Cardano’s recent price decline has led to a sharp exit of derivatives traders, with many closing their positions and leaving the market. This is evident in the altcoin’s open interest, which has dropped to its lowest level since June 2023.

With bullish momentum fading, ADA appears set for further losses. The key question is: just how far will the altcoin fall?

Cardano Traders Close Their Positions

Cardano’s open interest, a measure of the total value of its outstanding derivatives contracts, has taken a nosedive to its lowest level in 16 months. This decline began on October 21, mirroring the coin’s recent price slump.

As of this writing, the coin’s open interest is $138 million, dropping by 35% in three days. During that period, ADA’s price plummeted by 5%.

Read more: How to Stake Cardano (ADA)

Open interest decline often suggests market participants are losing interest or confidence in an asset’s potential upward price movements. As with ADA, a combination of falling price and open interest reflects a bearish market sentiment, suggesting that traders anticipate further price declines and are exiting the market to prevent further losses to their investments.

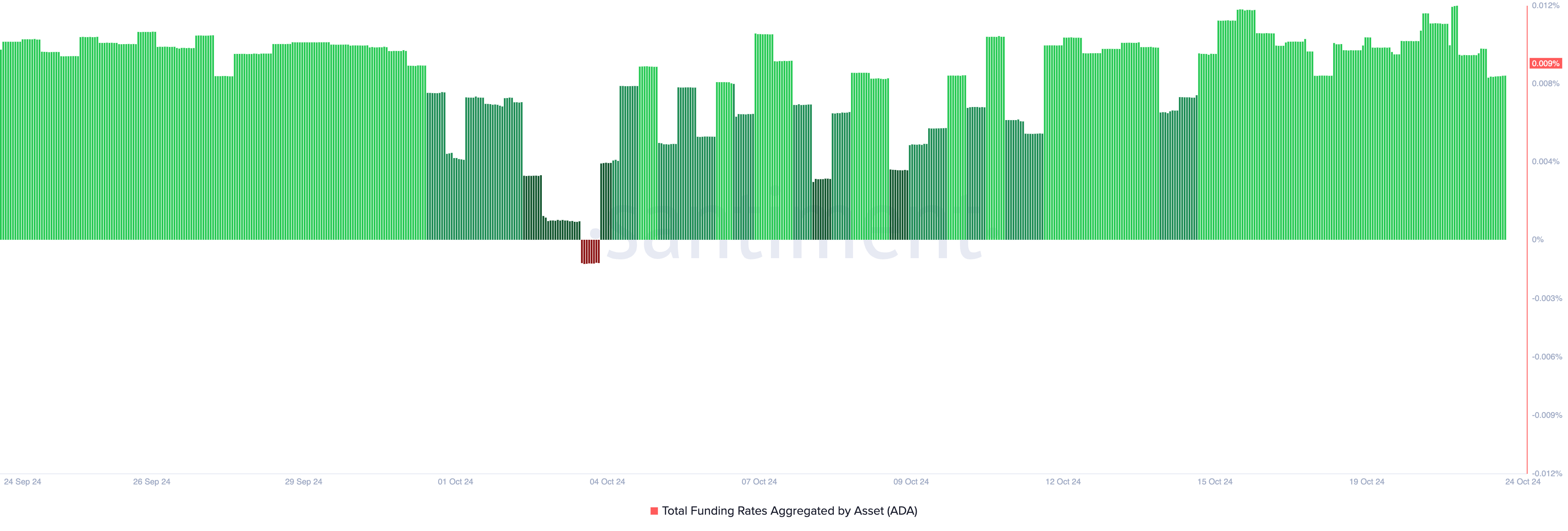

Interestingly, not all ADA’s derivatives traders share this sentiment. The coin’s positive funding rate across cryptocurrency exchanges suggests that many futures traders continue to open positions in favor of a price rally. As of this writing, the coin’s funding rate is 0.009%.

The funding rate refers to the periodic fee paid to ensure that an asset’s perpetual contract price stays close to its underlying spot price. A positive funding rate during a period of falling open interest and price depicts a market where bullish traders are holding onto positions despite weakening conditions. This often leads to a sharper decline as longs eventually give up, worsening the market downturn.

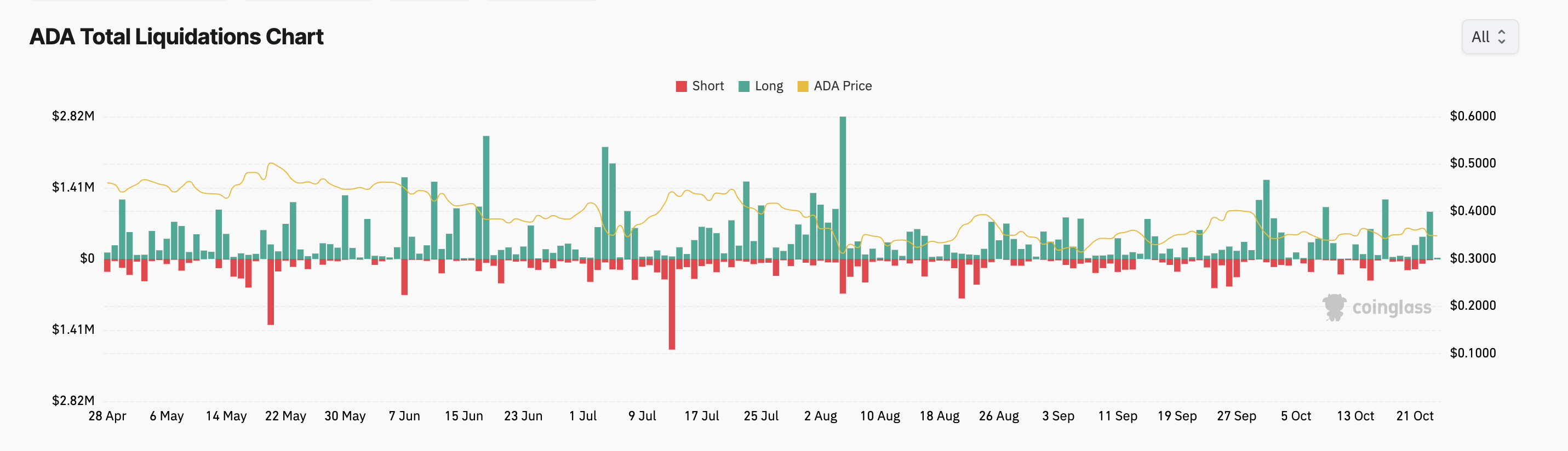

Moreover, these long positions have faced increasing liquidations as ADA’s price continues to decline. Long liquidations happen when traders holding long positions are compelled to sell their assets at a lower price to mitigate losses as the market shifts against them.

ADA Price Prediction: Targets You Need To Watch

Cardano trades at $0.34, just above the crucial support level of $0.31. This price point is significant because it is a key point between ADA’s present value and its August 5 low of $0.27. If selling pressure intensifies and bulls fail to defend this support, a decline of up to 21% to the August 5 low may become inevitable.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in October 2024

However, a shift in market sentiment from bearish to bullish could spark a rebound in Cardano’s price. Should demand surge, the coin’s price might rise toward $0.47, potentially invalidating the above bearish outlook. However, Cardano must first break through the resistance level at $0.39 for this to happen.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-open-interest-16-month-low/

2024-10-24 13:30:00