Bitcoin’s price has recently struggled to close above the $70,000 mark, a critical level needed to gain momentum toward its all-time high. Despite several attempts, BTC has been unable to maintain a solid footing above this barrier, which has slowed the bullish momentum.

However, there are signs that larger holders may be stepping in, which could create the conditions for a renewed push.

Bitcoin Whales Are Driving the Optimism

According to recent data from Santiment, retail traders appear to be offloading Bitcoin, with whales seemingly capitalizing on the dip. This shift in trading behavior is significant, as it suggests that larger players are accumulating BTC while retail traders reduce their holdings. Wallets holding 100 or more BTC have grown by 1.9% over the past two weeks, signaling that whale accumulation is underway.

This uptick in large wallet addresses is a bullish indicator. When whales accumulate, it generally reflects confidence in the asset’s potential for future growth.

“ As the largest key stakeholders in crypto continue to scoop up more coins from dumping retail traders, this historically leads to bullish outcomes,” stated Santiment.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

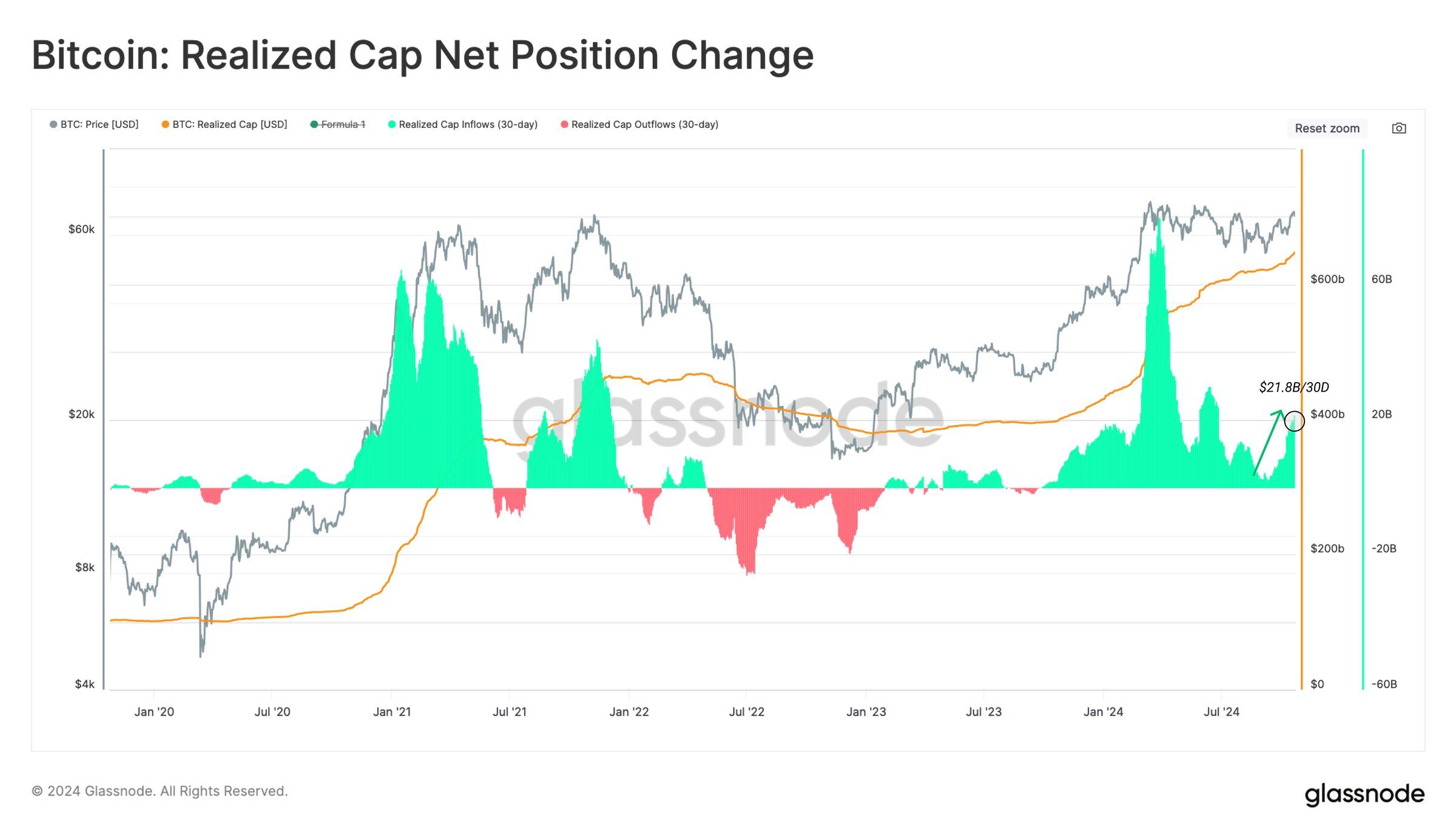

Bitcoin’s macro momentum is showing strong signs of support, particularly in terms of capital inflows. Net inflows into Bitcoin have accelerated, rising by 3.3%, or approximately $21.8 billion, over the past 30 days. This surge has pushed Bitcoin’s Realized Cap to a new all-time high of over $646 billion, indicating that substantial capital is entering the market.

The rise in Bitcoin’s Realized Cap demonstrates a growing liquidity base across the asset class. This influx of meaningful capital underpins BTC’s price increase, as larger inflows suggest sustained interest from both institutional and retail investors. The heightened liquidity provides a cushion against volatility, reducing the likelihood of sharp sell-offs and supporting the asset’s upward trajectory.

BTC Price Prediction: Aiming High

Bitcoin is currently trading at $67,553, with efforts to close above the $70,000 mark ongoing for the past ten days. Securing $68,248 as support is essential for BTC to move toward the next resistance at $71,367, a level that could determine the path to a new high.

The uptrend line has served as a consistent support, suggesting that a move to this resistance could unfold over the next few weeks. The whale accumulation pattern reinforces this bullish outlook, indicating that a rise in BTC’s price may be on the horizon, regardless of the timeframe.

Read more: Bitcoin Halving History: Everything You Need To Know

However, if Bitcoin loses the support of its uptrend line and slips below $65,292 due to macroeconomic factors or profit-taking, the bullish thesis would be invalidated. Such a drop could send Bitcoin to $61,868, marking a potential setback and creating further uncertainty around its price direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/btc-whales-could-rally-bitcoin-price/

2024-10-25 15:30:00