Cardano (ADA) price is currently at a pivotal point, and technical indicators reflect mixed signals. The ADX shows a weakening trend strength, while large ADA holders have maintained stability in their positions.

EMA lines also indicate ADA is at a decision point, with key support and resistance levels defining potential movement. Investors should monitor these factors to understand whether ADA will see a bullish breakout or continue consolidating.

ADA Current Trend Is Still Strong

The ADX (Average Directional Index) for ADA currently sits at 32.85, marking a decrease from the previous value of 37 just a day ago. This drop indicates that the strength of ADA’s prevailing trend has weakened slightly.

While an ADX above 25 generally points to a strong trend, the recent decline from 37 suggests a loss of momentum, indicating that the current downtrend may be losing its force. However, it’s still above the key threshold of 25, which implies that some level of directional strength is being maintained.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

Despite the dip, the ADX level remains in a range that reflects moderate trend strength, though the decrease warns of potential fading. If the ADX continues to drop further, it could suggest that ADA price is moving into a phase of consolidation or a potential rebound since the current downtrend may be losing steam.

Cardano Whales Are Still Stable

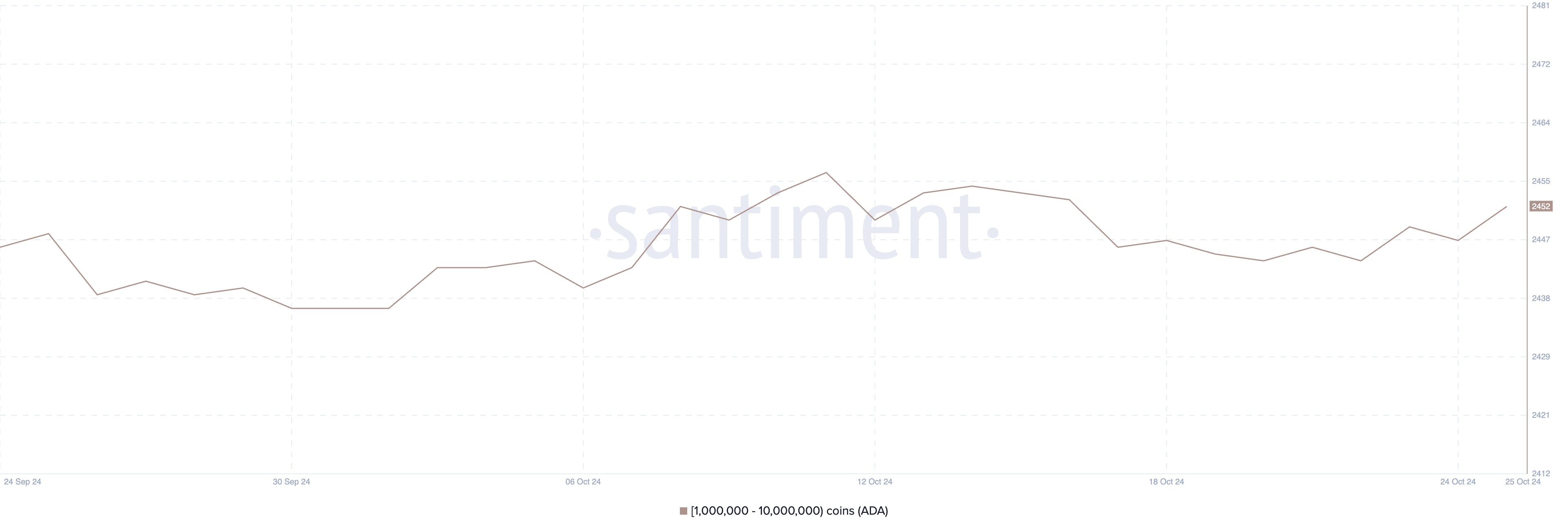

The number of addresses holding between 1 million and 10 million ADA has remained stable in recent days. From October 20 to October 28, this number grew slightly from 2,444 to 2,452.

This suggests that major holders, or “whales,” have not been making significant moves recently. This metric is important because it highlights the behavior of large market participants who can significantly impact ADA’s price.

Whales’ lack of noticeable buying or selling activity implies that they are adopting a neutral stance, neither bullish nor bearish. This can indicate a period of market indecision, where whales are waiting for clearer signals before taking action.

ADA Price Prediction: Can It Get Back to $0.41?

Currently, the coin’s price is below long-term EMA lines, suggesting that ADA remains in a downtrend. If the price can break above the higher EMA levels, it could signal a potential bullish reversal, while rejection at these levels may lead to further consolidation.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

Regarding support and resistance zones, immediate resistance is indicated around $0.36, as shown by the blue line. If that one is broken, ADA price could rise to $0.41, a potential 21% growth. ADA shows support at $0.31 and $0.30, highlighted in red. If the current downtrend continues and ADA tests $0.30, this would mean a potential 10% price correction.

These areas are crucial for ADA’s next move; a successful break above resistance could open the door for further upside, whereas a drop below support may signal increased bearish pressure and further downside risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/cardano-bears-take-lead/

2024-10-28 22:30:00