Earlier today, dogwifhat (WIF) experienced a decline below $3 amid a broader market downturn that affected many cryptocurrencies. However, the WIF coin price quickly rebounded and is currently trading at $3.16.

But does this mean the Solana meme coin will continue to climb? This analysis takes a look at the possibility.

Dogwifhat Sees Resurging Buying Pressure

WIF’s swift rebound coud be linked to a rise in the Chaikin Money Flow (CMF). On the daily chart, the CMF has remained in an elevated position.

The CMF is a technical indicator that gauges the flow of money into and out of an asset over a specified period. It helps assess the strength of a trend, the balance of buying and selling pressure, and overall market sentiment.

Positive CMF readings indicate strong buying pressure, while negative readings suggest selling pressure. Therefore, the current reading on the WIF/USD chart shows that buying pressure outpaces selling pressure.

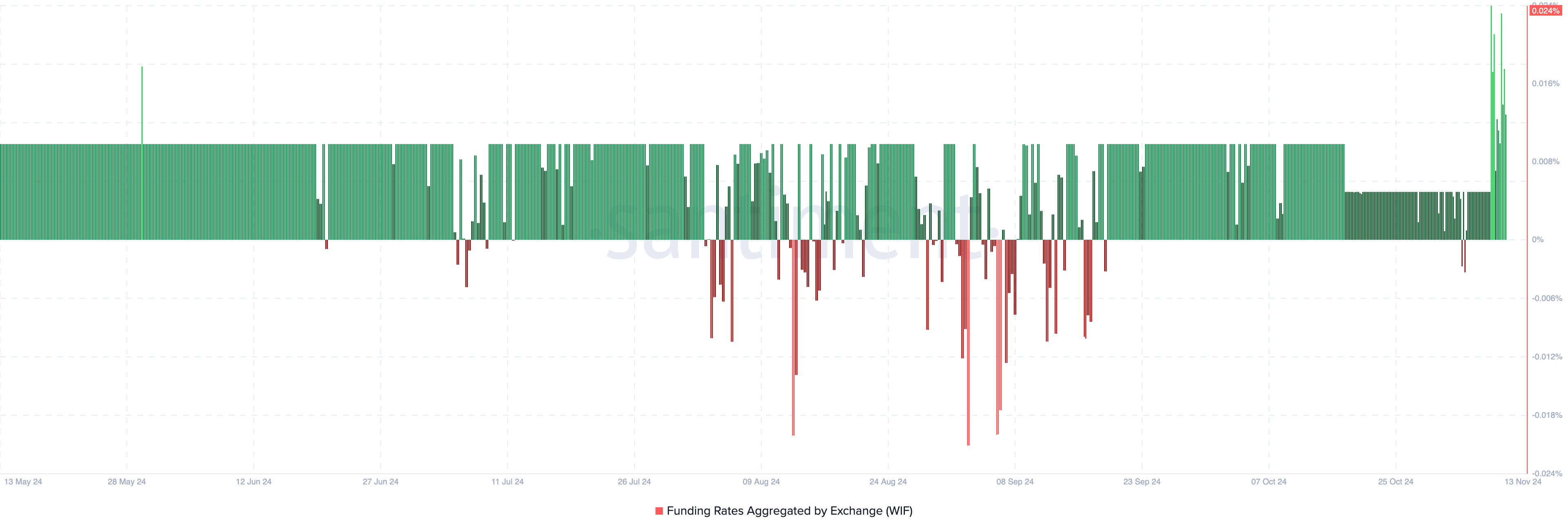

If that remains the same, then the WIF coin price might continue to ascend. Following this, data from Santiment shows that the funding rate has remained in the positive region. For context, the funding rate is the cost of holding an open position in the perp market.

A positive funding rate indicates that buyers (longs) are paying sellers (shorts), which helps align futures prices with spot prices. Conversely, a negative funding rate means shorts are paying longs, and the average sentiment is bearish.

According to Santiment, WIF’s funding rate has skyrocketed, indicating that traders are bullish on the meme coin’s recovery. Therefore, if demand increases, WIF’s price could rise, and most long positions might be profitable.

WIF Price Analysis: $4 On the Radar

On the daily chart, WIF has formed an inverse head and shoulders pattern. The inverse head and shoulders is a chart pattern that suggests a potential reversal of a downtrend. Opposite to the Head and Shoulders pattern, it consists of three troughs, with the middle trough being the lowest (the “head”) and the two surrounding troughs forming the “shoulders.”

Typically, this pattern is a bearish to bullish one. As such, it appears that WIF’s price might continue to rise. With this in play, it is likely for the meme coin to rally to $4.07.

On the other hand, if the CMF reading drops below the midpoint, that will suggest selling pressure. In that scenario, WIF could decline to $2.44.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/dogwifhat-wif-price-rebounds/

2024-11-13 19:30:00