Telegram coin Toncoin’s (TON) price recently experienced a steep 31% decline over the last ten days, which led to the cryptocurrency losing a key support level.

This sudden drop has alarmed many investors, but the emergence of opportunistic buyers could signal a potential shift from bearish to bullish sentiment.

Toncoin Saved by an Unlikely Group

New investors have flooded the Toncoin market, seizing the opportunity to buy at discounted prices. The share of short-term holders has increased significantly, rising from 23% to 33% in a short span.

While a rise in short-term holders is typically seen as a bearish signal, suggesting investors may soon cash out, the context here is different. Given the recent crash, it seems more likely that these investors are accumulating at low prices, anticipating future gains rather than looking for quick exits.

This accumulation phase could indicate a longer-term commitment from these new buyers.

Read more: 6 Best Toncoin (TON) Wallets in 2024

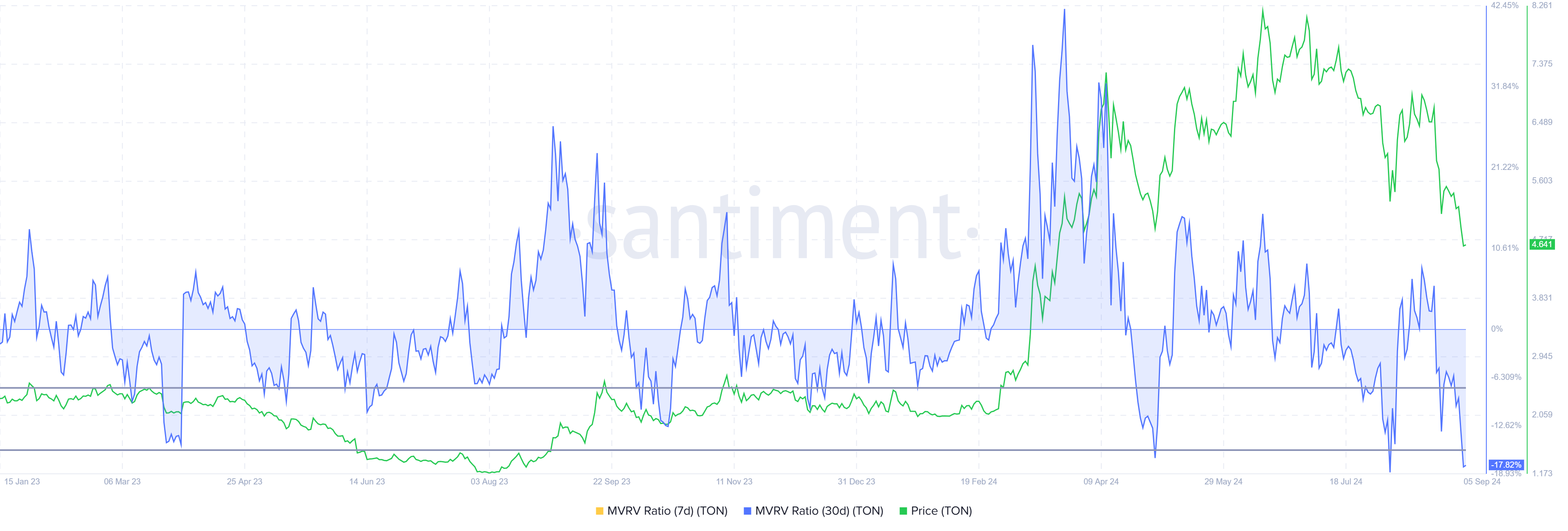

The potential of accumulation is backed by the Market Value to Realized Value (MVRV) ratio, which measures investors’ profits and losses. Currently, TON’s MVRV ratio sits at -17%, signaling that many holders are facing losses. However, this could also mark the end of selling pressure, as investors are less inclined to sell at a loss.

The MVRV ratio is now beyond the typical “opportunity zone,” which falls between -7% and -15%. This means that TON is potentially in an area where investors buy into the weakness. The increased buying activity could help the price recover, especially if sellers start to retreat, allowing the bulls to take control.

Toncoin Price Prediction: Crash Ahead?

Toncoin’s price is currently forming a head and shoulders pattern, an often bearish signal, and is nearing validation as TON hovers around $4.65, just below the breakdown point. However, the current market conditions and buyer activity suggest the potential for a reversal. With $4.29 acting as a key support level, TON could bounce off this price and recover to $5.00, offering a much-needed relief rally.

Read more: What Are Telegram Bot Coins?

However, a deeper drawdown is likely if Toncoin loses the $4.29 support. Technical patterns indicate the potential for a 41% drop, which would bring TON down to $2.85.

Nevertheless, this scenario is less likely to materialize, and in a more realistic outcome, Toncoin’s price might slip to $3.55. This would invalidate the bullish thesis but avoid the extreme downturn many fear.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/telegram-coin-toncoin-price-crash-unlikely/

2024-09-05 14:00:00