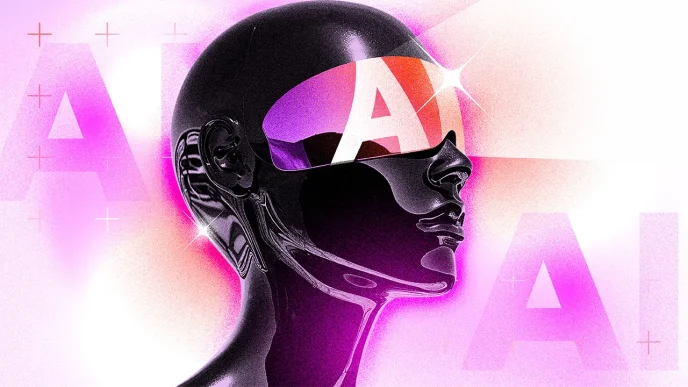

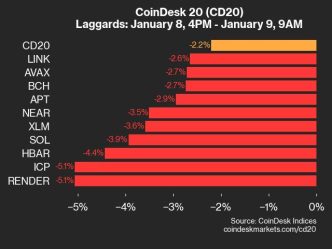

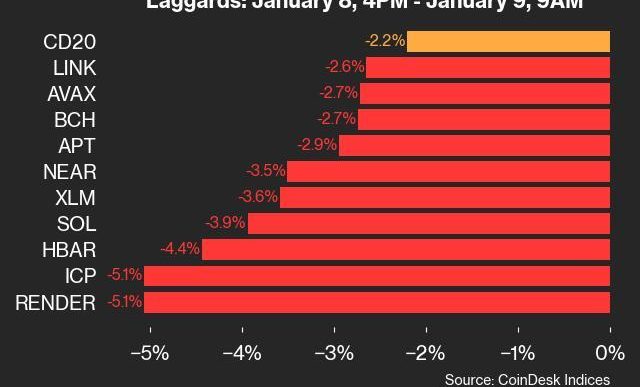

Cardano has faced significant downward pressure, with its price dropping by 15% in the last 48 hours. The altcoin failed to maintain $1.00 as support, falling below this crucial level.

This drawdown triggered panic selling among investors, amplifying bearish sentiment in the market.

Cardano Investors Move to Sell

The realized profits for Cardano spiked dramatically in the last 24 hours, reaching a 9-month high of 307 million ADA. This surge, worth approximately $276 million, highlights the intensity of panic selling. The selling wave coincided with Cardano’s price decline, reflecting growing skepticism among investors about the altcoin’s short-term recovery prospects.

This sentiment indicates that many ADA holders opted to secure their gains as the price slipped below $1.00. The heightened selling activity illustrates a lack of confidence in the altcoin’s ability to recover quickly, adding further pressure to its declining trajectory.

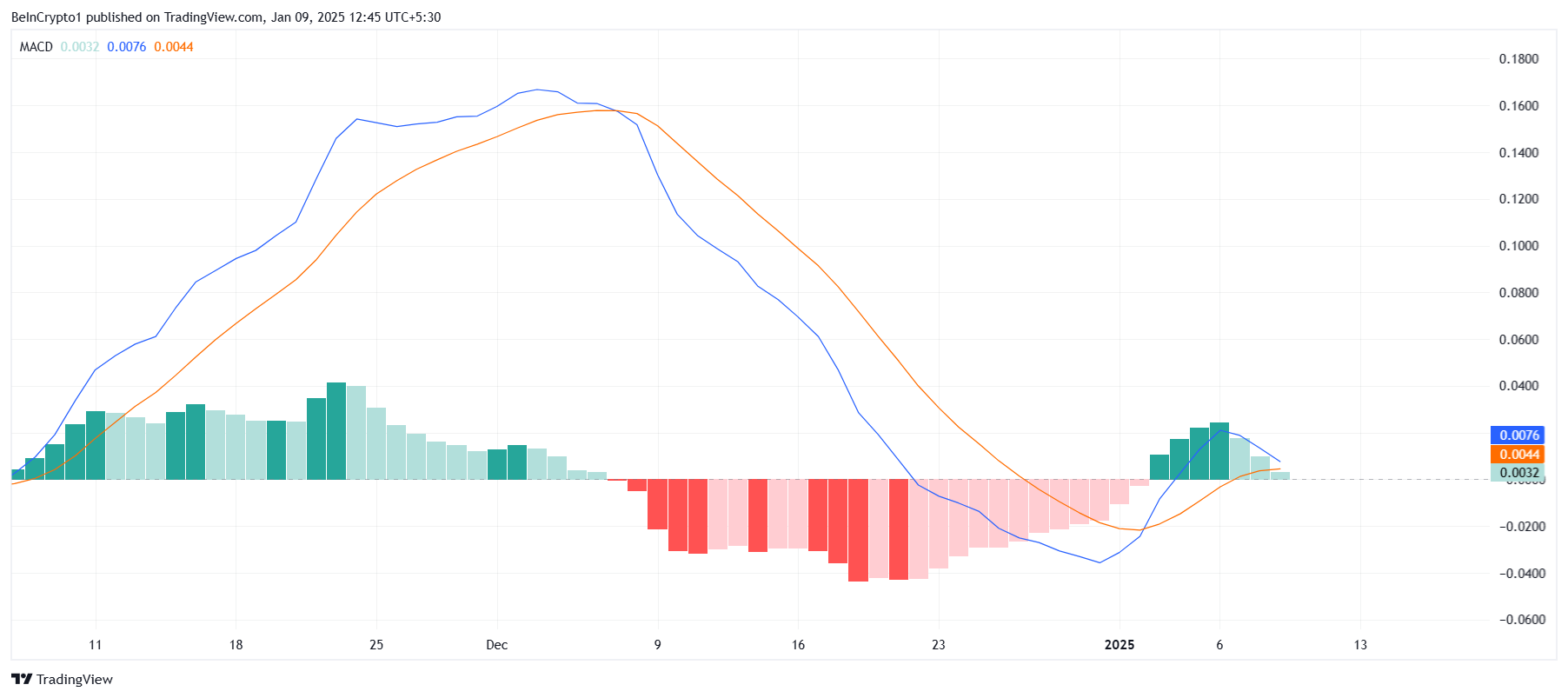

Cardano’s macro momentum is also showing signs of weakness as the MACD indicator approaches a bearish crossover. Less than a week ago, ADA exhibited a bullish crossover, but the shift toward bearishness highlights the impact of broader market cues on the cryptocurrency. This suggests that Cardano may face additional downward pressure in the coming days.

The broader market’s influence on ADA has made the altcoin vulnerable to corrections. The potential for further declines is evident as bearish momentum gains strength, driven by market uncertainty and investor skepticism.

ADA Price Prediction: Recovering Losses

Cardano’s price currently stands at $0.92, reflecting a 15% decline over the past 48 hours. Losing the $1.00 support level has left the altcoin exposed to further selling pressure, making $0.85 the next critical support level. A drawdown to this level could result in consolidation above $0.85 and below $1.00, as seen in previous corrections.

If Cardano stabilizes at $0.85, it may enter a consolidation phase, limiting further losses while the market recalibrates. This period could allow the altcoin to gather momentum for a potential recovery.

Reclaiming $1.00 as support would be a significant milestone for Cardano. Such a move could invalidate the bearish outlook, enabling the altcoin to recover its recent losses. A successful rebound may push ADA’s price to $1.23, restoring investor confidence and encouraging further accumulation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-selling-reaches-nine-month-high/

2025-01-09 13:30:00