Cardano’s (ADA) price is desperately holding onto the $0.35 support level amid attempts to send the altcoin further down the charts. Despite this, ADA is struggling to generate the momentum needed to reverse its downtrend.

This analysis examines the challenges facing ADA and whether the support can withstand mounting bearish pressure.

Cardano Faces Uncertain Path Ahead

During the first days of October, Cardano’s price cratered to $0.30. After reaching $0.40 just days earlier, ADA, like many cryptocurrencies, began a decline. The downward trend raised concerns about a potential return to the $0.30 level.

However, as of now, ADA has managed to stay above that point, with bulls defending the $0.35 support. Despite this resilience, the Exponential Moving Average (EMA) indicates that Cardano remains vulnerable to bearish trends.

The EMA measures trend direction and uses particular crossovers to determine if the price might move in an upward direction or a downward slope. When the longer EMA crosses above the shorter one, the trend is bearish. On the other hand, if the shorter EMA is above the longer one, the trend is bullish.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

The 20 EMA (blue) and 50 EMA (yellow) have nearly converged, signaling a critical moment for Cardano’s price. However, with the price sitting below both indicators, the likelihood of a bearish trend grows stronger.

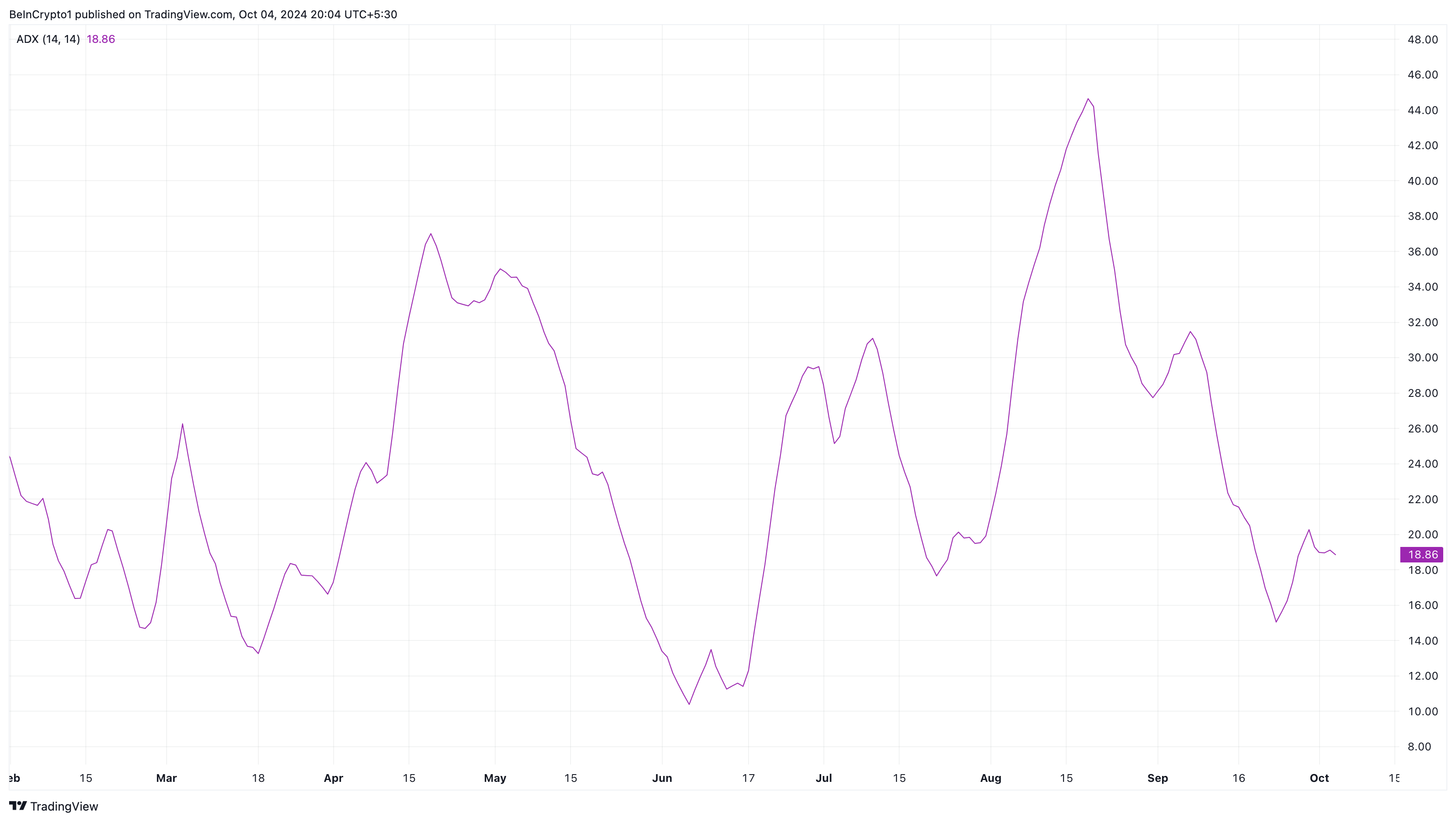

Supporting this outlook is the Average Directional Index (ADX), a key tool for measuring trend strength. When the ADX surpasses 25, it suggests a strong directional movement. In contrast, a reading below this level indicates weakness. For ADA, the current ADX stands at 18.86, suggesting that the recent upward movement lacks the strength to persist.

ADA Price Prediction: Bearish Pressure Mounts

Further assessment of the daily chart shows that ADA could face resistance at $0.36 in its attempt to climb higher. If that happens, and the cryptocurrency fails to break above the region, it could pull back, and the uptrend might be invalidated.

If that were to happen, ADA’s price might drop below the $0.35 support, and the next point to reach could be $0.31. Reaching $0.31 might put the token at risk of another downtrend, especially if the broader market condition fails to improve.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, Cardano might resist going that low if the price flips the 20 and 50 EMAs. In that scenario, the trend would have become bullish, leading ADA to hit $0.40 and potentially $0.48 in the mid-term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-price-weakness/

2024-10-05 09:30:00