Celestia, a top network and one of the few modular blockchains, is building. Less than a year after transiting to the mainnet after months of testing, the platform is taking bold steps to scale the base layer and further boost data availability.

Celestia Plans For 1 GB Blocks For Scaling

In a recent announcement, the platform’s core developers said it was preparing for the next phase, which will see the blockchain introduce 1 GB blocks. The decision to unleash 1 GB blocks will be a major move to scale on-chain and push throughput even higher.

It will only make sense. Celestia uses a modular architecture that allows the network to scale. Unlike Ethereum, which is struggling to scale on-chain and heavily reliant on off-chain platforms like Base and StarkNet, Celestia remains scalable and flexible, circumventing challenges legacy networks encounter.

With 1GB blocks and scaling increased, Celestia said developers would be free to build whatever they wish. Exemplifying progress made by modern chains, developers are not confined to deploying smart contracts using a single programming language like struggles to scale on-chain, which is Solidity or Rust. Instead, they can choose what they are comfortable with.

To achieve the 1 GB blocks, Celestia plans to introduce innovations such as content-addressable mempools and compact blocks. Moreover, plans will be made to deploy internally sharding nodes and improve its data availability sampling protocol.

TIA Down 80%, Will The Supply Uptick Fast-Track The Dump?

Impressive as this could be, TIA, the native currency, has been on a free fall. Price data shows that bears have been in control after prices soared to as high as $21 in February, forcing the coin down by over 80%.

At spot rates, the coin remains under intense selling pressure. If anything, sellers could unwind all progress made after listing on Binance in early November.

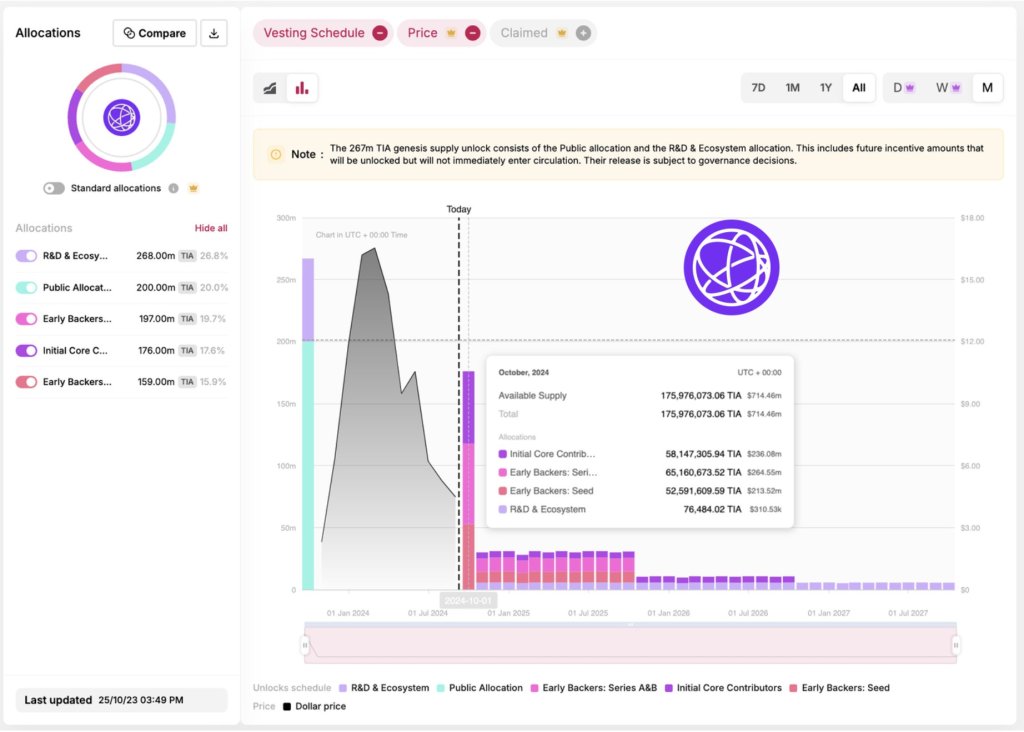

The immediate concern is the upcoming token unlock set for October 30. Usually, token unlocks are considered bearish due to the expected spike in supply.

Today, the platform will release 175 million TIA or 16.5% of the total supply. Afterward, a daily release of 1 million TIA will be from November 1.

By next year, Token Unlocks, a monitoring platform, projects that TIA’s supply will be up by nearly 4X. If demand remains low, as is currently the case, prices could plunge below November 2023 lows due to the deluge in supply.

Source link

Dalmas Ngetich

https://www.newsbtc.com/celestia/celestia-plans-for-1-gb-blocks-for-scaling-why-are-tia-holders-worried/

2024-09-13 00:00:02