Cardano (ADA) price has surged an impressive 265% over the last 30 days, becoming one of the biggest gainers among the top 10 biggest coins, only behind Ripple (XRP).

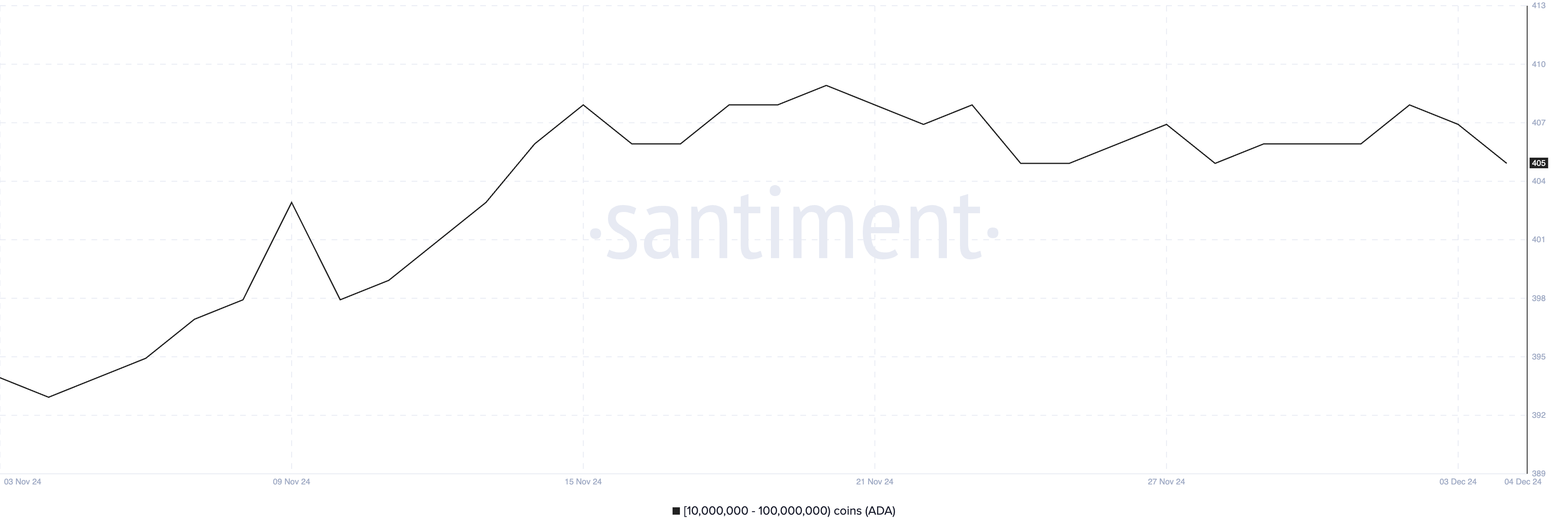

Whale accumulation, which drove confidence in November, has now stabilized, suggesting a cautious approach by major holders.

ADA Current Uptrend Appears To Be Fading Away

Cardano ADX has dropped to 19.4 from 33 on December 3, signaling a weakening trend. This decline indicates that the strength of ADA’s recent uptrend is fading, though the price remains in an upward trajectory. Between December 1 and December 3, ADA price surged almost 27%, which aligns with its ADX reaching 33.

A lower ADX suggests that while the trend continues, it lacks the momentum seen earlier, possibly pointing to consolidation or a slower pace of growth.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and below 25 suggesting a weak or consolidating market. ADA ADX at 19.4 reflects a weakening trend despite the ongoing uptrend, hinting that further upward movement may be more gradual.

However, if buyers regain momentum, the ADX could rise again, supporting a stronger continuation of the current uptrend.

Cardano Whales Are Now Stable After Accumulating In November

The number of addresses holding between 10 million and 100 million ADA saw significant growth early in November, increasing from 393 on November 4 to 409 by November 20.

This rise indicates a strong accumulation of whales during this period, suggesting heightened confidence in Cardano potential. Such activity often precedes major price movements, as large holders can significantly influence the market.

Since November 20, however, the number of these whale addresses has stabilized, hovering between 405 and 408, with the current count at 405. This plateau suggests that while earlier accumulation has slowed, these major holders are maintaining their positions.

This stability could indicate a cautious approach by whales, signaling that they are waiting for clear market cues before making further moves. This could potentially keep ADA price in a consolidative phase for now.

ADA Price Prediction: Can It Drop Below $1?

Cardano price remains in an uptrend, as reflected by its EMA lines, with short-term averages still above long-term ones. However, signals from the ADX and stabilizing whale accumulation indicate that this uptrend is losing momentum.

If buying pressure regains strength, ADA could climb to test resistance at $1.32, with a further push potentially taking it to $1.40, a price level not seen since 2022.

On the other hand, if the current trend weakens further and a downtrend emerges, ADA price might retest its nearest support at $1.15.

Failure to hold this level could trigger deeper corrections, with potential price drops to $1.03 or even $0.87, representing a possible 27% decline from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ada-price-slows-momentum/

2024-12-05 18:30:00