Two days ago, Cardano (ADA) was set for a rally toward $0.40, but that potential has diminished as crypto whales have stepped back.

While ADA’s long-term prospects remain interesting, recent on-chain data suggests the short-term outlook might be bleak.

Cardano Whales Surrender

On September 14, Cardano’s large transaction volume was 16.25 billion ADA. By September 16, the volume had increased to 19.50 billion, with speculation suggesting that it could hit the 20 billion milestone for the first time this month.

For context, large transaction volume provides an idea of the amount of cryptocurrencies transacted by institutional players or crypto whales. Furthermore, this metric measures transactions worth $100,000 and above.

When it spikes, it indicates that large players have likely bought a significant amount of the cryptocurrency. Conversely, a decrease suggests declining whale interest in the token. In Cardano’s case, the large transaction volume dropped from 19.50 billion to 18.44 billion at press time, signaling reduced activity from major holders.

Read more: How to Stake Cardano (ADA)

This decline, if sustained, suggests that Cardano’s price might not get the necessary push it needs to erase some of the recent losses.

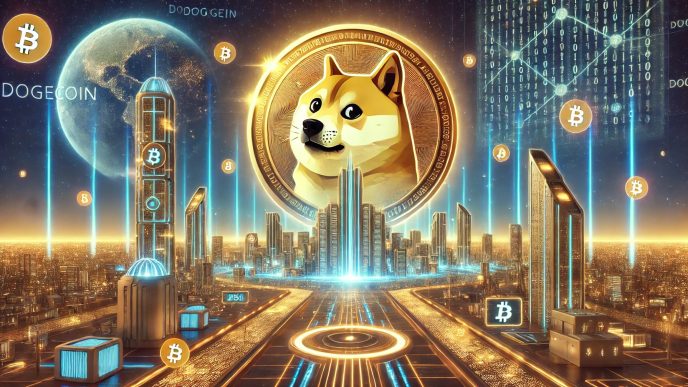

Following the development, ADA’s price, which was around $0.36 over the weekend, has now fallen to $0.33. This price decrease affected the Market Value to Realized Value (MVRV) ratio — a metric used to measure the level of unrealized losses or profits.

Put simply, the higher the MVRV ratio, the higher the level of unrealized profits. However, a drop in the ratio indicates otherwise. According to Santiment Cardano’s one-day MVRV ratio was -39% on Monday.

Today, the ratio has decreased to -61.25%, indicating that ADA’s price action has put more holders in a more difficult position to register gains.

ADA Price Prediction: Bearish Pressure Mounts

A look at Cardano’s price analysis shows that the token remains vulnerable to bearish cues. For instance, the Awesome Oscillator (AO), which was positive on September 15, has dropped to the negative region.

The AO is a technical indicator that measures momentum by comparing recent price movements to historical ones. A positive reading indicates bullish momentum, while a negative one suggests otherwise.

In addition, the fact that ADA failed to break above the major point of interest around $0.34 reinforces the bearish bias. Considering the current positions, it is unlikely for the cryptocurrency to experience a notable upswing.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in September 2024

Instead, a price decrease toward $0.30 could be next. However, if ADA’s daily candlestick closes above $0.35 amid a surge in crypto whales’ purchases, this prediction might be invalidated. In that case, the price could climb by 15% and hit $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/crypto-whales-put-cardano-price-at-risk/

2024-09-18 09:33:06