Cardano’s lackluster performance has prompted its largest holders to reduce their trading activity over the past week. On-chain data reveals that ADA whales have gradually distributed their holdings over the past seven days.

With a growing bearish bias against the altcoin, ADA risks further decline if the trend continues.

Cardano Whales Reduce Their Exposure

IntoTheBlock’s data shows that the netflow of large ADA holders has plummeted by 90% in the past seven days. Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply.

When this cohort of token holders reduces their netflow, the inflow of tokens into their wallets significantly decreases compared to outflows. This suggests that these major investors are either selling off their holdings or refraining from accumulating more, reducing their overall market influence.

The decline in large holders’ netflow signals weakening confidence among ADA’s big players, which can lead to lower liquidity and increased price volatility. If this trend continues, the coin may face further downside pressure as buying momentum from key investors falls further.

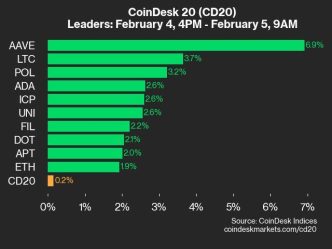

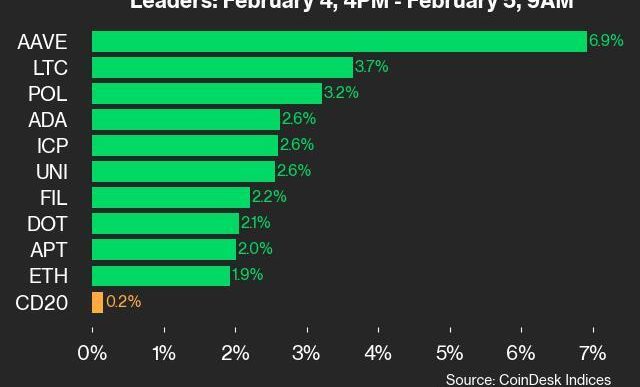

Moreover, this decline in ADA whale activity comes amid rising demand for short positions in the coin’s futures market. This is reflected by the coin‘s negative funding rate of -0.005%, which suggests that traders are increasingly betting against the asset.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts. It is designed to keep contract prices aligned with the spot market. When an asset’s funding rate is negative, short traders are paying long traders. This indicates a stronger demand for short positions, which signals a bearish market sentiment.

ADA Price Prediction: Bearish Trend Grows With Price Below Key Indicator

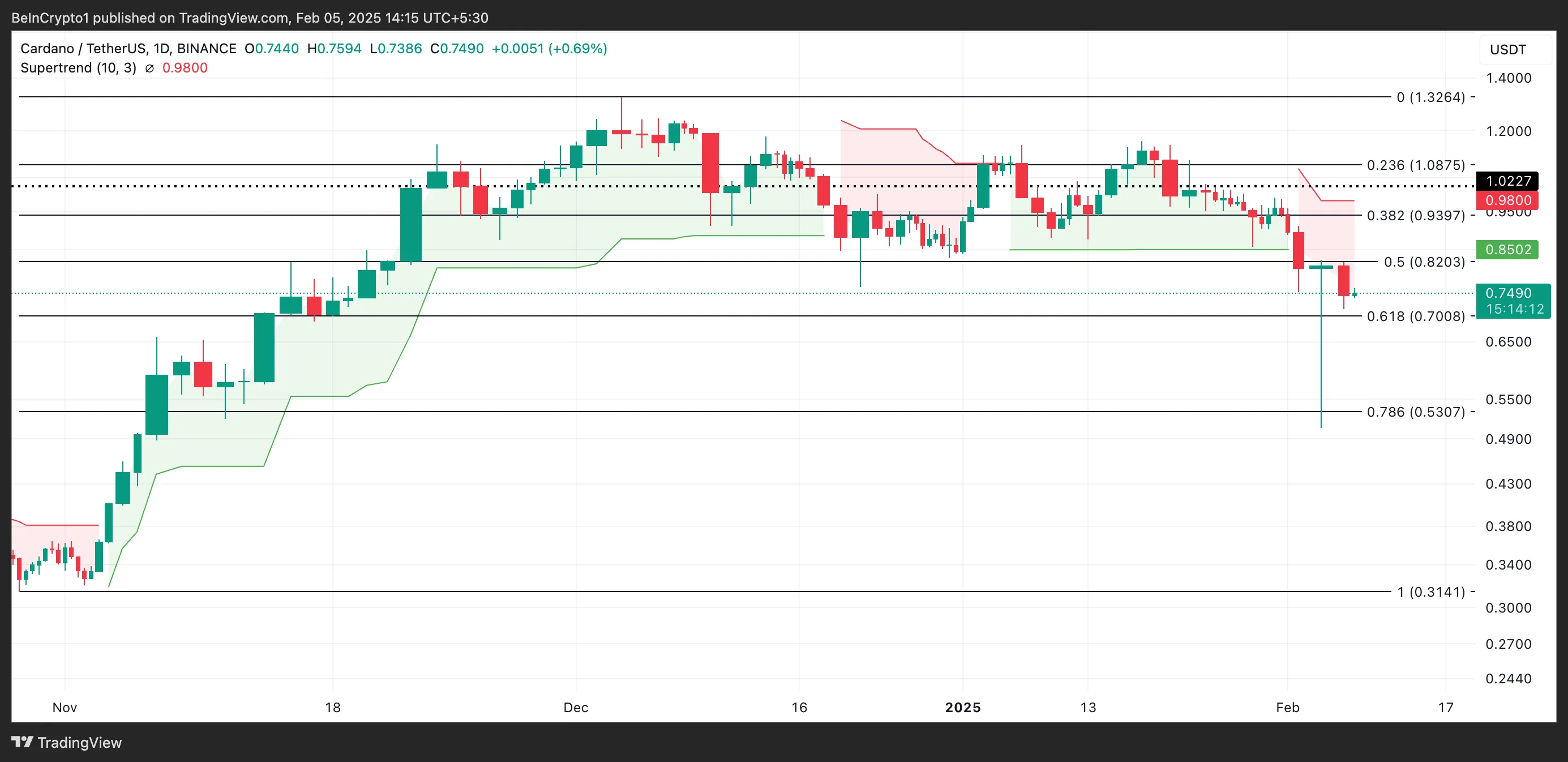

ADA remains below the red line of its Super Trend indicator on the daily chart, reinforcing the bearish outlook above. This momentum indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

As with ADA, selling pressure dominates the market when an asset’s price trades below the red line of the Super Trend indicator. If the selloffs persist, ADA’s price will extend its decline and fall to $0.70.

Conversely, should traders begin to accumulate the coin again, ADA’s price could climb to $0.82.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-whales-reduce-activity/

2025-02-05 14:00:00