Solana (SOL) has fallen 14% from its all-time high of $295.83, reached on January 19. Despite the decline, bullish sentiment remains strong as market participants ease up on profit-taking.

This shift suggests the potential for a rebound, with SOL poised to retest its all-time high and possibly exceed it. Here’s a closer look at the factors supporting this outlook.

Solana Bulls Attempt to Reclaim All-Time High

Today, Solana has recorded a resurgence in net inflows into its spot markets, signaling renewed investor interest in the cryptocurrency. This shift comes just a day after the altcoin experienced net outflows totaling $137 million, representing its highest over the past 30 days.

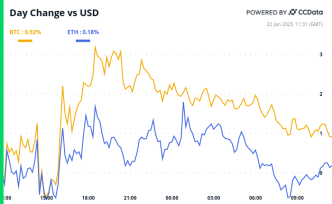

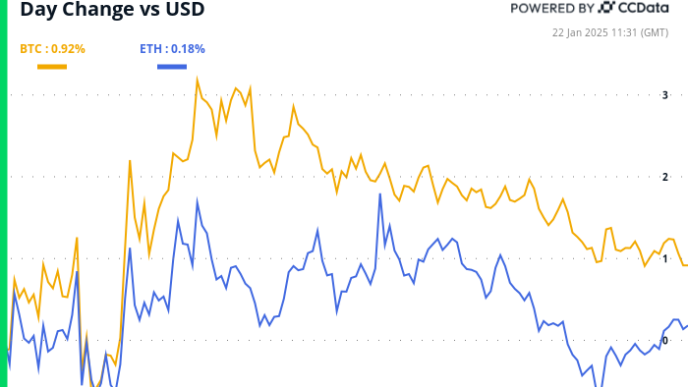

As a result of these inflows, SOL’s price has climbed by 9% in the past 24 hours. When an asset records net inflows into its spot market, it indicates that buying activity is outpacing selling activity, leading to increased demand. This reflects growing investor confidence and a shift toward accumulation.

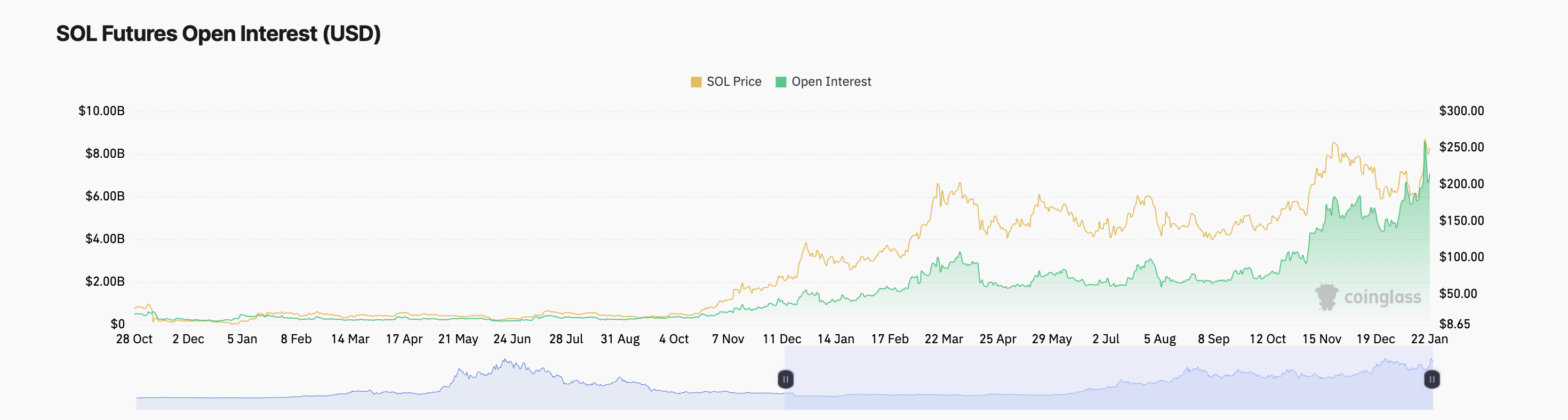

Furthermore, SOL’s Open Interest has surged by 11% over the past 24 hours, confirming the spike in demand for the altcoin. As of this writing, it stands at $7.25 billion.

Open Interest represents the total number of outstanding derivative contracts that have not been settled. When it rises during a price rally, it signals increased participation and conviction among traders. It indicates strong bullish momentum and the potential for the rally to continue.

SOL Price Prediction: a Move Back to ATH or a Drop to $239.39?

On the daily chart, SOL’s Relative Strength Index (RSI) reflects the growing demand for the altcoin. At press time, the indicator is in an uptrend at 67.49.

The RSI measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and might witness a correction. On the other hand, values under 30 suggest that the asset is oversold and might experience a rebound.

At 67.49, SOL’s RSI indicates it is in bullish territory, with strong buying momentum but not yet overbought. If accumulation strengthens, SOL’s price could revisit its all-time high.

However, a surge in selloffs will invalidate this bullish outlook. In that scenario, SOL’s price could fall to $239.39.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/solana-price-nears-all-time-high/

2025-01-22 10:30:00