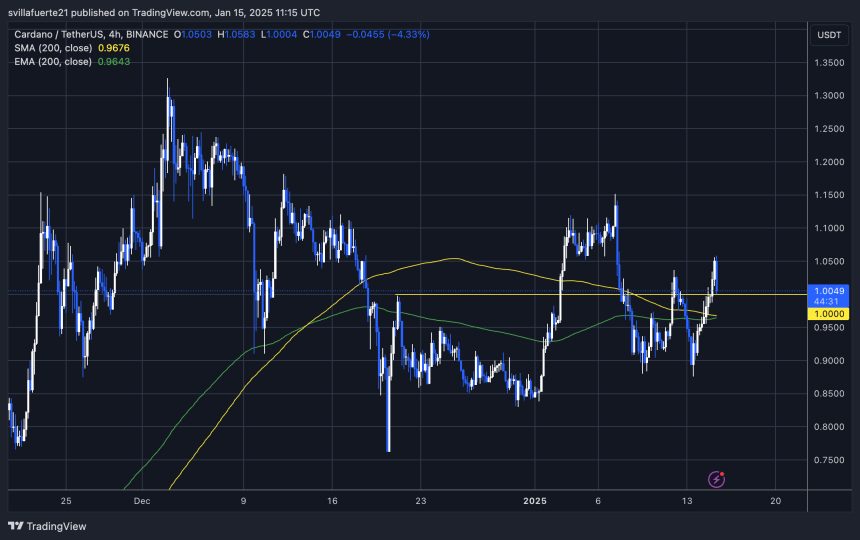

Cardano is at a pivotal moment, striving to hold the $1 mark as a key support level to sustain its upward momentum. The altcoin has experienced significant volatility in recent trading sessions, with a dramatic 15% drop followed by an impressive recovery of over 20% within just 24 hours. This rapid price action has brought renewed attention to ADA, as investors assess its potential for further gains.

Related Reading

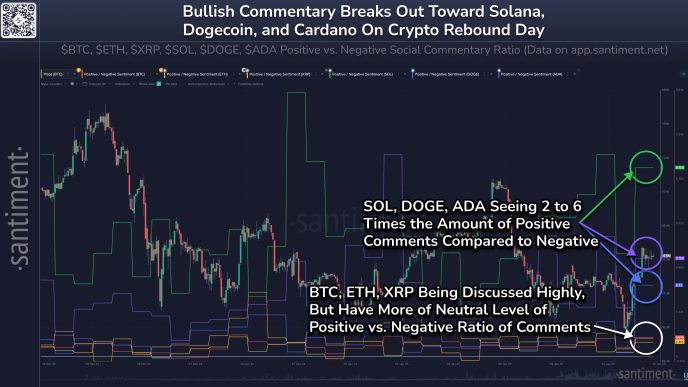

Top analyst Ali Martinez has shared crucial insights, revealing that whales have accumulated 100 million Cardano (ADA) in the past 48 hours. This significant buying activity by large holders underscores growing confidence in ADA’s long-term potential and its ability to maintain its bullish trajectory.

Cardano’s attempts to establish stability above $1, a psychological and technical level that could act as a springboard for further rallies. Investors are closely watching this level, as holding it as support could signify a strong foundation for ADA to challenge higher resistance zones.

Cardano Finds Strength To Rise

After a recent sharp drop, Cardano (ADA) is showing resilience, finding the strength to rise and eyeing a push above last year’s high of $1.32. This recovery has sparked optimism among analysts and investors, many of whom are calling for a significant rally. Cardano is increasingly viewed as a strong contender to become a market leader, driven by its robust development ecosystem and expanding use cases.

Top analyst Ali Martinez has shared compelling data highlighting growing interest from smart money investors. Posting on X, Martinez revealed a chart showing that whales have accumulated 100 million ADA over the past 48 hours. This substantial purchase underscores confidence among large holders that current price levels present a valuable buying opportunity, setting the stage for further upward momentum.

This surge in whale activity aligns with broader expectations for Cardano to capitalize on its technological advantages and potential as a leader in the blockchain space. The cryptocurrency’s ability to attract significant capital from institutional and high-net-worth investors reinforces its potential to outperform in the coming months.

Related Reading

Cardano’s next challenge will be reclaiming key resistance at $1.32. Successfully breaking this level would likely trigger a substantial rally, potentially propelling ADA into a new bullish phase. The coming days will be pivotal in determining whether Cardano can sustain this momentum and fulfill its promise of becoming a market frontrunner.

ADA Bulls Eye Key Levels

Cardano (ADA) is currently trading at $1 after briefly reaching $1.05 earlier in the session. The price is consolidating and seeking support at the psychologically significant $1 level. If this key support holds, the next target for ADA is $1.15, a resistance level that could open the doors to further gains.

Market sentiment around ADA remains cautiously optimistic. As a result, holding the $1 mark would signal strong demand and set the stage for a potential surge as bullish momentum builds. A breakout above $1.15 could lead to an extended rally, potentially revisiting previous highs and entering a new bullish phase.

However, losing the $1 support would suggest that demand is faltering. In this scenario, ADA could see a drop to its next major support level around $0.91, putting additional pressure on bulls to regain control.

Related Reading

The coming days will be crucial for ADA as it tests its ability to sustain current levels. Therefore, traders and investors are closely watching for signs of strength or weakness that could dictate the altcoin’s short-term trajectory. Whether Cardano can maintain its footing above $1 will determine whether the recent recovery evolves into a sustained rally or another period of consolidation.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/cardano/cardano-whales-go-on-a-shopping-spree-100-million-ada-in-48-hours/

2025-01-16 01:00:43