Crypto investment inflows registered a record-breaking weekly inflow of $3.12 billion last week. This surge brings the year-to-date inflows to an unprecedented $37 billion, highlighting Bitcoin’s growing dominance and renewed interest in digital asset investment products.

It comes as Bitcoin (BTC) continues to show potential for new record highs, with the peak price now standing at $99,588 on Binance.

Bitcoin Dominates Amid Crypto Inflows’ Record Highs

Bitcoin led the pack with $3.078 billion in inflows last week, marking its strongest performance to date. Despite reaching all-time price highs, the surge in interest extended to short-Bitcoin investment products, which recorded $10 million in weekly inflows. Notably, these short-Bitcoin inflows reached $58 million for the month — the highest since August 2022.

The recent $3.12 billion inflow is a sharp increase from previous weeks, continuing a strong upward trend. For context, the week prior saw $2.2 billion in inflows, buoyed by Republican electoral momentum and Federal Reserve dovishness.

The week before that brought $1.98 billion in post-election momentum. These successive inflows highlight the market’s resilience and growing confidence among investors despite broader economic uncertainties.

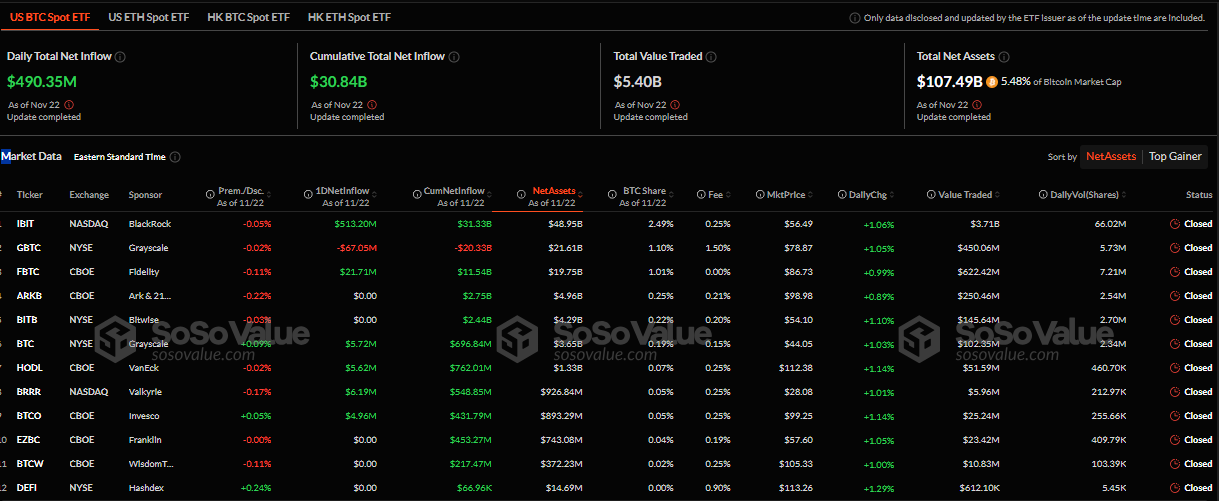

However, the growing adoption of Bitcoin ETFs (exchange-traded funds), which are attracting significant institutional interest, is driving Bitcoin’s rise. According to data on SoSoValue, the cumulative total net inflow for Bitcoin ETFs reached $30.84 billion as of November 22, when markets closed on Friday.

While all eyes were on MSTR, ETFs quietly ingested more than 10x the amount of BTC mined last week. Pac-Man mode activated,” quipped Eric Balchunas, an ETF analyst with Bloomberg Intelligence.

Amid the growing optimism, Balchunas recently noted that US spot ETFs are 98% to passing Satoshi as the world’s biggest BTC holder. Similarly, analysts predict Bitcoin’s upward trajectory could extend to $115,000 this holiday season. Whale activity and long-term holders capitalizing on the current rally bolster the enthusiasm.

MicroStrategy’s Michael Saylor, a vocal Bitcoin advocate, hinted at expanding the company’s Bitcoin holdings, further solidifying institutional confidence in the asset.

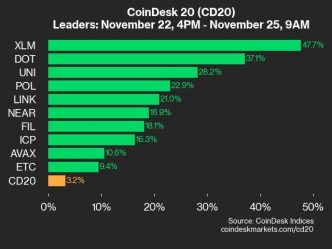

Solana (SOL) emerged as a strong contender among altcoins, recording $16 million in inflows last week. This significantly outpaced Ethereum’s $2.8 million. However, on a year-to-date basis, Solana still trails Ethereum, which remains the dominant altcoin with substantially higher total inflows.

Solana’s recent success can be attributed to increasing optimism surrounding Solana-based ETFs. With multiple filings from VanEck, 21Shares, and Bitwise, among others, investor confidence in Solana’s ecosystem has surged.

These ETFs are expected to broaden access to Solana’s technology for retail and institutional investors alike, pending SEC (Securities and Exchange Commission) approvals.

As Bitcoin and broader crypto markets continue their ascent, optimism remains tempered with caution. Market watchers like CryptoQuant caution against over-exuberance, warning of a possible price correction after Bitcoin’s recent climb. Other skeptics, including Justin Bons of Cyber Capital, raised concerns over the cryptocurrency’s vulnerability to liquidity risks.

On the one hand, analysts predict sustained growth driven by ETFs, institutional adoption, and strong market sentiment. On the other hand, warnings of over-leveraged positions and liquidity risks suggest that a pullback could follow this bullish phase. How long this momentum will persist depends on regulatory developments, market sentiment, and macroeconomic factors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/bitcoin-new-highs-drives-crypto-inflows/

2024-11-25 15:03:40