Shiba Inu (SHIB) price has risen by 59.71% in the last 30 days, although its market cap has decreased from the $18 billion mark. Despite this decline, SHIB remains the second-largest meme coin in the market, only behind Dogecoin.

SHIB’s 7-day MVRV is currently at -3.79%, indicating that holders have experienced an average loss of about 4% over the past week. This suggests that the asset may be undervalued or oversold, with the potential for further short-term corrections before any price rebound.

SHIB 7D MVRV Shows More Corrections Could Happen Soon

Shiba Inu 7-day MVRV is currently at -3.79%, down from 5% a day ago.

This indicates that SHIB holders have, on average, suffered a loss of about 4% over the past week, suggesting that the asset may be undervalued or oversold.

MVRV (Market Value to Realized Value) measures the difference between an asset’s market cap and its realized cap. A negative MVRV indicates that the asset is potentially oversold. While SHIB’s 7D MVRV is negative, historical data shows that it has often rebounded after reaching similar levels.

However, it has also continued to decline to -4% or even -9% before price surges occurred. This means that Shiba Inu price may face further short-term declines before a potential price recovery.

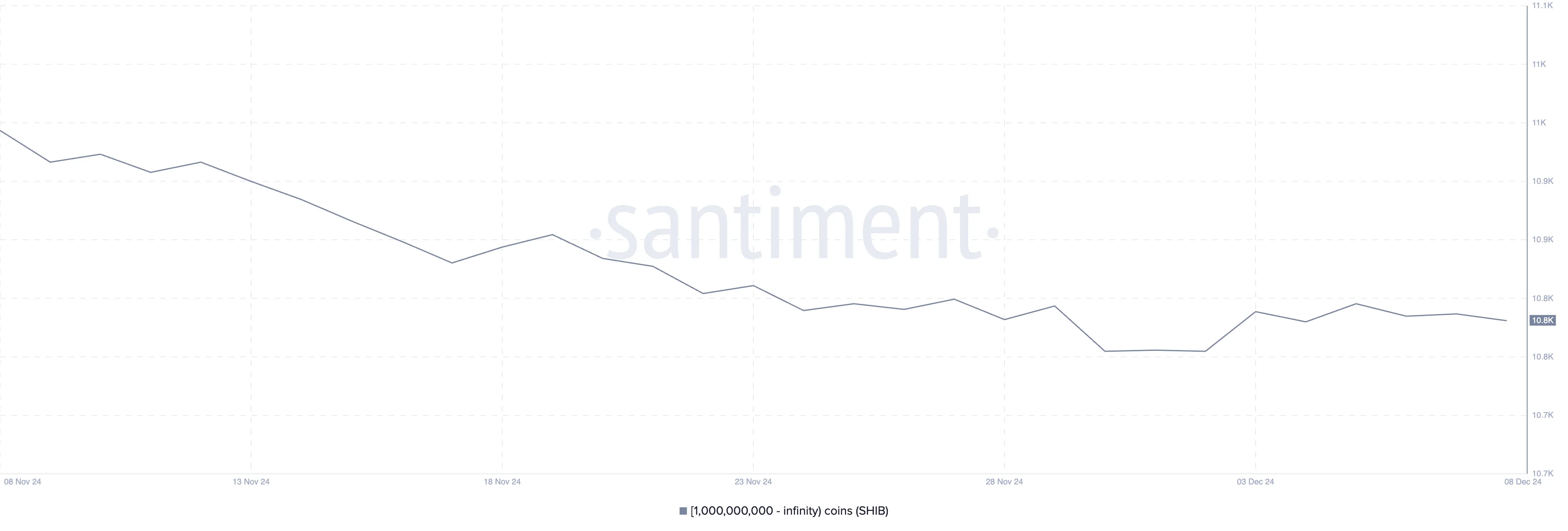

Shiba Inu Whales Are Not Accumulating

The number of addresses holding at least 1 billion SHIB has decreased recently, from 10,860 on December 5 to 10,845 now.

This decline follows a pattern seen over the past month, as the number of such addresses has been steadily falling since November 8, when it was at 11,013.

Tracking these whale addresses is important because they can significantly influence the price of SHIB. A decline in whale activity could suggest reduced buying pressure or potential distribution of holdings, which may put downward pressure on the price.

Given the recent decline in large SHIB holders, it could indicate that selling pressure is increasing, which may lead to further price declines if these whales continue to reduce their positions.

