Ripple’s XRP has struggled to break out of its trading range throughout August. Since August 9, the altcoin has consistently faced resistance at $0.61 and found support at $0.58.

Despite this challenge around the $0.60 level, XRP bulls have held firm, preventing any significant price drops.

Ripple Bulls Hold onto Hope

XRP bulls have focused on keeping the altcoin’s price above key moving averages to prevent it from slipping below $0.58. Currently, XRP trades above both its 20-day exponential moving average (EMA) and 50-day simple moving average (SMA).

An asset’s 20-day EMA is a short-term moving average that responds quickly to price changes, reflecting the average closing price over the past 20 days. In contrast, the 50-day SMA is a longer-term indicator that captures the average closing price over the last 50 days.

When an asset trades above these levels, it signals bullish momentum and suggests the potential for further price gains. Despite XRP’s sideways movement, trading above both the 20-day EMA and 50-day SMA indicates that bullish sentiment outweighs bearish pressure.

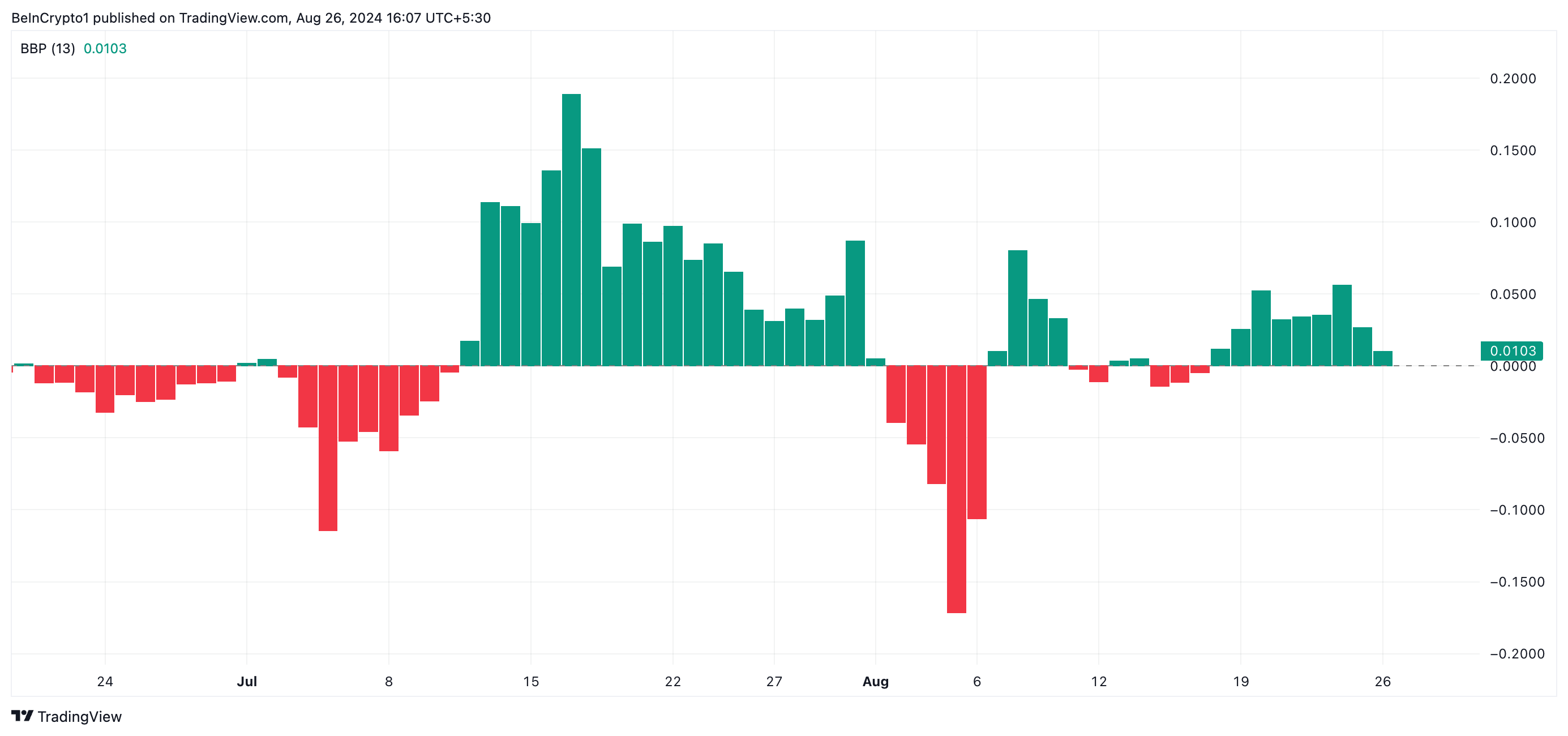

