Cardano (ADA) price has surged 41.89% in the last seven days, signaling strong bullish momentum in the market. The uptrend remains strong, supported by key technical indicators like the ADX and Ichimoku Cloud, which point to sustained positive sentiment.

However, signs of consolidation and narrowing gaps in short-term indicators suggest that the rally could face challenges if buying pressure weakens.

ADA Current Uptrend Is Still Strong

Cardano DMI chart shows an ADX of 42.7, indicating a strong trend. The metric has remained above 40 since November 7. This high ADX value confirms the robustness of ADA ongoing uptrend, signaling solid momentum behind the recent price movements.

With the positive directional index (D+) at 21.3 and the negative directional index (D-) at 11, bullish pressure continues to outweigh bearish activity, further supporting the upward trajectory.

The ADX measures the strength of a trend without considering its direction. Values above 25 indicate a strong trend, while those below 20 suggest a weak or nonexistent trend. With an ADX at 42.7, ADA is clearly in a strong uptrend, showing significant market confidence.

The gap between D+ and D- reinforces the bullish dominance, suggesting that ADA price could sustain its upward movement if current conditions persist.

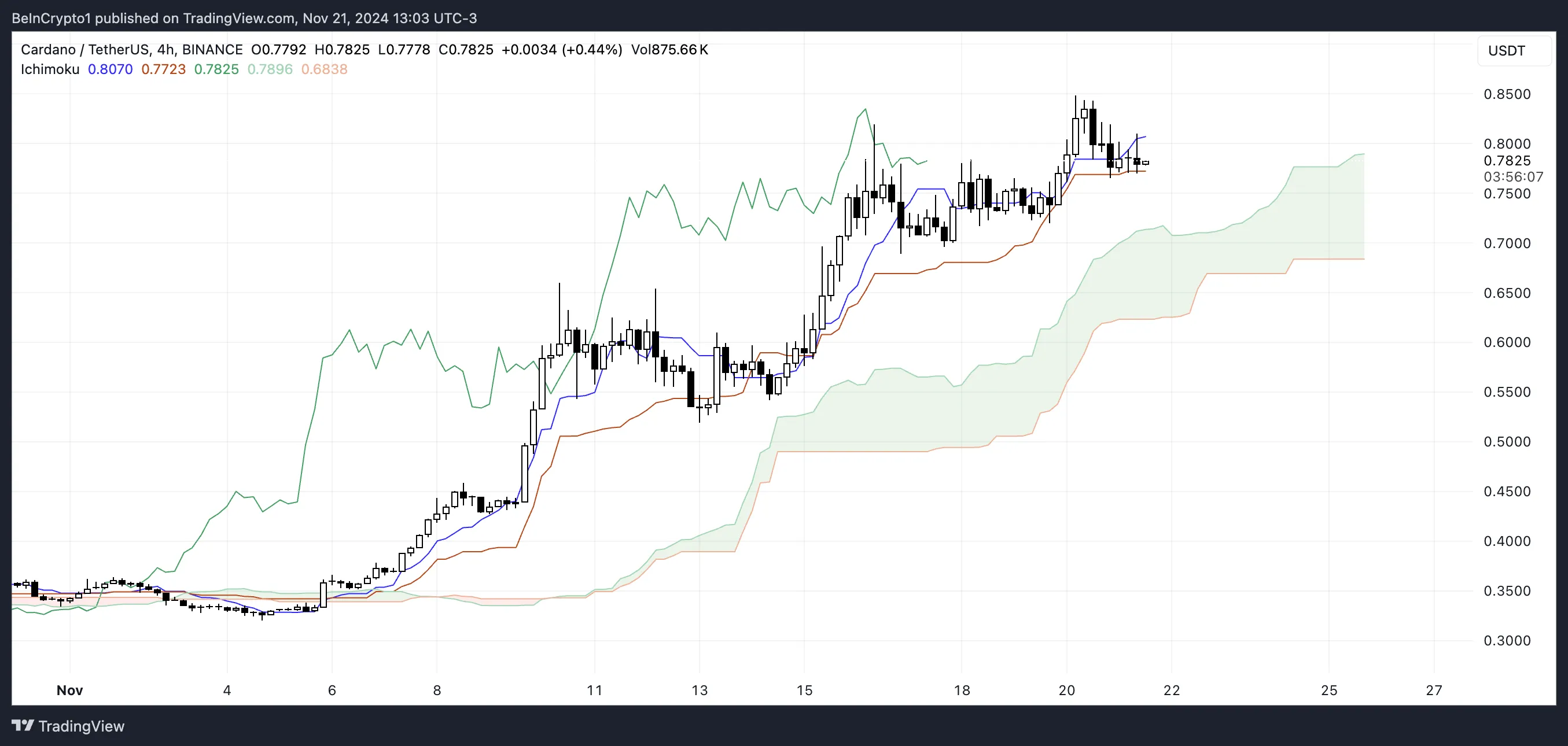

Cardano Ichimoku Cloud Shows An Important Signal

The Ichimoku Cloud chart for Cardano indicates a generally bullish trend, as the price remains above the cloud (Kumo). The Tenkan-sen (blue line) and Kijun-sen (red line) are relatively flat, showing signs of consolidation after ADA’s recent rally.

While the price is still trading above these lines, the narrowing gap between the price and the Tenkan-sen suggests weakening short-term momentum.

The green cloud ahead signals potential support for ADA uptrend, but the current consolidation phase highlights the need for sustained buying pressure to maintain this momentum.

If the price drops below the Kijun-sen or approaches the cloud, it could signal a possible shift toward bearish sentiment.

ADA Price Prediction: Can It Reach $1 In November?

If Cardano (ADA) maintains its strong uptrend, it could test the resistance at $0.85. Breaking this level could pave the way for further gains, with the potential to reach the $1 threshold, marking a 20% rise from current levels and the highest price for Cardano since April 2022.

However, as indicated by the Ichimoku Cloud, a potential reversal could be on the horizon. If bearish momentum takes over, ADA price could face significant downward pressure, potentially dropping to $0.51.

If this support fails, the price could decline further to $0.32, representing a steep 59% correction. This highlights the importance of the current support and resistance levels in determining ADA’s next direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/cardano-ada-price-below/

2024-11-21 19:30:00