Shiba Inu (SHIB) has faced a rough week, dropping 13% in value. Despite the decline, a group of whales has shown confidence in the leading meme coin, steadily increasing their holdings over the past few weeks.

However, short-term holders (STHs) have been selling off their SHIB, adding downward pressure on the price. This analysis explores why the selling activity from SHIB’s STHs may prevent any significant rally in the short term.

Shiba Inu Whales Fight Its Short-Term Holders

BeinCrypto’s assessment of Shiba Inu’s supply distribution shows that a cohort of whale investors holding between 10,000 and 100,000 coins has increased their supply over the past few weeks.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

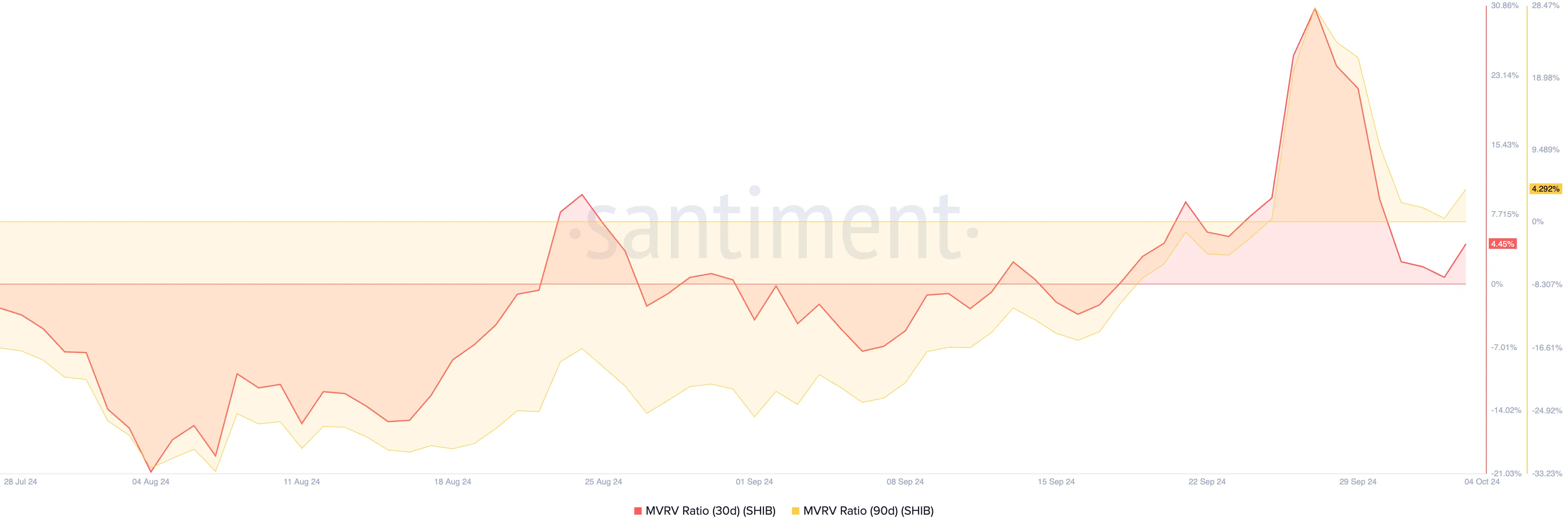

This group of large SHIB holders now controls 3.06 billion SHIB, a 2% increase from the 3.01 billion SHIB they held just a month ago. Their decision to accumulate more tokens may have been driven by SHIB’s undervalued status throughout September, as reflected by its market value to realized value (MVRV) ratio.

According to this metric, SHIB’s 30-day and 90-day MVRV ratios were negative for most of September, suggesting that the coin was trading below its historical value, which may have prompted these whales to buy more coins.

However, SHIB’s STHs, those who have held their coins for less than 30 days, have taken a more cautious stance. True to their “paper hands” nature, they have been selling off their coins in recent weeks.

Their selling activity is noteworthy, as STHs tend to be risk-averse, offloading their assets at the slightest sign of trouble. Given that they hold a sizable portion of SHIB’s circulating supply, their selling activity puts substantial downward pressure on the coin’s price.

SHIB Price Prediction: Coin Eyes $0.000010

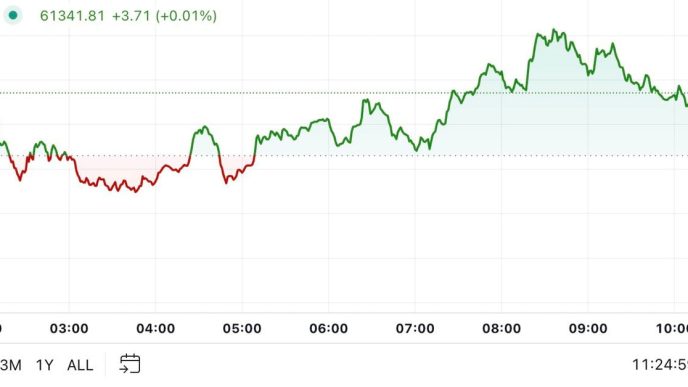

SHIB’s falling on-balance volume (OBV) reflects the selling activity from SHIB’s STHs. At 24.79 trillion, the meme coin’s OBV, which measures its buying and selling pressure based on trading volume, has maintained a downward trend since the beginning of the month.

A dropping OBV is typically a bearish indicator, suggesting potential downward price movement. When accompanied by a price decline, it points to a lack of buyer support. If demand for SHIB continues to plummet, it could revisit its August 5 low of $0.000010.

Read more: 6 Best Platforms To Buy Shiba Inu (SHIB) in 2024

However, if STHs become bullish and begin to accumulate, it may drive Shiba Inu’s price up by 69% to test the resistance formed at $0.000028.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/shiba-inu-whales-bet-on-price-rise/

2024-10-04 12:00:00