Story (IP) has surged by nearly 50% in the past 24 hours, making it the market’s top-performing asset. During Thursday’s early trading session, this rally pushed IP to a new all-time high of $3.67.

With strengthing buying pressure, the altcoin is poised to extend its gains in the short term.

Story Maintains Strong Uptrend as Indicators Signal Continued Gains

An assessment of the IP/USD four-hour chart shows the coin’s Aroon Up Line at 100%. This indicates that its current uptrend is strong, backed by significant demand, and not driven by speculative trades.

An asset’s Aroon Indicator measures the strength and direction of a trend by tracking the time since the highest and lowest prices over a given period. It comprises two lines: Aroon Up, which measures bullish momentum, and Aroon Down, which tracks bearish pressure.

As with IP, when the Aroon Up line is at 100, it means the asset has recently hit a new high, signaling strong upward momentum and a dominant bullish trend. This suggests that buying pressure is high, and the price may continue rising.

Converesly, IP’s Aroon Down Line is at 0% at press time. This indicates that the coin has not recorded a new low during the review period. These conditions, occurring simultaneously, suggest that IP is witnessing a strong uptrend with minimal downside pressure.

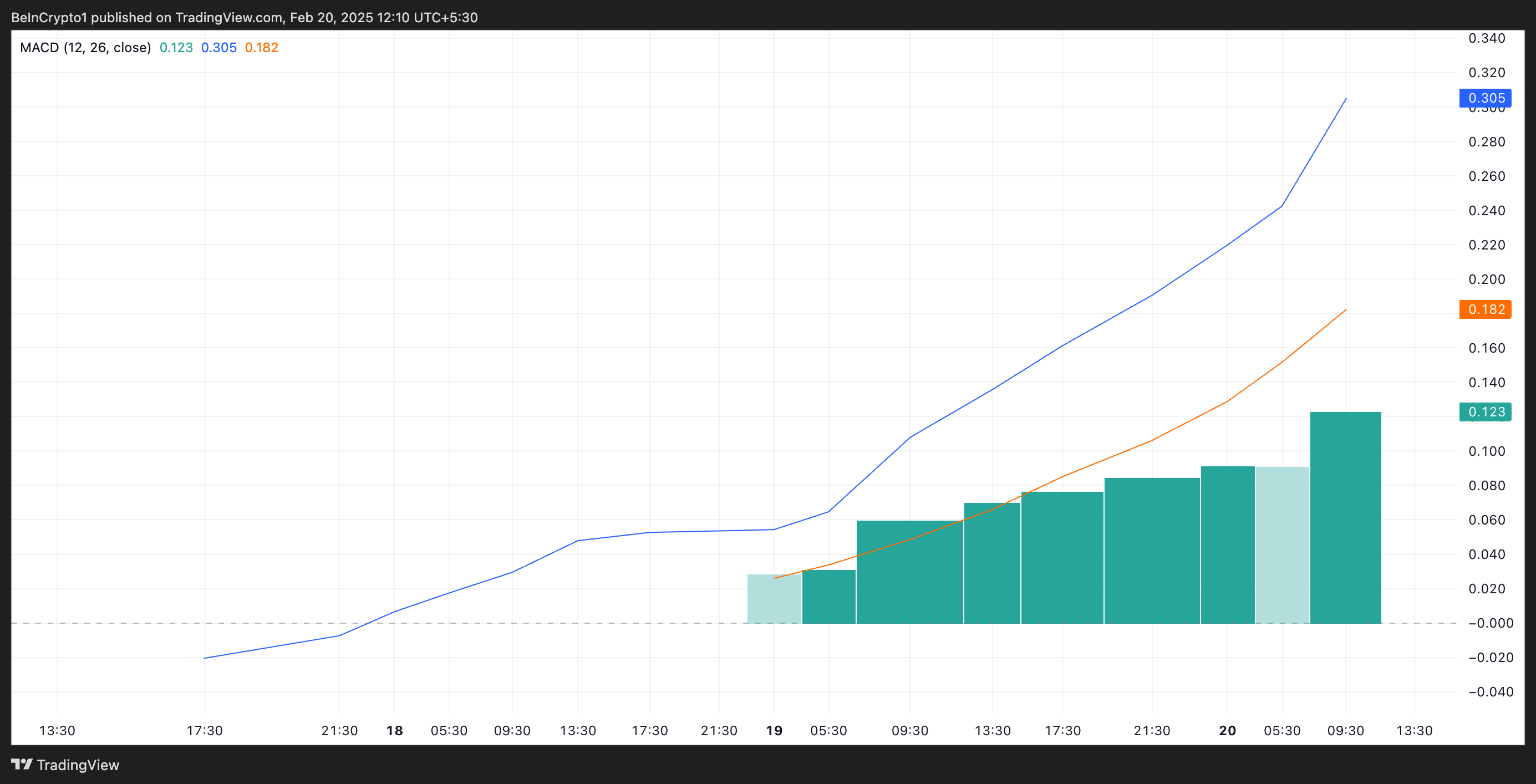

Further, its Moving Average Convergence Divergence (MACD) setup supports this bullish outlook. As of this writing, IP’s MACD line (blue) rests above its signal line (orange).

When this momentum indicator is set up in this manner, it indicates bullish momentum, suggesting that the asset’s price may continue to rise.

IP Eyes $4, But Overbought RSI Signals Caution

A sustained buying pressure in its spot markets will push IP to new highs. If this bullish momentum is maintained, the altcoin could maintain its price rally and exchange hands above $4 in the near term.

However, readings from its Relative Strength Index (RSI) suggest that the asset is overbought and at risk of a price correction. At press time, this indicator stands at 83.69.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 83.69, IP’s RSI hints at a potential correction in the near term. If that happens, the altcoin’s price could plummet to $1.69.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ip-all-time-high-leads-market/

2025-02-20 10:00:00