Crypto inflows surged to almost $2.2 billion last week, fueled by the US elections and the Federal Open Market Committee (FOMC) meeting.

It marks a sharp acceleration in investments, bringing the year-to-date (YTD) inflows to a record $33.5 billion. Meanwhile, total assets under management (AuM) soared to an all-time high of $138 billion earlier in the week.

Crypto Investment Inflows Near $2.2 Billion

The latest Coinshares report ascribes the spike in inflows to a confluence of factors, including the Federal Reserve’s looser monetary policy and a Republican (GOP) sweep in the recent US elections. Both developments have invigorated investor confidence in the digital asset market.

“Looser monetary policy and the Republican party’s clean sweep in the recent US elections,” Coinshares’ James Butterfill wrote.

Bitcoin accounted for $1.48 billion of last week’s inflows, highlighting its dominance in the digital asset space. However, its recent price surge to an all-time high triggered profit-taking, leading to $866 million in outflows during the latter half of the week. Notably, short Bitcoin products also saw $49 million in inflows, reflecting hedging activity by cautious investors.

Ethereum, which had struggled with outflows in previous weeks, rebounded strongly with $646 million in inflows. This resurgence is attributed to renewed investor optimism following Justin Drake’s Beam Chain upgrade proposal and the broader pro-crypto sentiment driven by the Republican victory.

“Ethereum researcher Justin Drake proposed a “Beam Chain” to replace the Beacon Chain, reducing the staking requirement from 32 ETH to just 1 ETH. This move aims to make staking more accessible. Bullish,” one popular user on X remarked.

Political and Economic Backdrop

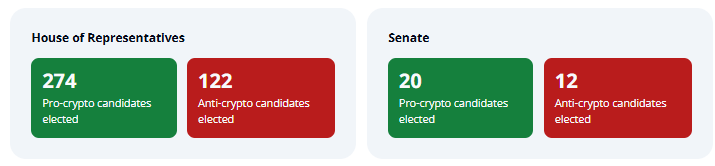

The Republican Party’s clean sweep in the House and Senate has sent a clear signal to markets. With 274 pro-crypto candidates elected to the House and 20 to the Senate, the political playing field now appears increasingly favorable to cryptocurrency adoption. In contrast, only 122 anti-crypto lawmakers were elected to the House and 12 to the Senate, according to data from Stand With Crypto.

The election results come at a pivotal time, as the Federal Reserve’s recent rate cuts have added liquidity to the markets. Analysts have noted that looser monetary policy often correlates with increased risk in investments, including cryptocurrencies.

Donald Trump’s pro-crypto stance also continues to fuel market optimism. Many expect regulatory clarity to improve under the new administration.

“Beta with a side of Bitcoin is how I’d best describe the flows over the past week, since the Election, and really for the whole year. Even though the market seems a little gassed, ETF investors still look pretty enthusiastically bullish,” said Eric Balchunas, an ETF specialist with Bloomberg.

While the record-breaking inflows and Bitcoin’s price surge highlight growing confidence in the crypto market, the profit-taking trend observed later in the week highlights investor caution.

Analysts suggest that the market’s trajectory will depend on regulatory developments and the Federal Reserve’s monetary policy in the coming months. Meanwhile, the political support from newly elected pro-crypto lawmakers could provide the regulatory certainty needed to sustain this momentum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/crypto-inflows-soar-with-gop-fed-softening/

2024-11-18 14:00:00