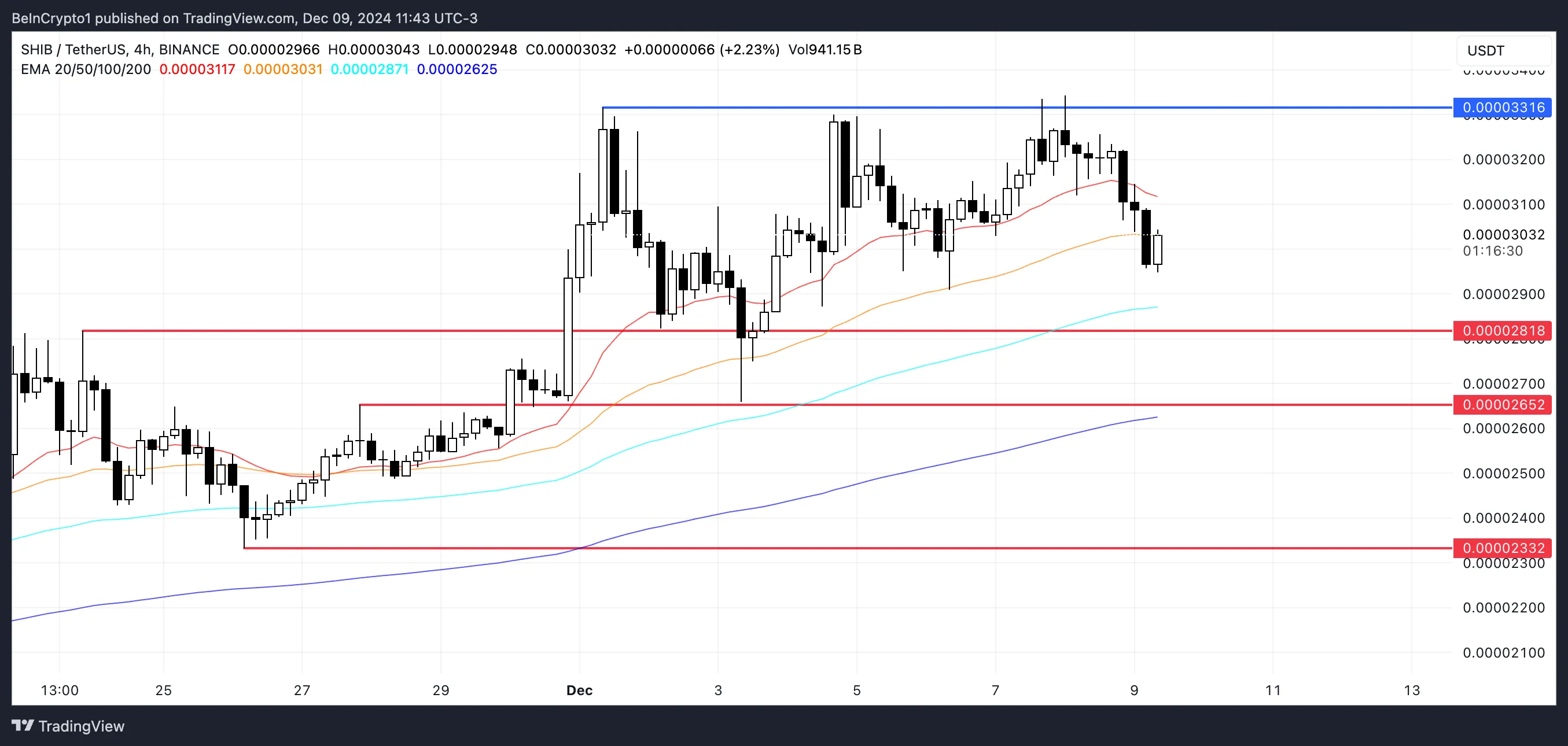

SHIB Price Prediction: Will SHIB Rebound Soon?

The SHIB price EMA lines are still showing a bullish trend, with short-term lines positioned above long-term ones.

However, the price is currently below the short-term lines, signaling a potential shift in the trend.

If the downtrend gains momentum, SHIB price could test its first support levels at $0.000028 and $0.000026. If these fail to hold, the price might drop further to $0.000023.

On the other hand, if whale activity picks up and MVRV triggers a rebound, SHIB price could rise and test resistance at $0.000033, potentially moving up to $0.000035 and $0.000040 if the resistance is broken.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/shiba-inu-shib-price-more-corrections-ahead/

2024-12-09 19:00:00