WIF has garnered substantial interest from investors and is currently on an upward path, showing promising signs of a potential rally. The coin’s recent price action highlights an attempt to solidify gains, with strong inflows suggesting rising investor interest.

This demand could serve as a crucial catalyst, helping WIF achieve the uptrend it is aiming for.

WIF Investors Seem Bullish

The Chaikin Money Flow (CMF) indicator for WIF has recently shown a sharp uptick, indicating a significant increase in inflows. This marks the first notable rise in CMF since the start of the month, as WIF has primarily experienced outflows. The return of inflows is a positive development, signaling that buyers are returning to the market with a renewed interest in the meme coin.

This inflow resurgence may reinforce the bullish sentiment around WIF, creating an environment conducive to sustained growth. When inflows outweigh outflows, it generally indicates that buying pressure is building, which can support a price increase. For WIF, this renewed demand could be instrumental in pushing it closer to its price target, helping to attract more investor attention.

Read more: How To Buy Dogwifhat (WIF) and Everything Else To Know

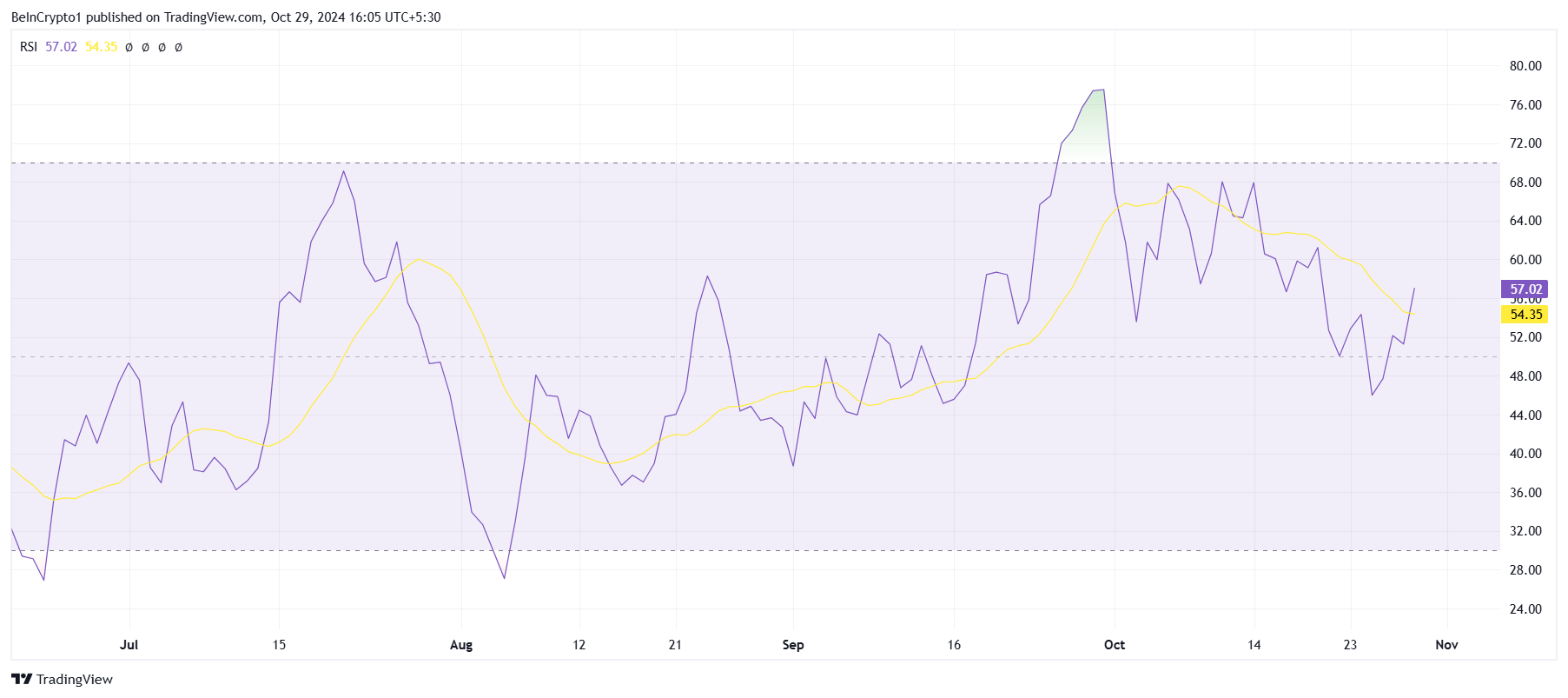

In addition to inflows, WIF’s macro momentum appears favorable, as seen in technical indicators like the Relative Strength Index (RSI). The RSI has recovered into the positive zone, rising above the neutral line at 50.0, signaling that bullish momentum is strengthening. This RSI position is essential, as it confirms that buying pressure is building and WIF’s current trend is stable.

A strong RSI above 50.0 suggests that WIF has regained its footing in the market and is positioned for potential gains. This increase could attract more investors, adding momentum to WIF’s upward trajectory.

WIF Price Prediction: Aiming High

WIF is currently trading at $2.65, facing a barrier at $2.75. As it tests the upper limit of an ascending wedge as support, WIF has a realistic chance of achieving a 55% rally if it can break through the $2.75 resistance. Successfully establishing this level of support could allow WIF to continue its climb.

The primary target for WIF is $3.38, a level it could reach if $2.75 is flipped into solid support. Once this resistance is converted, WIF could see increased investor confidence, pushing the meme coin toward its anticipated target of $3.38.

Read more: Dogwifhat (WIF) Price Prediction 2024/2025/2030

However, if WIF’s bullish momentum does not play out as expected and turns bearish, the price could fall to $2.36. Losing this support would also mean WIF loses its trend line support. This could potentially send the price down to $2.01, effectively invalidating the current bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/wif-price-rally-like-due-to-inflows/

2024-10-29 16:00:00