On December 10, Ripple’s (XRP) price temporarily slipped below $2, sparking speculation that its prolonged uptrend might be ending. However, the bearish concerns have been short-lived. XRP has rebounded strongly, recording an 8% upswing in the past 24 hours.

Interestingly, several under-the-radar indicators suggest that XRP’s rally for the year may still have room to grow. Here’s how.

Ripple Stakeholders Send More Tokens into Circulation

The Mean Dollar Invested Age (MDIA) is an on-chain metric that suggests XRP’s price could continue to trade higher. MDIA represents the average age of all tokens on a blockchain, weighted by their purchase value.

A rising MDIA indicates that coins, typically held by key stakeholders, have remained stagnant. Historically, this inactivity has made it difficult for the altcoin’s price to gain momentum. Currently, however, XRP’s MDIA has dropped to a notably low level. This metric, which reflects the median age of transacted tokens, signals the recirculation of previously dormant assets.

Unlike a high MDIA, which implies stagnation, a low MDIA is considered a bullish signal. The decrease shows that dormant XRP tokens have returned to circulation, boosting trading activity and liquidity.

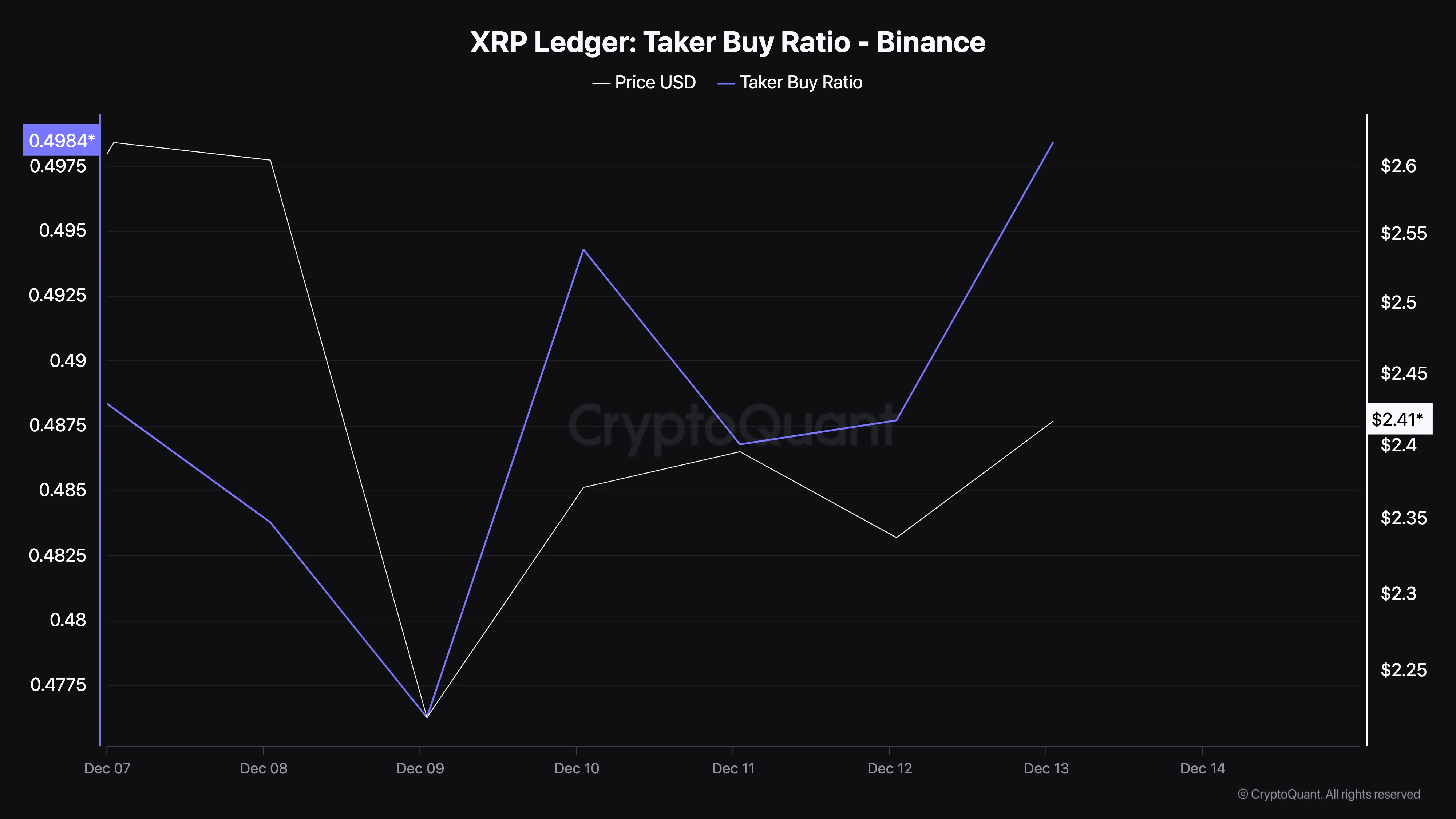

Apart from the MDIAs, the Taker Buy Ratio also suggests the potential for further XRP price gains. This ratio measures the proportion of buy orders filled compared to total trades in the derivatives market.

A Taker Buy Ratio above 0.5 reflects growing bullish sentiment, suggesting that buyers are gaining control. According to data from CryptoQuant, the metric has climbed to 0.55, highlighting a significant jump in buying pressure around XRP.

If this trend continues, it could signal strong market optimism, potentially pushing XRP to new price levels in the coming sessions. However, a dip below this threshold would indicate bearish sentiment, warranting caution.

XRP Price Prediction: Bulls Are in Control Again

On the 4-hour chart, XRP’s price had briefly dropped below the 20 and 50 Exponential Moving Averages (EMA) on December 12. The EMA is a technical indicator that measures trends.

When the price falls below these indicators, it typically signals a bearish trend, while a rise above them indicates bullish momentum. The recent downturn suggested a potential further correction for XRP.

As of now, however, bulls have regained control, pushing the price back above these lines. This shift indicates a return of bullish momentum, with XRP potentially climbing to $2.90 in the short term.

If buying pressure intensifies, it could rally toward $3.50. On the flip side, if the number of dormant tokens flowing into circulation drops, this might not happen, and the token could decline to $1.93.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/xrp-price-escapes-decline/

2024-12-14 10:00:00