Vitalik Buterin backed Polymarket, with the support coming at a time when prediction markets are on the regulator’s radar. The Ethereum co-founder calls them “social epistemic tools,” citing interest from economists and policy intellectuals alike.

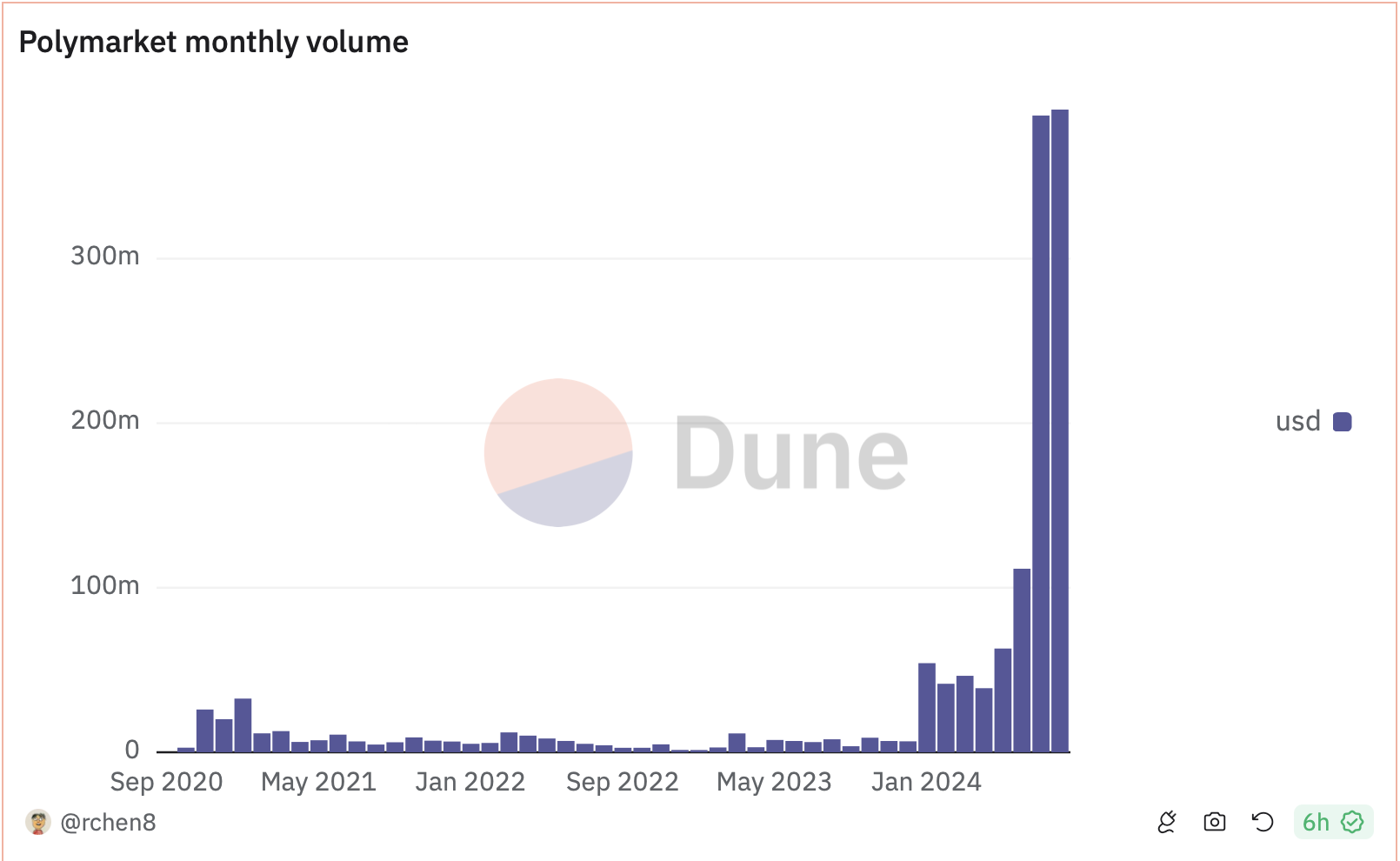

Polymarket has recorded growing interest as of late, causing its active traders and monthly volume metrics to go parabolic.

Vitalik Buterin Defends Polymarket Against CFTC Scrutiny

Buterin acknowledges the decentralized prediction market platform’s role in ensuring the public has a view of important events. He also highlighted Polymarket’s place in mirroring the things that are likely to happen.

“Putting Polymarket into the category of ‘gambling’ is a massive misunderstanding of what prediction markets are or why people (including economists and policy intellectuals) are excited about them,” Buterin wrote.

The assertion comes after the US Commodities and Futures Trading Commission (CFTC) proposed to limit prediction markets like Polymarket in May. The regulator says such markets are against public interest, indicating the risks associated with election-related gambling. US lawmaker Senator Elizabeth Warren shared this sentiment and signed a motion to ban prediction markets related to US elections.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Other crypto powerhouses, in addition to Buterin, have also criticized the CFTC’s assertions. For instance, Gemini has contested these regulations, arguing that they distort the goals of the Commodity Exchange Act (CEA) and go against public interest. Cameron Winklevoss, Gemini’s co-founder, stressed that decentralized prediction markets provide valuable forecasts for future events, praising their genuine public utility.

“Decentralized prediction markets are a significant innovation with real public utility. They provide valuable information on future events rooted in financial accountability. Unlike polls, pundits, or expert opinions, they require participants to put their money where their mouth is — to have skin in the game. This proof-of-stake requirement gives them an integrity that other information sources cannot claim,” Winklevoss noted.

Similarly, Coinbase has pushed back against the proposal, with the exchange’s Chief Legal Officer, Paul Grewal, highlighting concerns over the ambiguous definition of “gaming.”

On the other hand, Opinion Labs sheds light on why the Polymarket prediction market could be mistakenly categorized as a gambling platform. The firm points out that Polymarket isn’t “fully decentralized or permissionless,” noting that several projects using the term “prediction market” essentially function as casinos.

Polymarket Records Soaring Popularity Amid US Election Buzz

Despite the CFTC’s scrutiny potentially acting as a roadblock and bringing decentralized prediction markets under its radar, Polymarket continues to see increased participation, fueled in part by the excitement surrounding the US elections and ongoing campaigns.

Participants are betting on various potential outcomes in the presidential race, where Donald Trump and Kamala Harris are currently tied at 50%. In the Senate predictions, Republicans hold a strong lead, with 71% compared to the Democrats’ 29%.

Amid this surge of activity, Dune Analytics reports that Polymarket’s monthly trading volume climbed to over $390 million in August, surpassing July’s $387 million. The platform also hit a record number of monthly active traders, reaching 53,981 users, up from 44,523 the previous month.

Daily volume and active trader metrics show consistent growth, largely driven by election-related interest

Read more: How Can Blockchain Be Used for Voting in 2024?

This momentum has led Polymarket to partner with AI firm Perplexity, enhancing user experience with advanced news summarization features. However, concerns remain about the platform’s ability to accurately reflect market sentiment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/vitalik-buterin-defends-polymarket/

2024-08-26 08:22:31