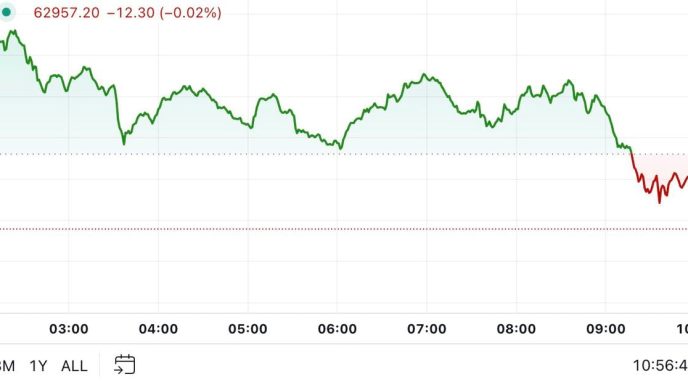

PEPE price has faced a challenging week, experiencing a 24% correction that caused the meme coin to fall short of breaching the key resistance at $0.00001146. Despite this setback, increased activity from PEPE whales could be the catalyst needed to turn things around.

With investors showing shaken confidence, the impact of large wallet holders may be crucial in driving a price rally if sentiment can shift back to optimism.

PEPE Whales Pack a Punch

Recently, large transactions involving PEPE have surged, indicating that whales are still active in the market. This metric tracks the total volume of transactions over $100,000, and at present, the volume has reached approximately $85 million. Typically, increased activity from these high-value transactions is a bullish sign, as it shows large wallet holders are positioning themselves for future gains.

This whale activity demonstrates that, despite the correction, major investors still have confidence in a potential price recovery. Their optimism could help restore broader market confidence and potentially fuel a rally. However, for this to happen, sustained buying pressure from these large investors is necessary to boost market momentum.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

One concerning sign is the slight dip in PEPE’s Mean Coin Age, which reflects the movement of tokens held by long-term holders (LTHs). When the Mean Coin Age dips, it indicates that LTHs are moving their coins, possibly preparing to sell.

An uptick in this indicator would suggest HODLing, showing conviction in the asset. If LTHs lose confidence and begin selling, it could hinder PEPE’s ability to rally.

The slight decline in Mean Coin Age could mean that some long-term holders are uncertain about PEPE’s future, which may limit the potential for a breakout. If LTH confidence continues to decrease, it could introduce further selling pressure, keeping PEPE’s price suppressed.

PEPE Price Prediction: Finding Strength

At the time of writing, PEPE is trading at $0.00001040, looking to breach the local resistance at $0.00001146. Successfully flipping this level into support would allow for a rise toward the crucial barrier at $0.00001369, potentially reversing the recent losses.

However, the declining confidence among LTHs could make this breakout challenging. If PEPE fails to breach $0.00001146, the coin will likely continue consolidating between $0.00001146 and $0.00000839, limiting its upside potential.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

On the other hand, a successful breach of $0.00001146 could result in a 33% rally, reigniting optimism among investors. This would recover the losses from the 24% correction and invalidate the bearish-neutral outlook, giving PEPE room to rise further.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pepe-price-rally-at-risk/

2024-10-07 12:00:00