Notcoin’s (NOT) price is reacting just as other Telegram bot tokens have over the last couple of days.

The ongoing controversy surrounding Telegram’s CEO has resulted in the altcoin slipping into a downtrend.

Notcoin Faces Bearishness

The arrest of Telegram’s CEO has had a significant impact on Notcoin’s price. This event sent shockwaves through the market, altering investor sentiment and weakening the bullish momentum.

One of the key indicators of this shift is the Relative Strength Index (RSI). The RSI, which was close to breaching the neutral line, has now nearly plummeted to the oversold threshold. This drop highlights a sudden and sharp decline in buying pressure.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

The loss of bullish momentum is evident as the market reacts to the news, with many investors pulling back.

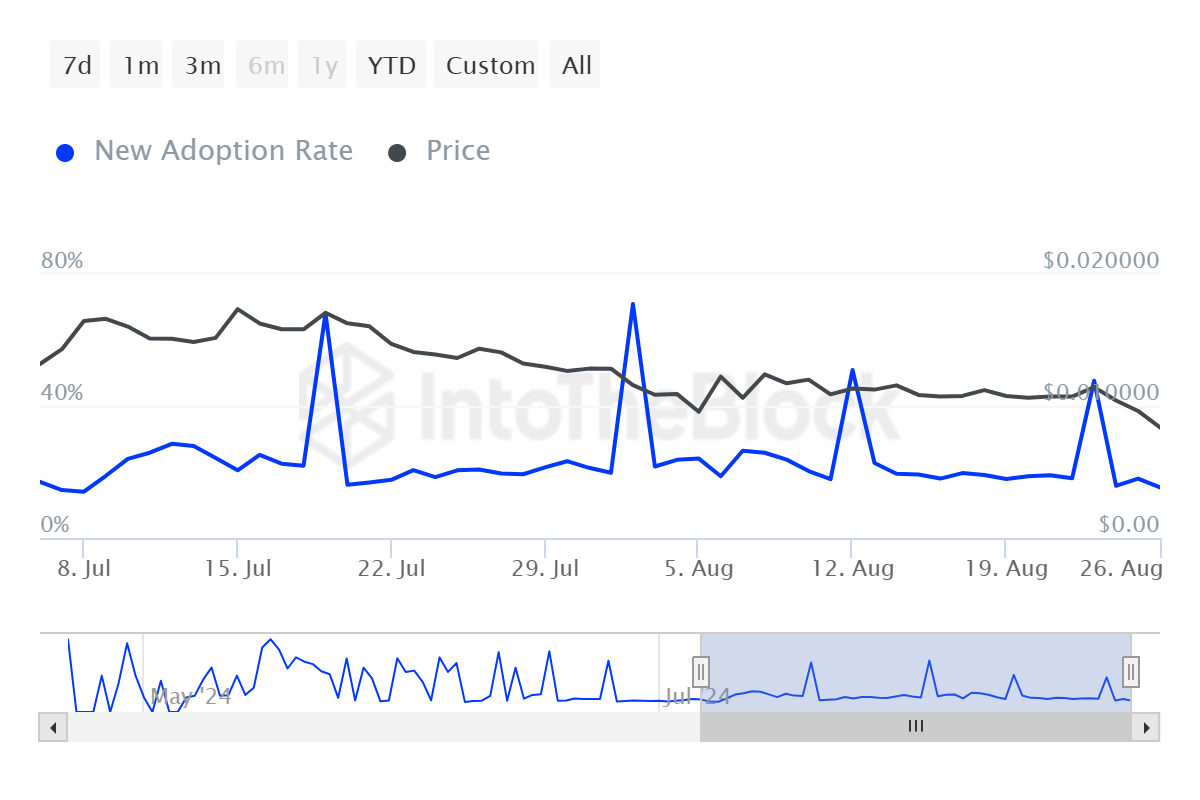

As a result, Notcoin’s adoption rate has suffered, hitting a near two-month low. This metric measures the overall contribution of newly formed addresses to the active addresses.

At the moment, this rate is at 15.31%, the lowest since the beginning of July. The decline reflects growing uncertainty among investors, particularly new ones who have been spooked by recent developments.

This could prove to be detrimental to Notcoin’s price.

NOT Price Prediction: Accepting the Downtrend

Notcoin’s price has failed in four attempts to breach the almost three-month-old downtrend. Two of these attempts even saw NOT closing above the downtrend line, but it couldn’t sustain the rise.

Trading at $0.0086 at the time of writing, the altcoin lost the support of $0.0094 and is closing in on $0.0076 after falling by over 27% in the last three days. There is a chance that Notcoin’s price could bounce off this support level and reclaim $0.0094 as support. This is because, despite the bearish cues, NOT could see demand from those looking to accumulate at low prices.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

However, if the macro downtrend outweighs the demand, Notcoin’s price could drop below $0.0076. This would bring the altcoin closer to the all-time low of $0.0045, and testing this level would invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/notcoin-not-price-returns-multi-month-downtrend/

2024-08-27 11:00:00