Cardano (ADA) has been experiencing a gradual decline since the beginning of December, pushing its price below $1. This extended drawdown has left investors uncertain about ADA’s recovery prospects.

The altcoin’s hopes now rest on long-term holders (LTHs) who have historically provided stability in challenging market conditions.

Cardano Investors’ Participation Is Declining

Active addresses on the Cardano network are dropping sharply, reflecting growing skepticism among investors regarding ADA’s recovery. This decline in participation is a concerning sign, as reduced activity indicates that many traders are pulling back from the market, leaving the altcoin with diminished liquidity.

With declining liquidity, ADA faces increased difficulty rebounding from its current levels. The lack of active engagement from short-term traders highlights the broader market’s hesitation, making a recovery to critical price points more challenging in the near term.

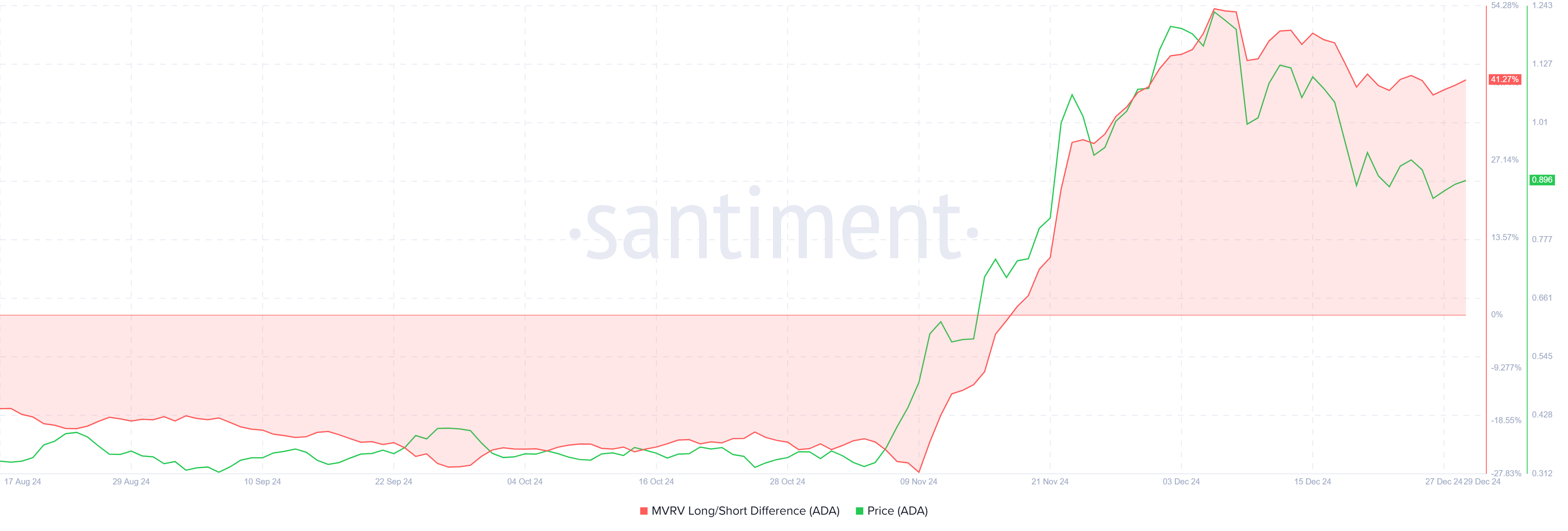

Cardano’s macro momentum offers a glimmer of hope, supported by the MVRV Long/Short Difference, which currently stands at 41%. This high positive value suggests that LTHs are significantly more profitable than short-term holders (STHs), showcasing the dominance of investors willing to HODL rather than engage in short-term profit-taking.

The presence of strong LTH participation typically stabilizes an asset’s price and provides room for recovery. If these investors maintain their positions, they could offset the broader market’s cautious sentiment, keeping ADA’s price from falling further and potentially aiding its rebound.

ADA Price Prediction: Reversing Losses

Cardano is currently priced at $0.89, holding just above the crucial support level of $0.87. Maintaining this support is essential for ADA to regain upward momentum and aim for the $1.00 mark, a key psychological and technical barrier.

Flipping $1.00 into support is critical for initiating recovery. If ADA achieves this milestone, it could begin reversing recent losses, with a target of $1.23 to reclaim a stronger position in the market. This level would mark a significant step toward restoring investor confidence.

However, losing the $0.87 support could have severe consequences for Cardano’s price trajectory. A drop to $0.77 or lower would invalidate the bullish outlook, extending losses and deepening investor skepticism. Holding above this support is vital for avoiding a prolonged downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-tests-critical-support/

2024-12-29 12:03:12