SAGA, the native token of the Layer 1 protocol Saga, has experienced a surge in trading activity over the past 24 hours. The token’s price has spiked by 30%, accompanied by a 350% increase in trading volume during this period.

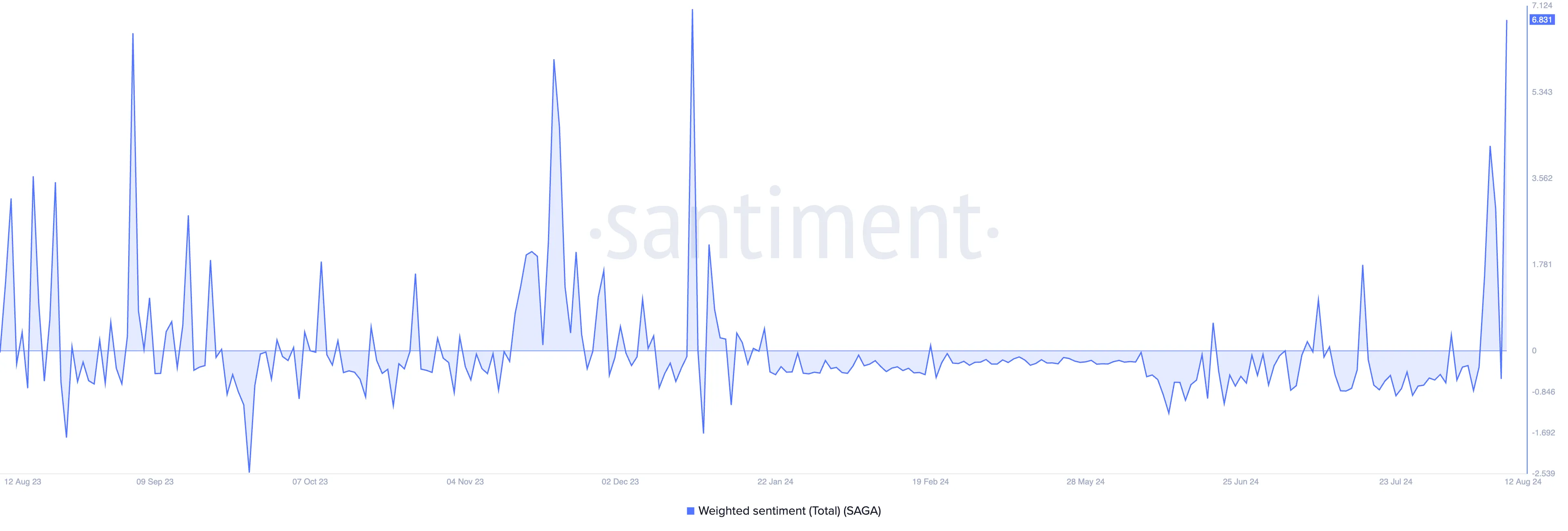

Token holders maintain their bullish outlook as SAGA’s weighted sentiment climbs to its highest point in nine months.

Saga Sees Spike in Positive Bias

As of this writing, SAGA trades at $1.60. During Tuesday’s trading session, the altcoin climbed to a seven-day peak of $1.70 before witnessing a 5% price correction.

In the past 24 hours, SAGA’s trading volume has totaled $123 million, representing the altcoin’s single-day highest trading volume since July 9.

When a corresponding surge in trading volume accompanies an asset’s price rally, it indicates that an actual demand backs the price growth. It suggests that many market participants are actively buying and selling the asset and that the rally is less likely to be a short-term spike caused by small trades.

The uptick in SAGA’s trading activity over the past 24 hours is due to the spike in positive sentiments among traders during that period. As of this writing, SAGA’s weighted sentiment is 6.83, representing its highest since December 15, 2023.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

An asset’s weighted sentiment metric tracks the market’s mood regarding it. When its value is positive, the majority of social media mentions, news articles, and other online discussions about the asset are bullish.

With a weighted sentiment of 6.83, SAGA’s recent price surge in the past 24 hours is backed by a positive outlook from traders, suggesting the potential for continued gains.

SAGA Price Prediction: Token May Touch 30-Day High

Demand for SAGA has spiked, as evidenced by its momentum indicators assessed on a one-day chart. For example, the token’s Relative Strength Index (RSI) is at 58.03 and in an uptrend at press time.

This indicator measures an asset’s overbought and oversold market conditions. At 58.03, SAGA’s RSI indicates that buying pressure outweighs selling activity.

Likewise, its Chaikin Money Flow (CMF)—which tracks the flow of money into and out of the asset—maintains upward momentum. This means there is liquidity inflow into the SAGA market. As of this writing, the indicator’s value is -0.08.

Traders should note that a negative but rising CMF is often a potential early sign of a shift in market sentiment. If the trend continues, the CMF might eventually cross into positive territory, signaling a transition from a bearish to a more bullish market.

If the demand for SAGA remains high, its price may climb to a 30-day high of $1.89.

Read More: What Is Altcoin Season? A Comprehensive Guide

However, any profit-taking activity can cause its price to fall to $0.04.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/can-bulls-push-saga-price-new-highs/

2024-08-13 10:30:00