(Bloomberg) — A signal from the Bitcoin derivatives market points to the growing risk of a “short squeeze” that can stoke sharp rallies in the largest digital asset, according to cryptocurrency specialist K33 Research.

Most Read from Bloomberg

The metric is the funding rate for Bitcoin perpetual futures, which helps to gauge how bullish or bearish speculators are. K33 said the seven-day average annualized funding rate on Aug. 20 was the lowest since March 2023 — when US bank failures rattled investors — indicating a prevalence of downside wagers.

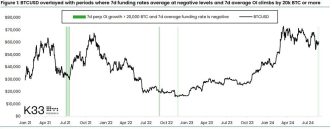

“Perpetual swap funding rates have averaged at negative levels over the past week, while open interest has sharply increased,” K33 analysts Vetle Lunde and David Zimmerman wrote in a note. “This suggests aggressive shorting, structurally creating a setup ripe for a short squeeze.”

In such a squeeze, surprise price jumps force fast-money traders to close out bearish bets, adding fuel to the bounce. The mood in the Bitcoin market has been gloomy of late: the digital asset is nursing losses for August and has struggled to hold above the $60,000 level. Meanwhile, a global stock gauge has rebounded toward a record high and gold has set fresh peaks.

K33 said notional open interest — or outstanding contracts — in the perpetuals market rose by the equivalent of almost 29,000 Bitcoin over the past week. The seven-day average annualized funding rate on Aug. 20 was minus 2.5%. Such rapidly increasing open interest alongside a negative funding rate is a comparatively rare backdrop, Lunde and Zimmerman said.

Perpetual futures are popular with speculators in the crypto sector as they have no set expiry. Activity has also been climbing in the more traditional Bitcoin futures market hosted by Chicago-based CME Group Inc., which may be an indication of re-engagement by US institutional investors.

Bitcoin has been sapped recently by concerns that the US government is selling seized tokens. Traders are also awaiting a key speech by Federal Reserve Chair Jerome Powell, whose signals on expected interest-rate cuts could stir volatility. The token was steady at $59,550 as of 7:12 a.m. on Wednesday in London, about $14,250 below its March all-time high.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

Sidhartha Shukla

https://finance.yahoo.com/news/crowded-bitcoin-derivatives-bets-spur-050957372.html

2024-08-21 06:14:23