First Neiro on Ethereum (NEIRO) has climbed by almost 10% over the past week. This rally is driven by a significant increase in coin holding time and whale accumulation.

This trend indicates a growing bullish sentiment among investors as they hold onto their NEIRO tokens for longer, suggesting confidence in the token’s future price.

NEIRO Price Surges as Whales Accumulate and Hold Times Increase

An assessment of NEIRO’s on-chain activity has revealed a significant increase in the holding time of transacted coins over the past week. According to IntoTheBlock’s data, this metric has surged by 80% during the period under review.

The holding time of an asset’s transacted coins measures the average duration its tokens are held in wallets before being sold or transferred. When this metric rises, investors have stronger conviction as they reduce their selling activity and hold on to their coins for longer periods. This shift suggests growing confidence or a more optimistic market sentiment toward the asset.

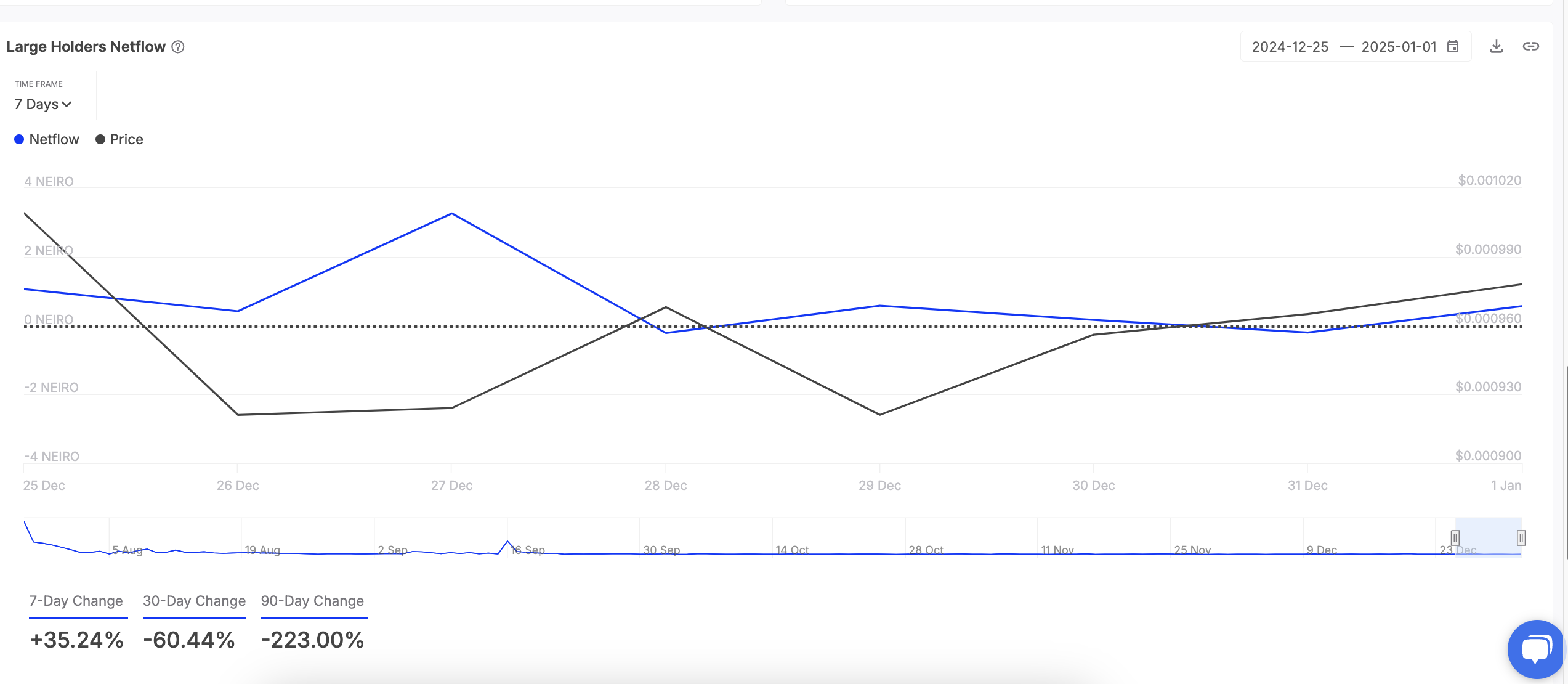

In addition, NEIRO whales or large investors have also increased their accumulation. Over the past week, NEIRO’s large holders’ netflow has spiked by 35%.

Large holders refer to whale addresses that hold more than 0.1% of an asset’s circulating supply. When their netflow sees a positive spike, it indicates that major investors are accumulating more of the asset than they are selling or transferring out. This signals bullish sentiment, as increased accumulation by whales reflects confidence in the asset’s future price performance.

NEIRO Price Prediction: Whale Moves Could Drive Further Increase

NEIRO currently trades at $0.0010. If investors increase their holding time and whales intensify their accumulation efforts, they will push the altcoin above the $0.0011 resistance level. Breaking this resistance could drive NEIRO’s price toward its all-time high of $0.0031.

On the other hand, if traders begin to take profits and its whales reduce their accumulation, they will invalidate this bullish projection. In this scenario, the NEIRO token price may plunge to $0.00053

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/neiro-whales-accumulation/

2025-01-02 18:00:00