Cardano (ADA) price has been trapped in a consolidation phase since early August, unable to break free from macro-level stagnation. Despite initial signs of bullish momentum, ADA has struggled to sustain upward movement.

This prolonged consolidation has left investors questioning what’s next for Cardano’s price as it approaches key support levels.

Cardano Faces the Bears

Cardano’s current market sentiment reveals a potential challenge, especially among short-term holders. The MVRV Long/Short difference, a metric indicating market profitability, shows that short-term holders are currently in profit. These short-term holders typically hold assets for less than a month and are more inclined to sell during market fluctuations.

Highly negative values on the MVRV Long/Short difference highlight their profitability, signaling an increased likelihood of selling pressure, which may create additional headwinds for ADA’s price stability. A wave of short-term selling could stall any potential upward movement, especially if ADA’s price fails to regain momentum.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

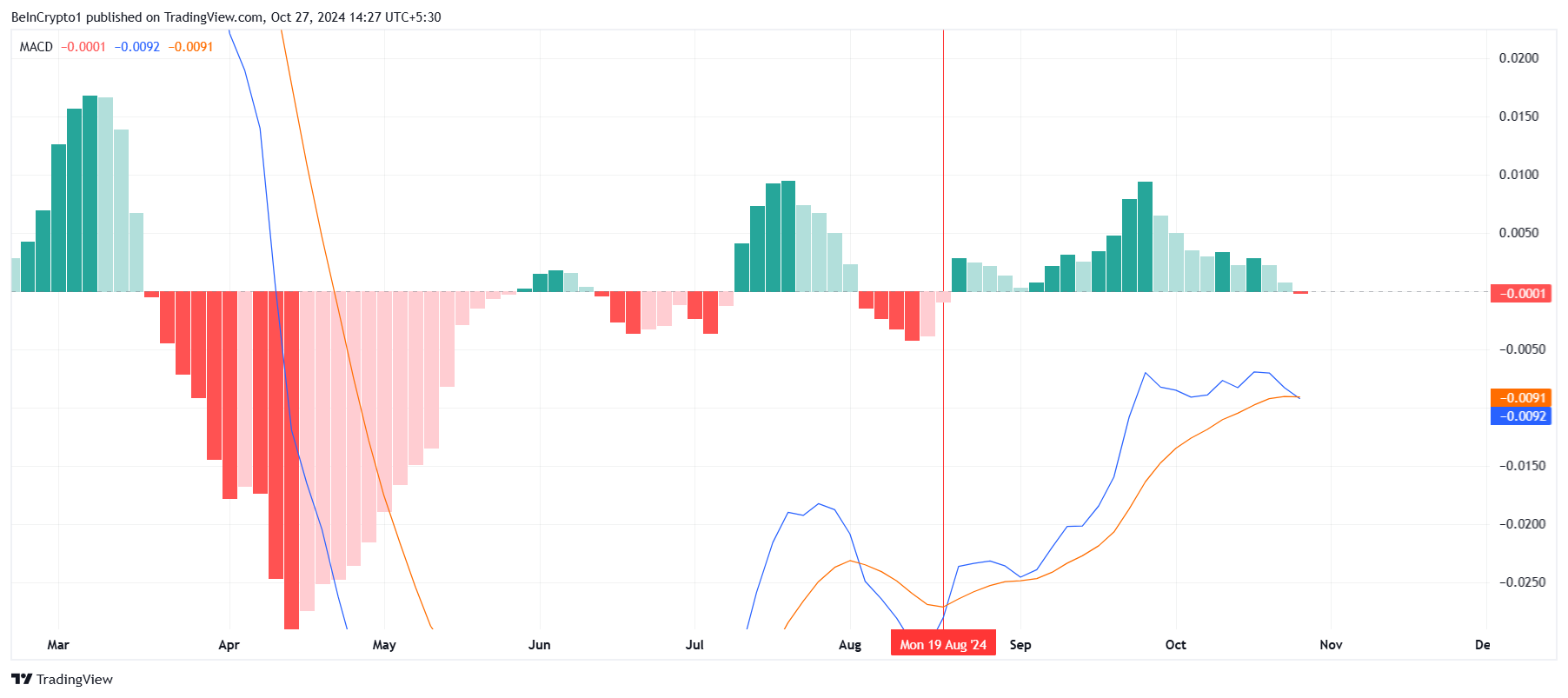

Cardano’s macro momentum has shifted recently, with technical indicators such as the Moving Average Convergence Divergence (MACD) signaling an end to the bullish phase. After over two months of positive movement, the MACD has recorded its first bearish crossover since mid-August. This change reflects a loss of upward momentum and introduces the possibility of a continued downtrend.

The bearish crossover on the MACD suggests that Cardano may face further resistance in gaining ground. This direction highlights the challenges faced by ADA, with bearish momentum casting a shadow over the near-term outlook.

ADA Price Prediction: Finding a Support

Cardano’s price has dropped by 10% in recent days, currently hovering below the $0.33 level. This price point has served as a crucial support floor for over a month, and losing it indicates further downside.

While recovery is possible, ADA may still consolidate below $0.33, as it has struggled with this level acting as resistance in the past months. If ADA remains range-bound, it is likely to trade between the $0.31 support and $0.33 resistance in the short term.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Should Cardano manage to breach $0.33, it would then face resistance at $0.37, a key barrier marking the upper limit of ADA’s recent consolidation range. Only a breakthrough above $0.37 would invalidate the bearish-neutral thesis and signal a stronger uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-stalls-bullish-momentum-fades/

2024-10-27 09:47:37