Three days ago, SUI reached a new all-time high of $2.36, but Fear, Uncertainty, and Doubt (FUD) surrounding a recent development overshadowed the achievement.

Despite this, market investors remain confident that SUI will soon overcome the setback and break resistance levels again. This analysis explores the factors driving this sentiment and what SUI’s price could reach in the near term.

Traders Are Bullish on Sui Again

SUI’s price is currently $2.12, down 10.63% from its all-time high of $2.36 on October 14. The decline may be tied to rumors of a $400 million insider sell-off of SUI, a claim the Sui Foundation has denied.

During that time, the coin’s Funding Rate dropped into negative territory. The Funding Rate measures the difference between an asset’s perpetual futures price and its spot price. When the rate is high, traders favor long positions and are willing to pay to maintain them, reflecting bullish sentiment.

On the other hand, a negative Funding Rate signals bearish sentiment, as short positions dominate and traders are paying longs to hold their positions. Currently, the Funding Rate has returned to positive territory, indicating that traders have moved past the FUD and are now expecting a significant rebound for Sui.

Read more: Everything You Need to Know About the Sui Blockchain

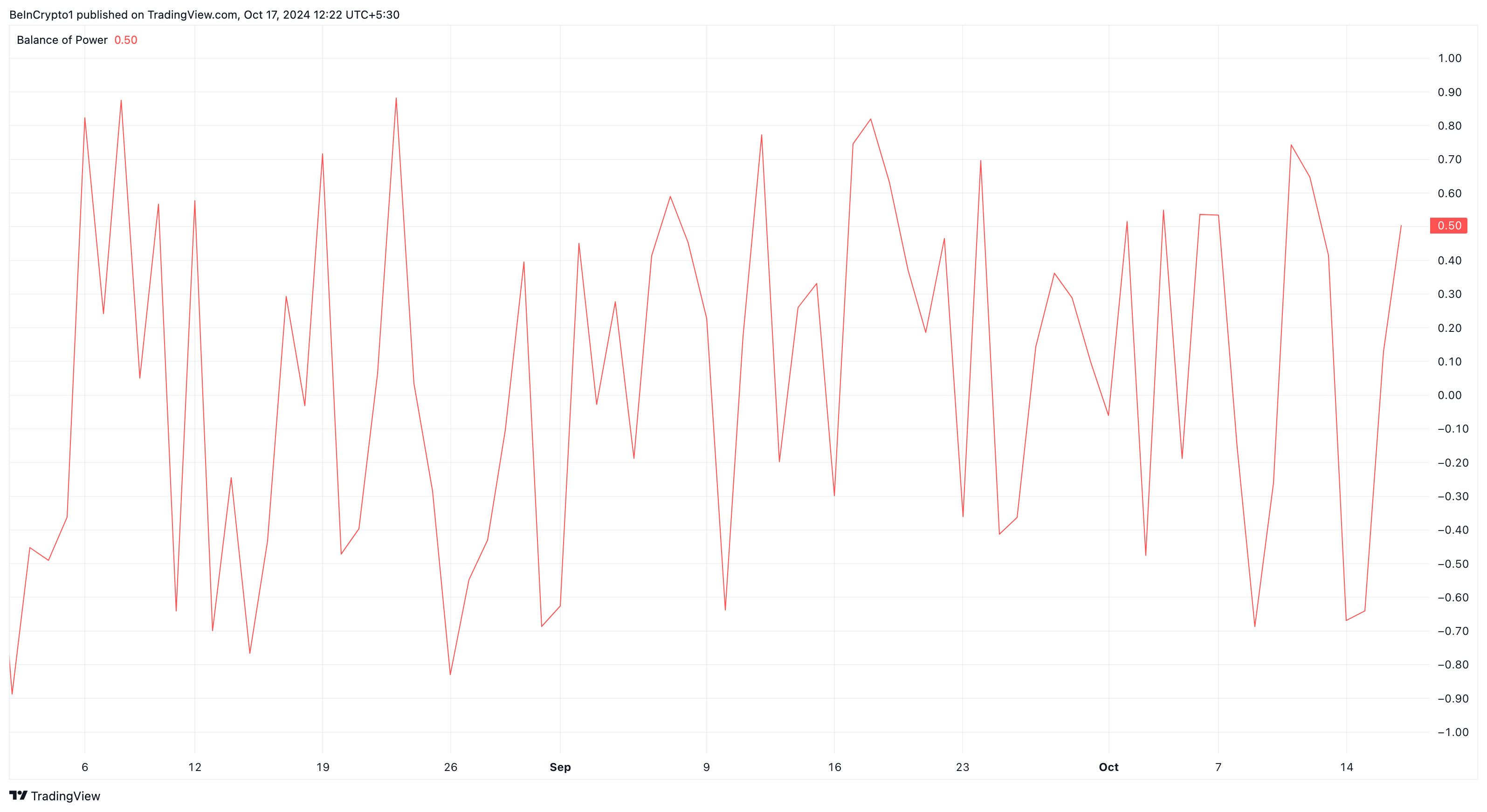

In line with this outlook, the Balance of Power (BoP), which gauges the strength of buyers versus sellers, has risen. When the BoP drops, it indicates sellers (bears) are dominant, often leading to a price decline.

However, an increasing BoP suggests that bulls (buyers) are outpacing the bears, which appears to be the case with SUI. This could signal that SUI’s price may climb above $2.11 in the short term.

SUI Price Prediction: New All-Time High Soon

On the daily chart, SUI seems to have solid support around $2.05. This level was vital to the initial move up to $2.36. With SUI’s price at $2.12, it appears that the same support is proving to be instrumental in cementing strength for the altcoin.

If this remains the same, SUI’s price is likely to surpass $2.36 within a few days. But that would only happen as long as bears do not tug the price back from $2.12. Should that happen, the altcoin’s value might climb by 20% and hit $2.55.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

On the other hand, this forecast could be invalidated if SUI holders cash out before the price runs beyond $2.36. In that scenario, the cryptocurrency might drop back to the $2.05 support, and if it loses that level, it could decline to $1.84.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/sui-price-to-shake-off-fud/

2024-10-17 07:29:23