representing the total number of active contracts or positions in the market — gauges trading activity and investor confidence. When both an asset’s price and open interest fall, it typically indicates waning interest and participation as traders close their positions and take profits.

Therefore, MEW’s open interest decline suggests that many traders are stepping back due to reduced confidence in the token’s near-term recovery or momentum.

MEW Price Prediction: Falling Demand Puts Meme Coin at Risk

At press time, MEW is trading at $0.0096, hovering below key resistance at $0.0099. With selling pressure intensifying, the meme coin may drop further, targeting major support at $0.0085. Should buyers fail to hold this level, MEW’s price could slide even lower toward $0.0065.

Read more: 11 Top Solana Meme Coins to Watch in October 2024

However, renewed demand could invalidate this bearish outlook. If momentum shifts and buying pressure increases, MEW’s price may break through the $0.0099 resistance, setting the stage for a rally back to its all-time high of $0.011.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/mew-price-chance-of-reclaiming-ath/

2024-10-30 19:30:00