Cardano (ADA) has experienced a significant surge over the past four days, with its price increasing by an impressive 32%. In the last 24 hours alone, ADA has climbed 16%, boosting its market capitalization to $14.932 billion. This surge has propelled Cardano back to its position as the ninth-largest cryptocurrency by market cap. Several factors have contributed to this bullish momentum:

#1 Bulls Takes Over The Entire Crypto Market

The optimistic market sentiment extends beyond Cardano, with the crypto market as a whole experiencing a significant rally. This upward movement has been mostly driven by Donald Trump’s victory in the US presidential election. Trump’s administration has committed to ending the “war on crypto” and positioning the United States as a central hub for crypto businesses.

Related Reading

Adding to the positive momentum, the Federal Reserve’s decision on November 7 to reduce interest rates by 0.25% has provided additional tailwinds for the crypto market. The Fed cited easing labor market conditions and increased confidence that inflation is moving sustainably toward the 2% target. Analysts from The Kobeissi Letter noted that the vote for the rate cut was unanimous. Powell said that “labor market conditions have generally eased” and that “risks to goals remain roughly in balance.”

#2 Cardano Whale Activity

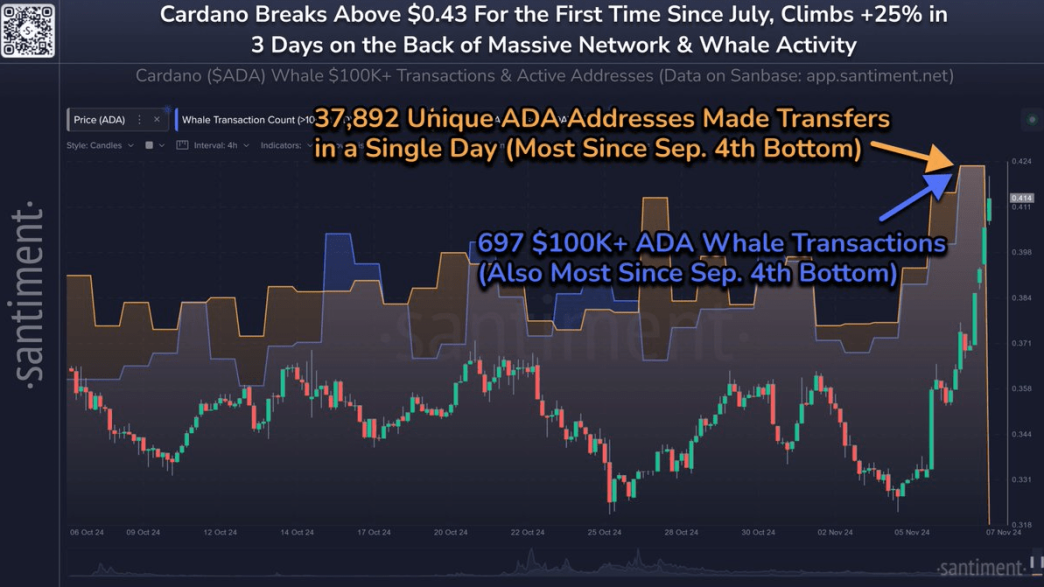

On-chain analysis firm Santiment has highlighted a surge in whale activity surrounding Cardano. In a recent post on X, they observed that ADA has been “one of the notable surprise altcoins taking flight during this crypto-wide pump.” They suggested that “we may be seeing some retail FOMO coming soon,” acknowledging that this surge “has been a long time coming for the patient ADA community.”

Santiment reported that Cardano broke above $0.43 for the first time since July, climbing 25% in three days due to “massive network and whale activity.” Specifically, they pointed out that 37,892 unique ADA addresses made transfers in a single day—the most since the September 4th bottom—and there were 697 transactions exceeding $100,000, also the highest since that date. This uptick in large transactions and active addresses indicates heightened interest from major investors, signaling the potential for continued upward momentum.

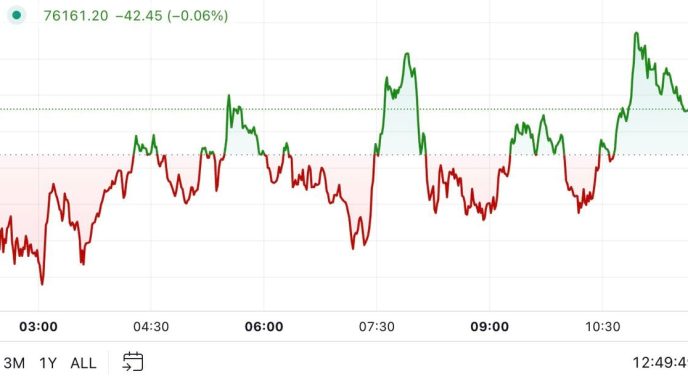

#3 Technical Breakout

Unlike many other altcoins, ADA has been in a prolonged bearish phase. However, the recent surge could mark a pivotal turning point, indicating a potential bullish reversal. Since August, Cardano’s price has been making a series of higher lows.

Related Reading

The current move has also allowed the ADA price to break above a downtrend line that has dictated its price movement since April, after being rejected five times previously. The breakout can be considered significantly bullish as it aligned with the pattern of higher lows.

Notably, ADA has surpassed the 20-, 50-, 100-, and 200-day moving averages during this surge. Additionally, ADA has moved past the 0.236 Fibonacci retracement level, the most critical horizontal resistance point. A successful retest of this price level at $0.40 today could pave the way for further upside.

At press time, ADA traded at $0.4266.

Featured image from Shutterstock, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/cardano/cardano-ada-price-surges-32-in-4-days-heres-why/

2024-11-08 12:30:18