Pepe (PEPE), a popular meme coin, has been trading within a set range throughout October, encountering resistance at $0.000010 and finding support at $0.00000084.

With growing demand for meme coins, PEPE appears ready to break out of this range. Its price could potentially climb to a 60-day high of $0.000012.

Pepe Sees Spike in Demand

PEPE has traded within a horizontal channel since September 27. This channel is formed when an asset’s price moves within a range for some time. The upper line of this channel forms resistance, while the lower line represents support.

This sideways movement happens when a relative balance between buying and selling pressures prevents an asset’s price from trending strongly in either direction.

PEPE’s outlook is shifting, aligning with the recent surge in the broader meme coin market. Over the past week, activity in the meme coin sector has intensified, driving its market capitalization up by 19% to reach $63 billion — the highest level since June.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

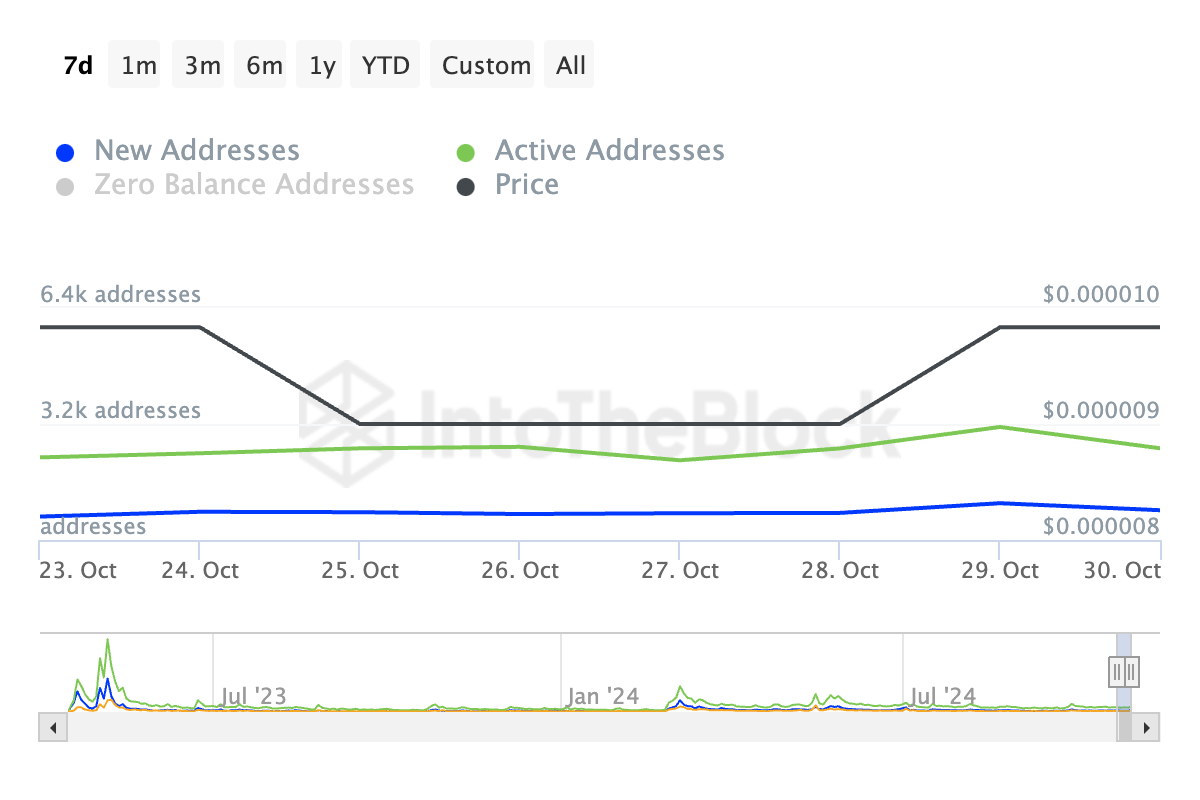

On-chain data highlights a sustained increase in demand fueling the PEPE meme coin rally. IntoTheBlock’s data shows a 27% spike in the daily count of new addresses that have traded the meme coin in the past seven days. Also, during the same period, the number of unique daily active addresses that have completed at least one transaction involving PEPE has increased by 11%.

