Early Friday morning saw the movement of some previously dormant Cardano (ADA) coins. This was accompanied by a spike in the coin’s daily active addresses, signaling an uptick in trading activity.

However, ADA’s muted price reaction in the past 24 hours suggests that the coin movement may not be for bullish purposes.

ADA Tokens on the Move

Santiment’s data shows that ADA’s age consumed rose to a seven-day high of 6.33 billion on Friday morning. This metric tracks the movement of long-held coins; therefore, when it spikes, it is noteworthy. This is because long-term holders rarely move their coins around. When they do, it often precedes a shift in market trends.

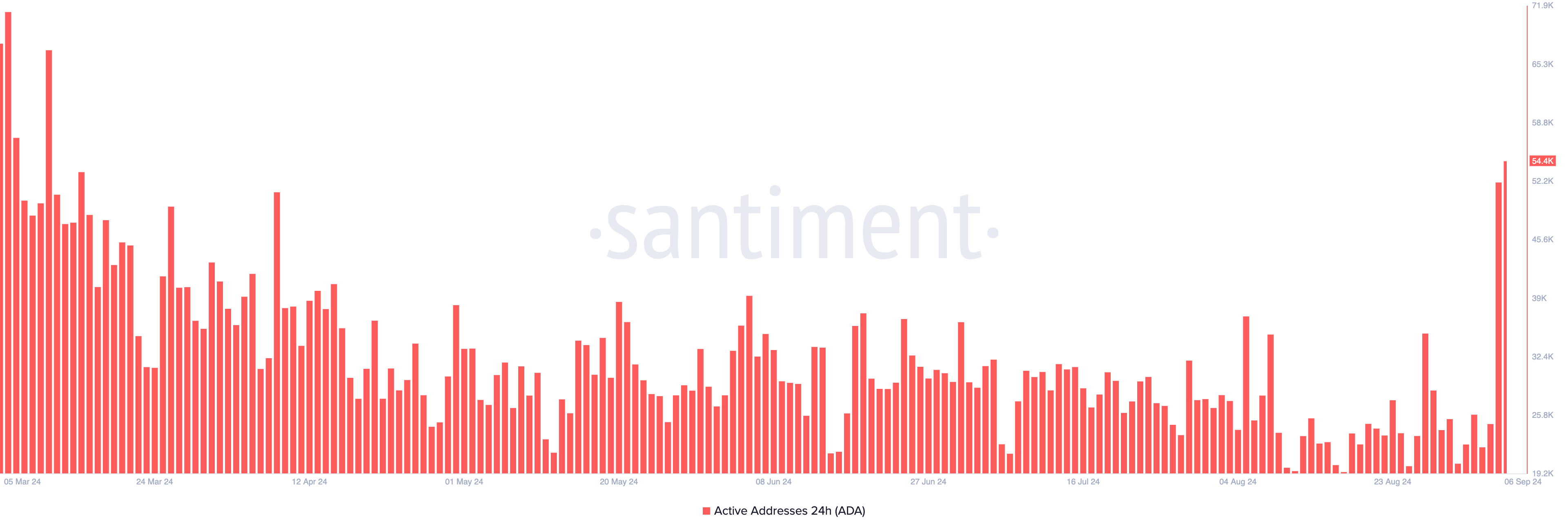

The uptick in ADA’s age consumed is accompanied by a rise in the number of active addresses that currently trade the altcoin. Per Santiment’s data, the number of addresses involved in ADA transactions totals 54,200, the single-daily highest since March 6.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

While an increase in an asset’s active address count ordinarily connotes bullishness, the decline in ADA’s price after the rally in its age consumed suggests that a local top may have been reached. This indicates that the coin could be poised for further decline.

Cardano Price Prediction: More Decline

Readings from Cardano’s one-day chart suggest that the altcoin may extend its decline. For example, the dots of the coin’s Parabolic Stop and Reverse (SAR) indicator, which highlights potential trend direction and reversal points, are positioned above its price. When these dots are so arranged, the market trend is bearish, and the price decline is poised to continue.

Further, the setup of the coin’s Moving Average Convergence Divergence (MACD) indicator shows its MACD line (blue) below its signal (orange) and zero lines. This signals that ADA’s price is gaining downward momentum.

Traders often interpret this as a sell signal, which puts negative pressure on an asset’s price. If the downtrend persists, ADA’s price will revisit its August 5 low of $0.27.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

However, a resurgence in ADA demand will invalidate the bearish projections above. If ADA sees a rally in buying activity, this may push its price above resistance at $0.39. Breaking past this level could trigger an upswing to $0.48.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-holders-move-tokens/

2024-09-06 22:09:58