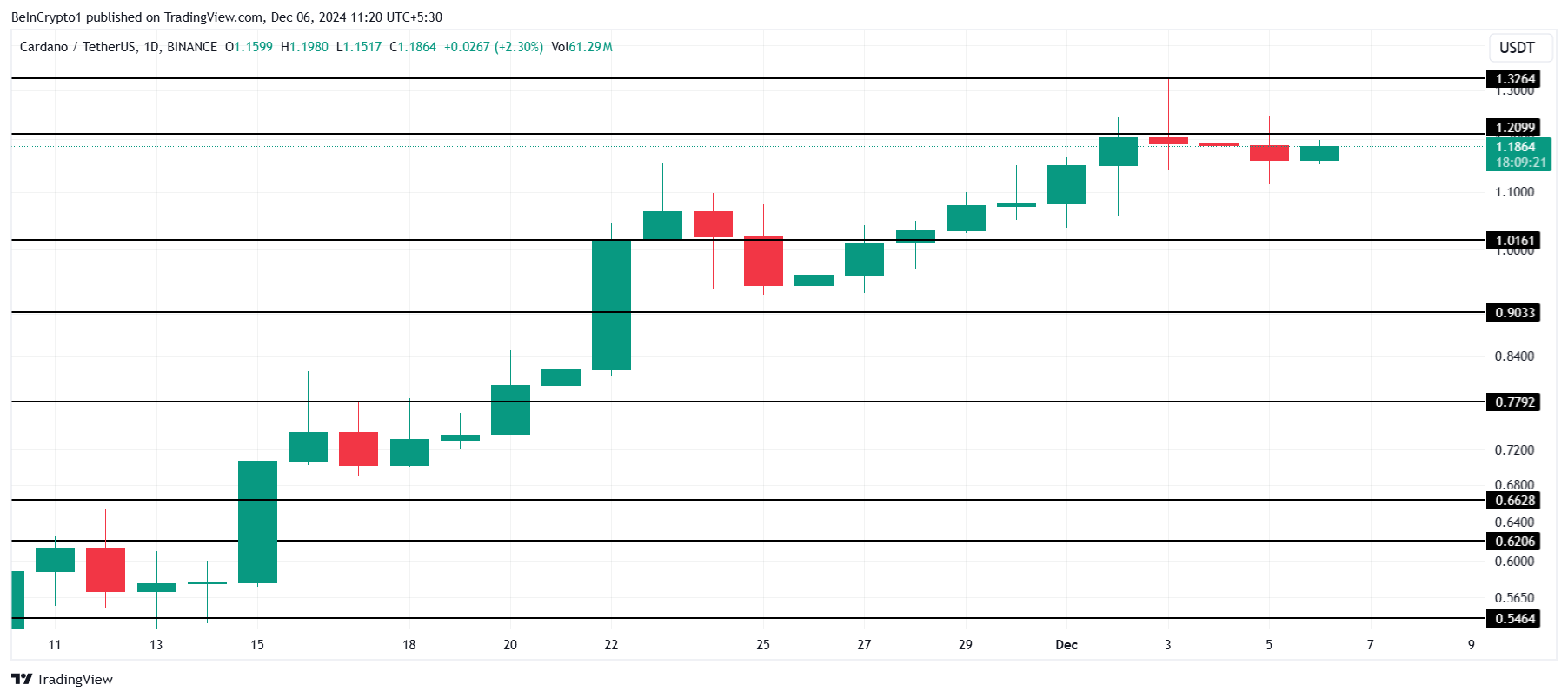

Cardano (ADA) has experienced a massive 264% rally over the past month, reaching impressive gains. However, the cryptocurrency faced resistance at the $1.20 level, indicating that it may be reaching the saturation point of its recent rally.

While Cardano has seen strong growth, overcoming this barrier remains a critical challenge for further price appreciation. The price action suggests that Cardano is nearing a crucial juncture where sustaining the rally could require significant market support.

Cardano Is in Danger

Cardano’s Market Value to Realized Value (MVRV) ratio is currently well above the danger zone, signaling potential risks for investors. The MVRV ratio tracks the profit or loss of ADA holders over the past month.

When the MVRV ratio rises above historical norms, it suggests that many investors are holding profitable positions. As a result, the risk of profit-taking increases, which could trigger a pullback in price. Currently, Cardano’s MVRV ratio is in a range that historically signals an overvalued market, leaving ADA vulnerable to short-term corrections.

The danger zone for the MVRV ratio typically lies between 18% and 33%. When the ratio exceeds this threshold, past trends suggest that corrections are likely to follow. With ADA now exceeding these levels, the potential for a market downturn grows.

Cardano’s macro momentum is heavily influenced by the broader cryptocurrency market, particularly Bitcoin (BTC). ADA shares a strong correlation with Bitcoin, currently standing at 0.88. This high correlation suggests that Cardano’s price movements are largely driven by Bitcoin’s market direction.

As Bitcoin recently crossed the $100,000 mark, its positive momentum could provide continued upward pressure for Cardano as well. ADA’s price movements will likely mirror Bitcoin’s, benefiting from the latter’s bullish trend.

ADA Price Prediction: Breaking Saturation

Cardano’s price is currently facing resistance at the $1.20 mark, making it a key level to watch in the coming days. If ADA can break through this barrier and establish $1.20 as support, the altcoin could see further gains toward $1.50.

Moreover, if Cardano continues its strong correlation with Bitcoin and the broader cryptocurrency market remains bullish, there is a strong likelihood that ADA will continue its upward trend. A sustained move above $1.20 could trigger more buying activity, pushing Cardano toward new highs, continuing its 264% month-long rally.

Should ADA fail to break the $1.20 resistance and experience a major drawdown, it could revisit the $1.01 support level. A fall below this level would significantly reduce the chances of further price gains and may lead to a period of consolidation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-fails-to-surpass-resistance/

2024-12-06 07:30:00