This bullish bias is reinforced by XRP’s positive Elder-Ray Index, which currently stands at 0.010. Notably, the indicator has remained in positive territory since August 18, nine days after the sideways trend began.

Read more: Getting Started With XRP Wallets

XRP Price Prediction: A Rally Toward $0.66 Is Possible

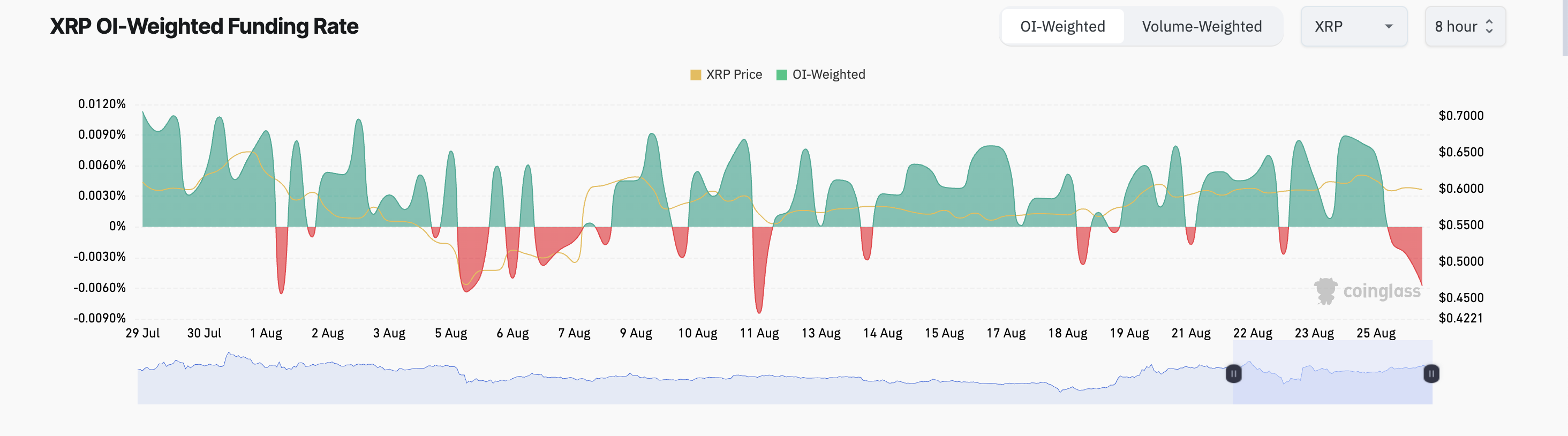

XRP’s derivatives traders have also stayed bullish. Since the altcoin’s price started moving sideways, its futures open interest has surged by 4%, reaching $722 million at press time.

Despite XRP’s range-bound movements, its futures traders continue to favor long positions. While there have been occasional spikes in short demand, traders have consistently opened more long positions than shorts during this sideways phase, as reflected in the positive funding rate.

If bullish sentiment strengthens enough to break resistance, XRP’s price could rise to $0.66.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Conversely, if bears push the token’s price below support, it may dip under the 20-day EMA and 50-day SMA, potentially dropping to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-struggles-bulls-remain-optimistic/

2024-08-26 21:30:00