Cardano (ADA) has shown resilience in preventing a massive drawdown, maintaining investors’ optimism through challenging market conditions.

This stability is now reflected in ADA’s price recovery, with support from long-term holders (LTHs) playing a significant role. With their backing, ADA is poised for continued momentum in the coming weeks.

Cardano Investors Support Recovery

The MVRV Long/Short Ratio indicates that Cardano’s long-term holders are currently in profit. Known as the backbone of any crypto asset, this cohort’s HODLing behavior helps prevent sharp declines. Their resilience has been instrumental in ADA’s recovery, creating a stable foundation for further price increases.

This consistent support from long-term holders has kept Cardano on track for a gradual rebound. By holding their positions, these investors have reduced selling pressure, allowing ADA to sustain its recovery and maintain market optimism. This dynamic is crucial for driving the altcoin’s positive price trajectory.

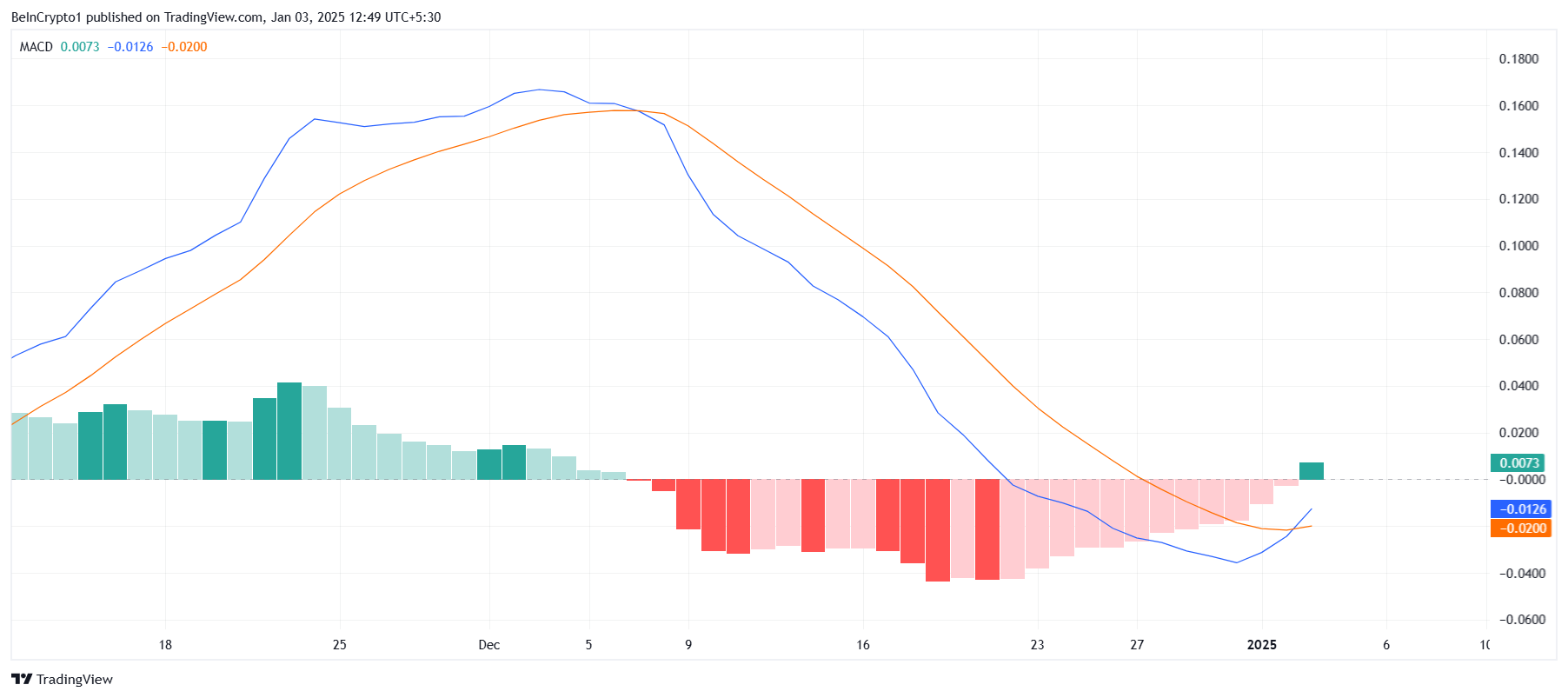

The overall macro momentum for Cardano is improving, as seen in the Moving Average Convergence Divergence (MACD) indicator. ADA recently experienced a bullish crossover, its first in nearly a month. This technical signal suggests a shift in market sentiment, favoring ADA’s price recovery in January.

The bullish crossover reflects increasing investor confidence and a positive outlook for Cardano. As broader market conditions improve, ADA is well-positioned to capitalize on this renewed momentum. This shift in sentiment could help sustain the altcoin’s uptrend over the coming weeks.

ADA Price Prediction: Regaining Support

Cardano’s price has surged by 11% in the past 24 hours, trading at $1.02 at the time of writing. By breaching the $1.00 resistance level, ADA has reignited investor optimism, signaling the potential for further gains. Holding this level is critical for maintaining market confidence.

Support from ADA holders and favorable market cues could push the altcoin toward the $1.23 resistance. Achieving this milestone would mark a full recovery of recent losses, reinforcing the bullish outlook and attracting more investor attention.

However, if investors begin to sell their holdings, ADA could lose the $1.00 support. A drop to $0.85 would invalidate the bullish momentum, raising concerns about further declines. Sustaining current levels is vital for preserving Cardano’s recovery path.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-reclaims-key-support/

2025-01-03 12:30:00