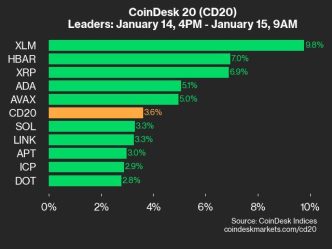

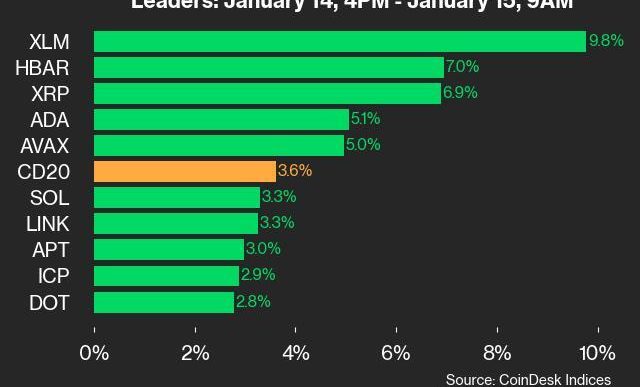

Cardano (ADA) has witnessed a significant increase in coin holding time over the past week. This surge suggests that investors are storing their ADA tokens for longer periods.

This bullish signal indicates the growing confidence in the coin’s near-term potential as traders expect it to stabilize above $1.

Cardano Traders Resist Selloffs

BeInCrypto’s assessment of ADA’s on-chain activity has revealed a spike in the holding time of all coins transacted over the past seven days. According to IntoTheBlock, this has increased by 78% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are kept in wallets before being sold or transferred.

Longer holding periods translate to reduced selling pressure in the market, reflecting stronger investor conviction as they choose to keep their coins rather than sell. This decline in selloffs has contributed to an 8% increase in ADA’s value over the past week.

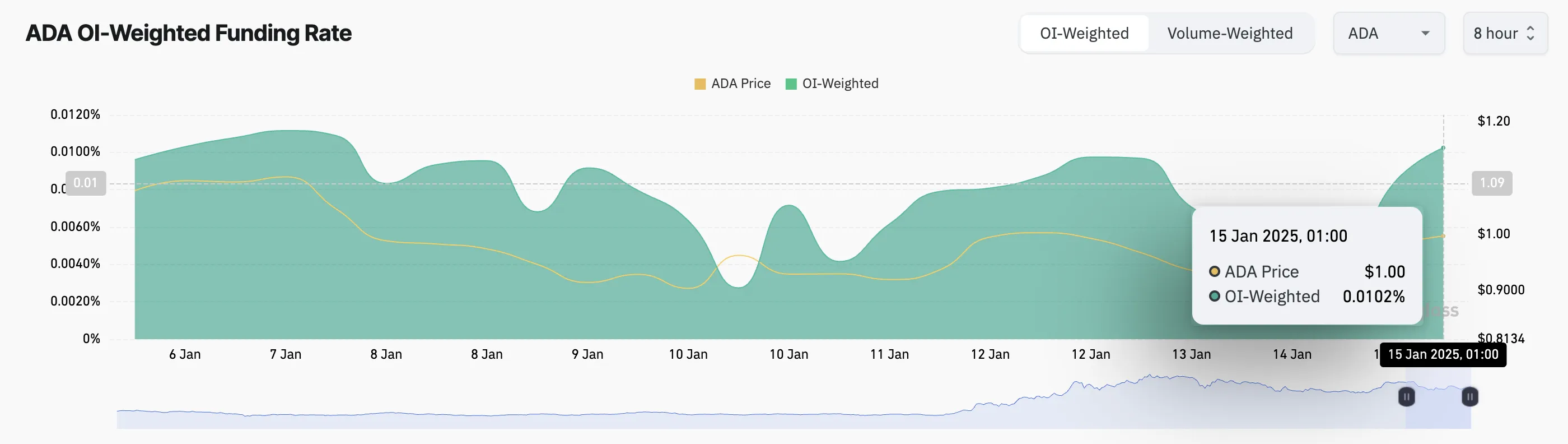

Furthermore, Cardano’s funding rate, which reflects the cost of borrowing ADA in perpetual futures contracts, has remained positive. As of this writing, this stands at 0.01%.

A positive funding rate indicates that traders are willing to pay a premium to hold long positions, suggesting strong bullish pressure in the market.

ADA Price Prediction: Breakout Above $1.12 Resistance

On the daily chart, ADA’s price rests slightly above the upper line of the symmetrical triangle it traded within over the past few weeks.

This pattern is formed when an asset’s price creates a series of lower highs and higher lows, converging into a triangle shape on the chart. It signals a period of consolidation, with the potential for a breakout in either direction as market momentum builds.

If ADA holders extend their holding periods and bullish pressure strengthens, the coin’s price will extend its breakout and climb toward the monthly high of $1.32.

On the other hand, a surge in selling activity will invalidate this bullish projection. In that scenario, ADA’s price could fall below $1 to trade at $0.72.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-holding-time-sees-surge/

2025-01-15 13:00:00