Telegram coin Notcoin (NOT) has experienced short-term consolidation since the beginning of September. Due to multiple support levels, the cryptocurrency has avoided sharp corrections in the past months.

However, the key level to watch is $0.00732—if Notcoin falls below this, investors could face significant losses. A breach of this level could result in a sharp downturn, sending prices tumbling.

Notcoin May Not See Red Soon

The Relative Strength Index (RSI) continues its downtrend, suggesting a bearish outcome for Notcoin. Since mid-July, bullish momentum has steadily faded, impacting the overall market sentiment surrounding the altcoin. The declining RSI reflects weakening buying pressure, which could negatively affect Notcoin’s price in the near term.

As the RSI continues to drop, the potential for a price recovery also diminishes. Without a significant uptick in buying interest, Notcoin could struggle to hold its current price levels.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

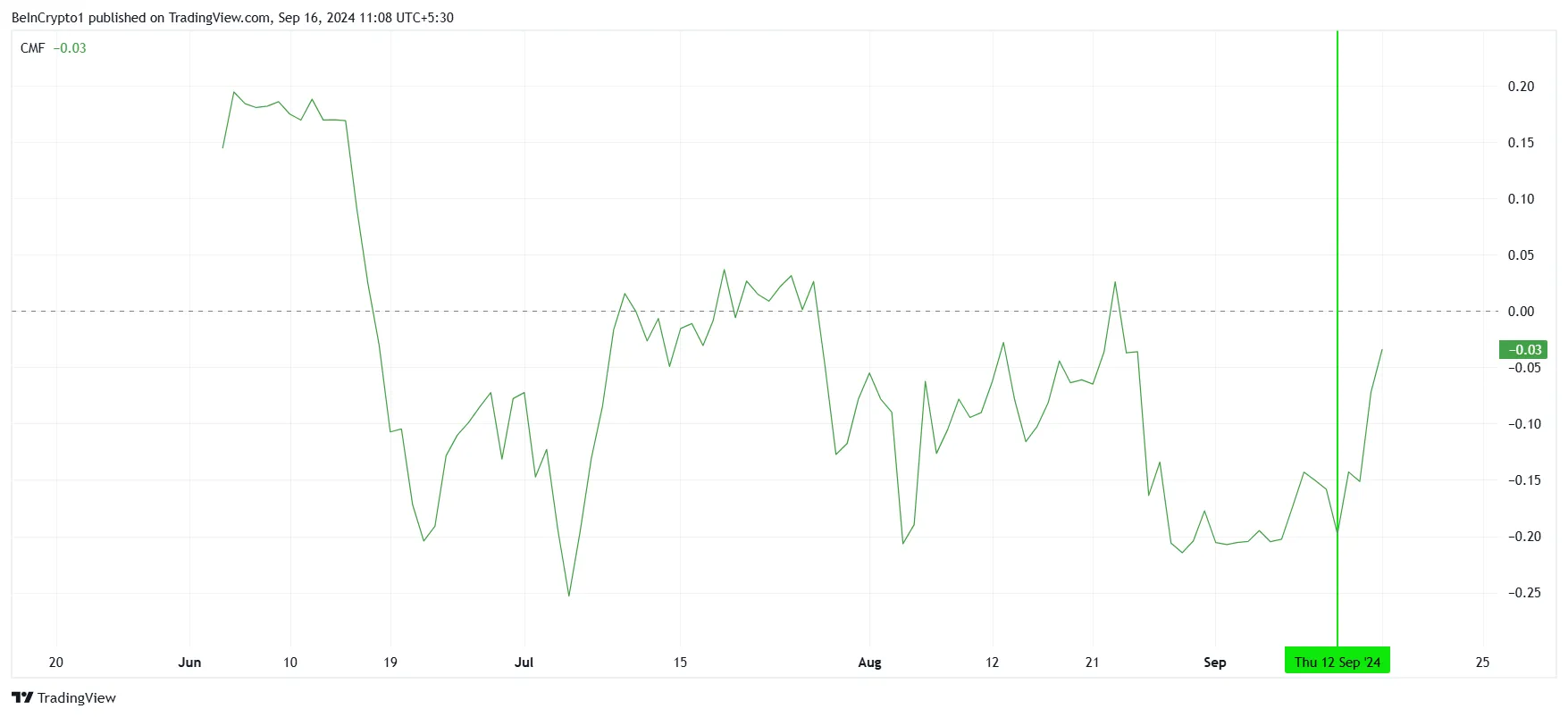

However, despite bearish signals, there is still some hope for Notcoin, thanks to the Chaikin Money Flow (CMF) indicator. The CMF shows that investor interest remains, with inflows gradually increasing.

A sharp uptick in the indicator suggests that once it crosses the zero line, netflows could turn positive. This shift might prevent a price decline and keep Notcoin relatively steady in the near term.

NOT Price Prediction: Aiming Right

Notcoin is currently trading at $0.00744, hovering just above the critical support level of $0.00732. If this level is tested as support, it will mark the second time in September that Notcoin faces the threat of a decline. However, multiple technical factors suggest that the altcoin may avoid a full-blown drop and continue its consolidation phase.

If Notcoin manages to hold above the $0.00732 support level, the cryptocurrency could gain enough momentum to test the upper limit of $0.00855. This would provide a much-needed boost for investors and allow the coin to recover some of its recent losses.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

However, if bearish sentiment prevails, Notcoin may fall through its critical support, potentially dropping to $0.00572, which would result in a 23% decline. The lack of strong technical and psychological support at this level could exacerbate the fall, undermining any bullish recovery attempts.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/notcoin-threatened-by-sharp-correction/

2024-09-16 07:25:49