The recent listing of First Neiro on Ethereum (NEIRO) on Binance has caused unexpected disruption in the market. This development, which was initially expected to significantly boost the price of Neiro Ethereum (NEIROETH), ended up disappointing holders.

About a week ago, Binance introduced Neiro Ethereum on its futures market, leading holders to anticipate a spot market listing, which they believed would boost the price. However, yesterday’s unexpected futures listing impacted the price negatively and affected holders’ profitability, leaving many surprised and frustrated.

Sudden Binance Listing Shocks the Market

On September 7, BeInCrypto reported that the price of Dogecoin-inspired Neiro Ethereum surged by 500% within seven days. This happened the same week Binance listed the meme coin in the futures market.

However, on Monday, the exchange listed another NEIRO token. Before listing on the spot and futures market, the meme coin’s market cap was less than $20 million. A few hours later, the price of First Neiro on Ethereum jumped by 1000%.

In contrast, the more recognized NEIROETH experienced a price crash, falling from $0.14 to $0.077. It’s also worth noting that the death of Kabosu and the introduction of a new Shiba Inu puppy with the trending meme coin name led to the launch of several Neiro tokens.

Read more: How To Trade Crypto on Binance Futures: Everything You Need To Know

As a result, it was not surprising that different tokens with similar tickers appeared on the same exchange. Following the price movement, Neiro Ethereum holders expressed frustration with Binance. Some even accused the exchange of tarnishing its reputation, according to comments shared on X (formerly Twitter).

For example, crypto trader VikingXBTC criticized the listing decision, suggesting that there were other meme coins with greater market interest that could have been prioritized over Neiro-related ones.

“The more I think of these listings, the worse they get. It’s three listings no one wanted. If you absolutely want to list meme coins, there are so many others that actually make sense. They have a total of 11 memes on their futures now — you’re telling me these three are the top ones?” VikingXBTC asked.

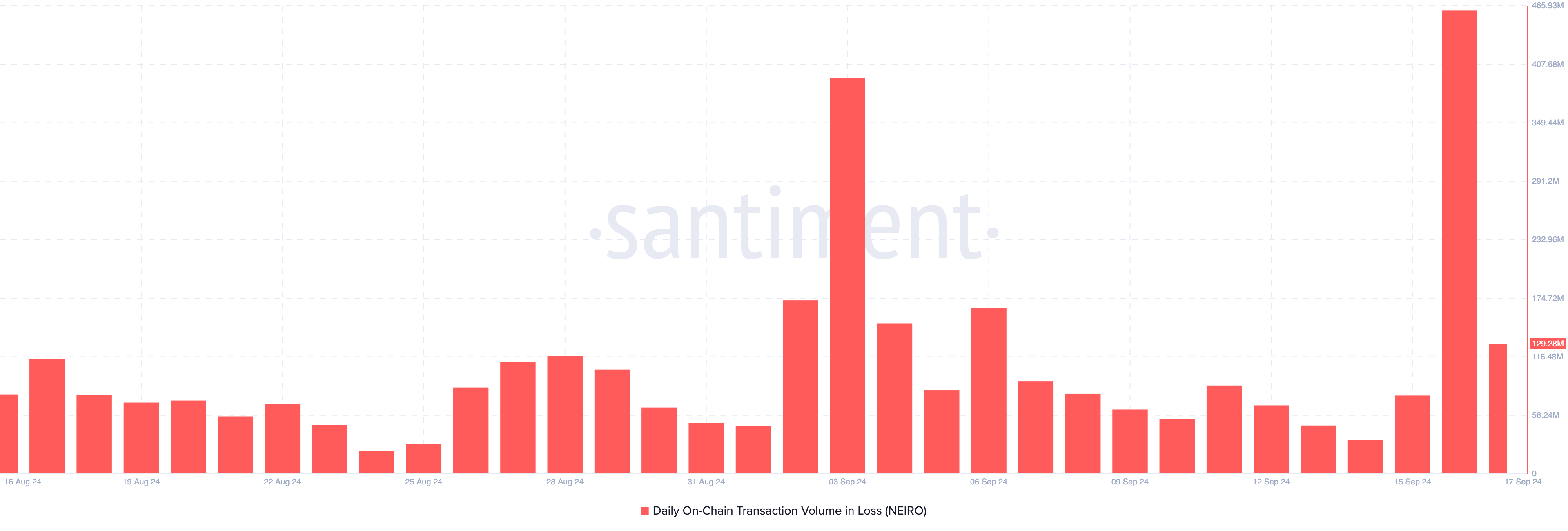

Besides that, NEIROETH’s price collapse led to the highest level of realized losses since its launch. According to data from Santiment, the on-chain transaction volume in loss hit 460 million on Monday. This surge suggests that holders engaged in panic selling as the price sharply declined.

NEIRO Price Prediction: Rebound Expected

Despite the notable price drop, market maker Wintermute Trading increased its NEIROETH holdings by buying an additional 19 million tokens earlier today. Purchasing such a large amount could be a positive sign for the troubled meme coin.

On the technical side, the Relative Strength Index (RSI) has reached an oversold level. The RSI measures momentum, with readings above 70.00 indicating an overbought condition, while those below 30.00 suggest an oversold condition.

Since the cryptocurrency is oversold on the 4-hour chart, a rebound could follow. If buying pressure increases, NEIROETH’s price might jump to $0.11.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, the meme coin’s value could drop to $0.052 if selling pressure increases and attention continues to shift to First Neiro on Ethereum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/binance-listing-triggers-crash-in-neiro-price/

2024-09-17 19:30:00