When an asset’s price rises alongside an increase in daily active addresses (DAA) and new addresses, it often indicates growing network activity and user interest. A combined reading of PEPE’s rising price and active address count is a bullish signal that suggests a surge in interest in the meme coin.

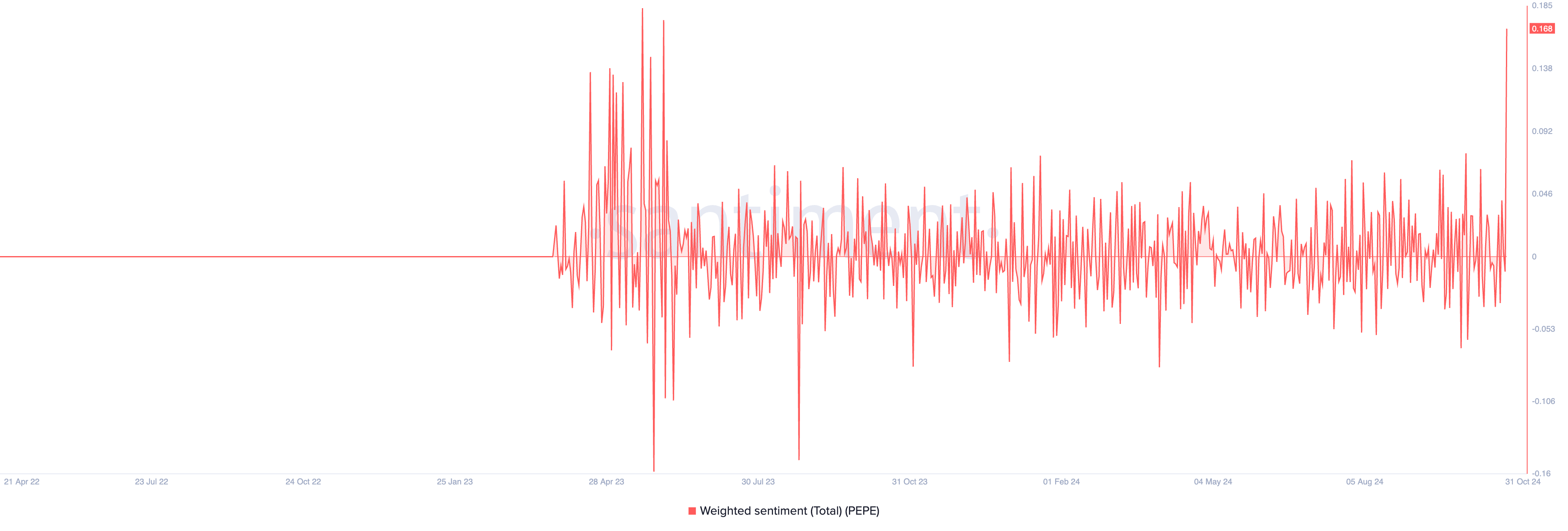

PEPE’s bullish outlook is further reinforced by its positive weighted sentiment, currently at 0.168 — its highest since May. Weighted sentiment measures the market’s overall mood, with values above zero indicating predominantly positive social media discussions. This positive sentiment suggests that market participants anticipate continued price growth.

PEPE Price Prediction: Where Meme Coin May Be Headed

At press time, PEPE trades at $0.0000094, edging closer to the upper boundary of its horizontal channel, a key resistance level. With rising demand for the meme coin, a breakout above this threshold could be imminent.

If it successfully turns the $0.000010 mark into support, it would set the stage for an uptrend toward its 60-day high of $0.000012, ensuring the continuation of the PEPE meme coin rally.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

However, if buying momentum weakens, PEPE risks slipping back into its current range, potentially targeting the support at $0.0000084. Should the bulls fail to defend this level, PEPE could retrace further, eyeing the $0.0000070 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pepe-meme-coin-rally-underway/

2024-10-31 20:30:00