Ripple’s (XRP) price faced an 8% drop from October 21 to 25, suggesting that the altcoin might go lower. Yet, since Saturday, October 26, XRP bulls have vigorously defended the critical $0.50 support level and initiated a modest rebound.

Historically, XRP has briefly bounced from these levels only to see renewed selling pressure soon after. This analysis examines if XRP is set for a similar pullback or if this bounce marks the beginning of a sustainable recovery.

Ripple Sees Rising Positive Sentiment

On-chain data from BeInCrypto reveals that Ripple’s Weighted Sentiment has recently shifted out of negative territory, suggesting a more optimistic market outlook among investors.

A rise in Weighted sentiment often indicates that traders and holders feel more positive about the asset. If maintained, this could lead to increased demand and, most likely, further price increases.

On the other hand, a negative reading of the metric indicates a pessimistic outlook for the average market participants. In most cases, this foreshadows a price decrease unless the negative reading is very extreme, which could fuel a rebound.

However, in this case, sustained buying pressure will be key to confirming a continued uptrend, as sentiment alone might not be enough to drive XRP’s price further up.

Read more: XRP ETF Explained: What It Is and How It Works

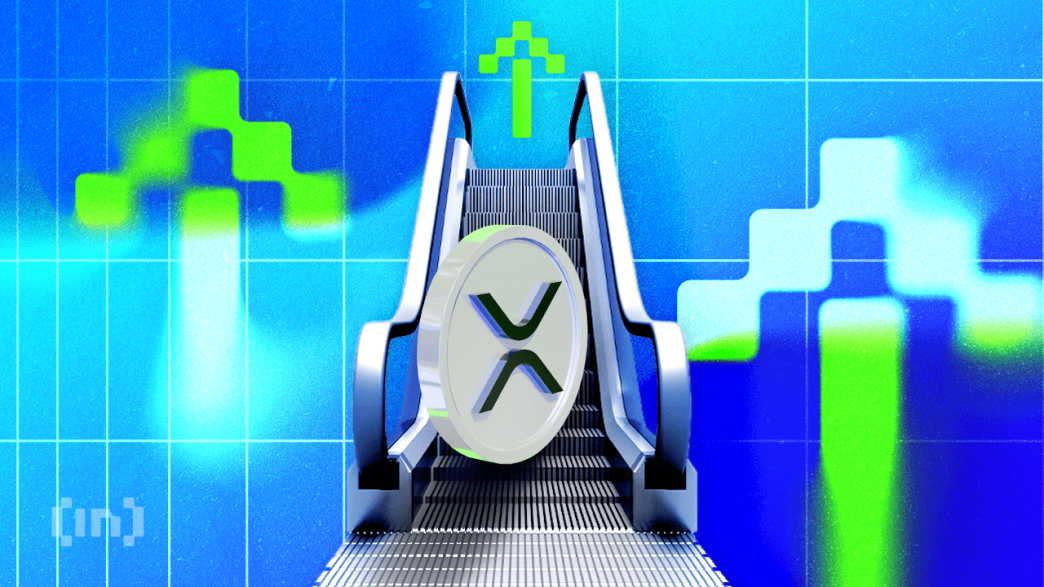

Interestingly, the 4-hour chart reveals that XRP bulls are showing determination to sustain the recent uptrend, as evidenced by the Bull Bear Power (BBP) indicator.

The BBP measures the balance of buying and selling pressure. When the reading stays in positive territory, it often indicates a continuation of the upward momentum. However, a decline in BBP could indicate waning buyer strength, signaling a possible retracement.

As of this writing, the indicator favors the bulls, as they outpace selling pressure. Therefore, if XRP bulls manage to keep the BBP indicator above neutral levels, the altcoin could break through near-term resistance.

XRP Price Prediction: Altcoin Eyes Run to $0.60

On the daily chart, XRP’s price fell below the 20-day Exponential Moving Average (EMA) on October 21, signaling a shift toward bearish sentiment in the short term. The EMA is a technical indicator that gauges the trend of an asset.

When prices trade below this level, it often indicates that selling pressure has intensified and may hinder bulls’ ability to sustain an upward movement. Despite the decline, XRP bulls were able to regain the $0.50 support, offering the altcoin the chance to break out of higher resistance zones.

Considering the current buying pressure, XRP’s price is likely to rise above the 50 EMA (yellow). If that is the case, the altcoin might rise to $0.55 and possibly break $0.60 in the near term.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

On the flip side, bears would have to ensure that XRP does not rise above $0.55 to invalidate this thesis. In that scenario, the price could drop to $0.49.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/xrp-bulls-target-breakout/

2024-10-29 08:00:00